The market has soared since the beginning of 2023. The S&P 500 index has posted a total return level of 48% over that time frame, pushing the index’s price-to-earnings (P/E) ratio of nearly 29.

This is much higher than the long-term market average, with many popular stocks such as Apple, Nvidia, and Microsoft trading at even higher multiples. High earnings ratios likely mean high risks for strong forward returns. You need to be optimistic in order to believe the returns over the next 10 years will look like the last 10 for the S&P 500.

So, what are investors to do with so many stocks looking expensive? I have one dividend stock that looks wildly attractive compared to the market: British American Tobacco (NYSE: BTI). The company has a dividend yielding close to 10% and a dirt-cheap earnings ratio. Unlike most stocks, the market is extremely pessimistic about the company’s prospects right now.

Here’s why you should buy British American Tobacco stock for the second half of 2024.

Declining unit volumes, consistent price hikes

Investors have soured on tobacco companies due to accelerated volume declines for traditional cigarettes. British American Tobacco saw an 8% decrease in sales volume for cigarettes around the world in 2023.

While numbers like this are concerning, investors should remember that tobacco companies are dealing with fallout from conflicts around the world, which is making the volume numbers worse. On an organic basis, British American Tobacco saw a 5.3% volume decline around the world.

The company is able to counteract volume declines with consistent price hikes on cigarettes. This is why revenue from combustible products only declined 4% in 2023 and a measly 0.8% when excluding currency movements, which the company cannot control.

When taking in the whole picture, it is clear that British American Tobacco’s cigarette business is doing fine despite heavy volume declines. While it’s not a hypergrowth business, its price hikes have led to stable consolidated revenue over the last five years.

And this isn’t the company’s only product segment.

Growth in pouches and vaping

Outside of cigarettes, British American Tobacco has invested in new and less harmful nicotine products. Most important are the Velo nicotine pouch brand and the Vuse electronic vaping brand.

Organic revenue for vaping products grew 27%, and oral nicotine pouches grew 39% in 2023. Overall, these new categories are closing in on $5 billion in annual sales and reached segment-level profitability last year.

In the coming years, this segment will finally start to contribute to the company’s overall profit pools and free cash flow. It’s still much smaller than the company’s cigarette business, which does over $20 billion in annual sales around the globe, but vaping and pouches are new categories that can help replace legacy cash flows and build a sustainable British American Tobacco over the long term.

A sustainable 10% dividend yield

Today, British American Tobacco has a dividend that yields 9.2% on a forward-looking basis. This is much higher than the S&P 500’s figure, which is below 2%, and more generous than a high-yield savings account, which pays just under 5% at the moment.

A high dividend yield indicates that investors are pessimistic about the company’s future profits, and the stock currently has a dirt-cheap P/E of 6.2.

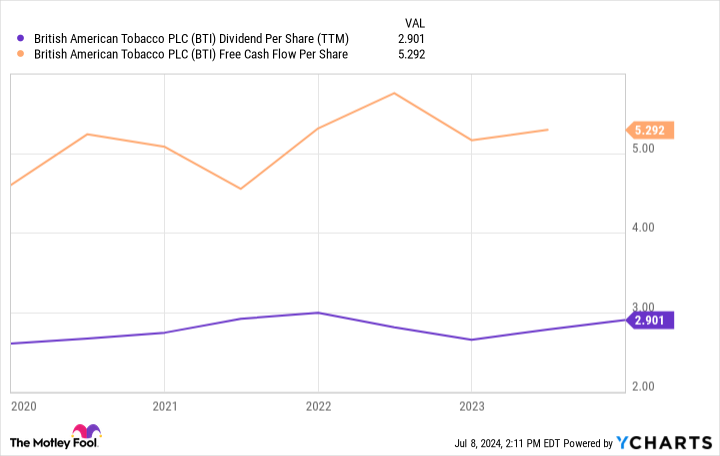

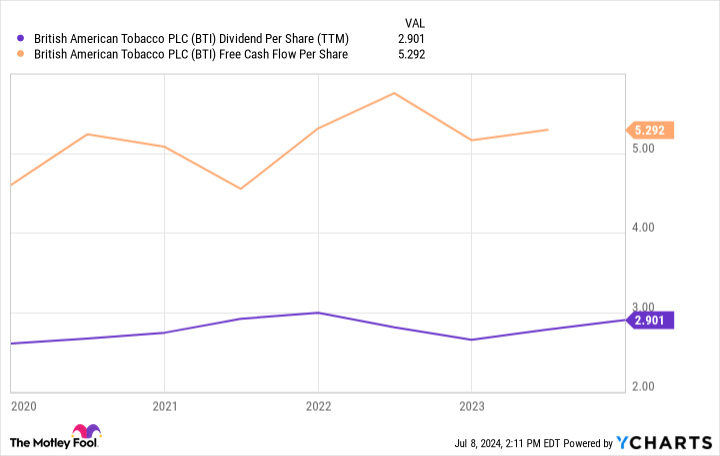

However, I think this is misguided, and investors can take advantage of this pessimism right now. British American Tobacco’s annual dividend per share is $2.90 (in dollar terms). This is funded by free cash flow per share of over $5. Even if the company’s cash flows don’t grow, the dividend is not only sustainable but also looks poised to grow.

And with the rise in profits coming from nicotine pouches and vaping, I think it is likely that British American Tobacco’s free cash flow per share will be higher 5 and 10 years from now. For these reasons, the stock looks like a great buy in the middle of 2024 and an easy hold over the long term.

Should you invest $1,000 in British American Tobacco right now?

Before you buy stock in British American Tobacco, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and British American Tobacco wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $785,556!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends British American Tobacco P.l.c. and recommends the following options: long January 2026 $395 calls on Microsoft, long January 2026 $40 calls on British American Tobacco, short January 2026 $40 puts on British American Tobacco, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Spectacular Dividend Stock Yielding Close to 10% to Buy for the Second Half of 2024 was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel