Those who don’t learn from history are doomed to repeat it, or so the saying goes. Wise words and sage advice for investors. When the market seems to be making new all-time highs weekly, and there is tremendous enthusiasm on Wall Street and in the world of amateur investors, it can feel as if stocks will go up forever and valuations are irrelevant. But this is when investors should be cautious.

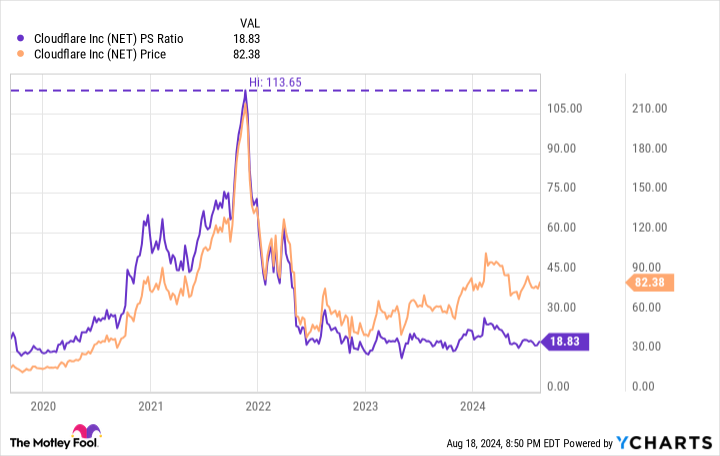

The most recent example is the 2021 tech bubble. The economy was flush with economic stimulus, interest rates were near zero, and stocks traded for ridiculous valuations. For example, edge-computing company Cloudflare‘s (NYSE: NET) stock valuation reached an astounding 114 times sales, as shown below.

As you can see, it now trades at a more reasonable 19 times sales, and the stock is down 62% from its all-time high. And guess what? Cloudflare is a terrific company but wasn’t a great investment at that high valuation.

There are undervalued and overvalued stocks in the current artificial intelligence (AI) boom. Here’s where I stand on three popular companies.

Amazon stock looks like a terrific value.

Amazon‘s (NASDAQ: AMZN) stock dipped after its second-quarter earnings report as top-line growth disappointed. Total sales increased 10% to $148 billion, and guidance for Q3 forecast an increase of just 8% to 11%. Product sales were the anchor, increasing just 4% in the quarter.

Consumer spending is slowing economy-wide by design. Interest rates remain above 5% as the Federal Reserve tames inflation. Some investors are concerned about a potential recession and a further decline in consumer spending. However, the Federal Reserve is widely expected to lower rates soon. In addition, most of Amazon’s profits come from Amazon Web Services (AWS), not product sales.

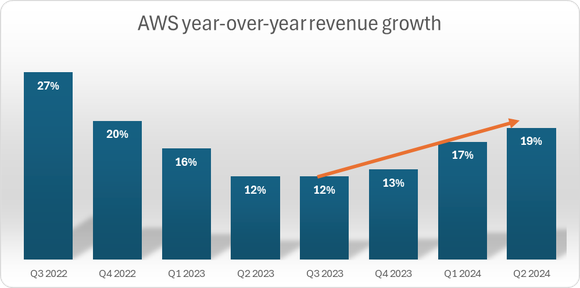

AWS is the straw that stirs the drink for Amazon, and growth is back. As depicted below, AWS’ sales growth has accelerated for four straight quarters after a down year in 2023.

Cloud data providers, like AWS, will continue to see growth driven by AI data needs and the continued migration to the cloud.

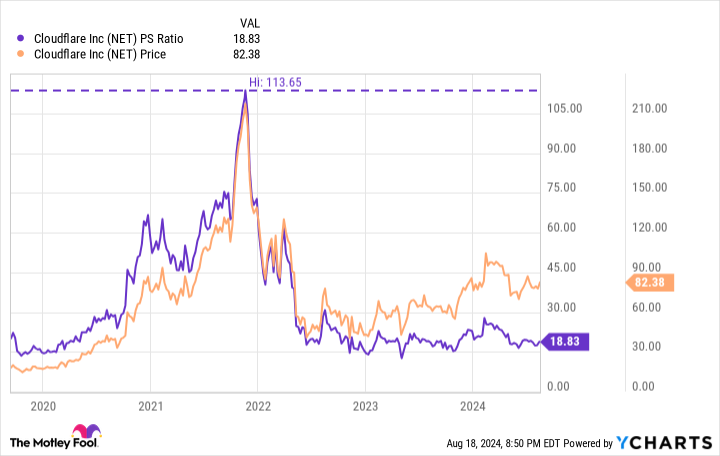

Amazon stock is undervalued on multiple measures. My preferred metric is price-to-cash from operations. In other words, what am I paying for the cash produced by the business’s core operations? The stock hasn’t been this inexpensive by this metric in more than 10 years, as shown below, and it is 50% off the 10-year average.

Given AWS’ accelerating growth, brisk AI tailwinds, and the stock’s historical undervaluation, Amazon now looks like a terrific long-term value.

Two great companies looking too pricy

AI has tremendous coattails, and Arm Holdings (NASDAQ: ARM) and Palantir (NYSE: PLTR) are riding them to lofty valuations.

Arm Holdings designs the “architecture” for semiconductors sold by the biggest names in tech. More than 99% of smartphones use its technology, and the company reported that 287 billion Arm-based chips have been sold to date. It expects 100 billion more to be shipped by the end of fiscal 2026. The company earns royalty income and license fees from companies that use its designs. It will benefit tremendously from the rise in AI, which requires high-powered chips.

Revenue was up 39% last quarter to $939 million, and Arm expects sales of $3.8 billion to $4.1 billion this fiscal year with $1.45 to $1.65 in diluted earnings per share. These are excellent results, but they still don’t justify the current valuation. Arm trades at nearly 40 times sales and 85 times forward earnings.

This is much too pricey for me; however, I would love to repurchase this stock should it pull back to under 25 times sales.

Palantir helps companies harness massive amounts of data so that their customers can visualize, analyze, and use their data to make better decisions. It has a strong foothold with government customers, mainly defense departments, and is proliferating in the private sector. Its new Artificial Intelligence Platform (AIP) helped grow its commercial customer count by 83% year over year last quarter to 295. Revenue rose 27% to $678 million, and Palantir is consistently profitable now.

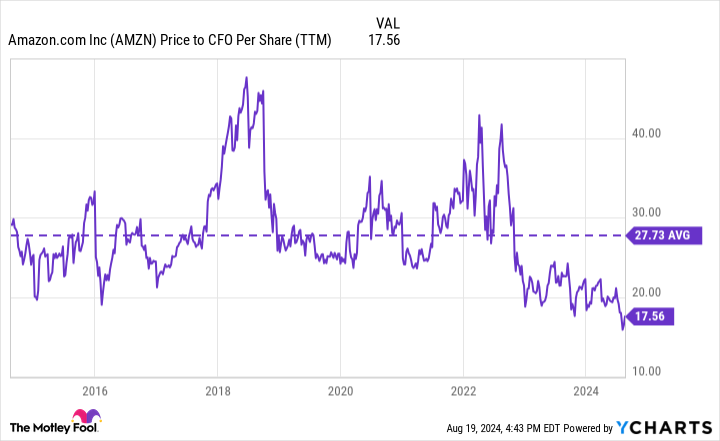

However, just like Arm, the valuation doesn’t allow for much room for error. Palantir’s price-to-sales ratio of 31 is its highest since the 2021 tech bubble and is 60% above its historical average, as shown below.

The stock deserves a premium price because of its outstanding results and AI tailwinds, but not to this extent. Patient investors will likely have a better entry point.

AI fervor is real, and so are the significant tailwinds for Amazon, Arm, and Palantir. However, valuations are still crucial in the long run. Among this trio of tech titans, only Amazon is attractive right now.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Cloudflare, and Palantir Technologies. The Motley Fool has a disclosure policy.

1 Artificial Intelligence (AI) Stock to Buy Right Now, and 2 to Wait for a Pullback was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel