Upstart Holdings (NASDAQ: UPST) was a pandemic darling. Its stock came public in 2020 priced at $20, and it soared 20-fold to over $400 within just 10 months. Historically low interest rates drove a surge in demand for loans among consumers, which was great for the company’s artificial intelligence (AI)-powered lending marketplace.

Unfortunately, Upstart came unstuck when interest rates started to rise in 2022. Consumer demand for loans declined sharply, and risk appetite dried up among Upstart’s financing partners, so the company struggled to find reliable funding for its originations. As a result, Upstart stock plunged by more than 96% to trade at just $13 near the end of 2022.

But the company’s financial results for the recent second quarter of 2024 (ended June 30) suggest it’s on the road to recovery. Upstart stock is already well off its lows, and here’s why more upside could be around the corner.

A new era in consumer lending

Some of the largest tech companies in the world invested billions of dollars to develop AI over the last couple of years, because it has the potential to significantly boost productivity for them and their customers. But that isn’t news to Upstart, because the company used artificial intelligence for over a decade in an attempt to transform the lending industry.

Banks have used Fair Isaac‘s FICO credit scoring system to determine the creditworthiness of potential borrowers since the late 1980s, but Upstart believes that method is outdated. FICO only measures a handful of data points, like a borrower’s existing debts and their repayment history, which offers a very narrow insight into their likelihood of repaying a loan in the future.

Upstart’s AI-powered algorithm considers over 1,600 variables instead to gain a more accurate sense of creditworthiness. So far, the company says its AI models approve more than double the amount of loans compared to traditional assessment methods and at an interest rate which is 38% lower, on average. Plus, those models are constantly improving because they are trained on data from over 80,500 new customer repayments every day.

In fact, Upstart recently launched its most accurate model to date, which it calls M18. It runs over 1 million predictions for each applicant — six times more than its previous model — in order to arrive at the most accurate interest rate for their loan. That means the consumer gets the best possible price, but it also ensures Upstart and its lending partners are charging a rate which accurately reflects the risk posed by each deal.

During Q2, 91% of Upstart’s loan approvals were entirely automated. That means no human intervention on Upstart’s side, and customers didn’t have to spend any time making phone calls or uploading documents. The company said 90% of applicants who received an instant approval actually proceeded with the loan, which is three times higher than the conversion rate for non-automated deals. In other words, customers are less likely to drop off if they receive a quick decision.

Upstart’s revenue is stabilizing, with growth to come

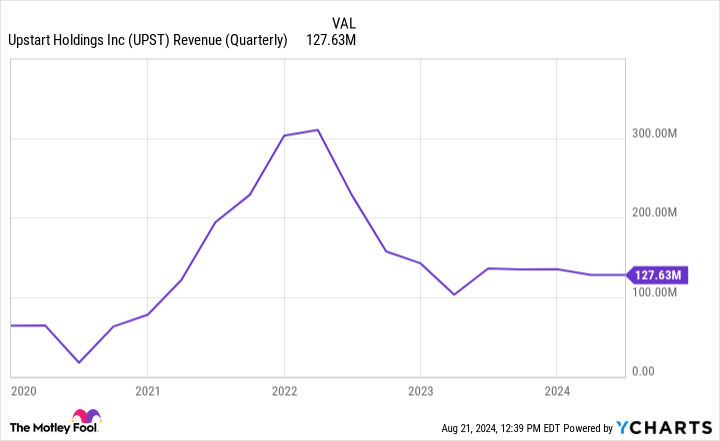

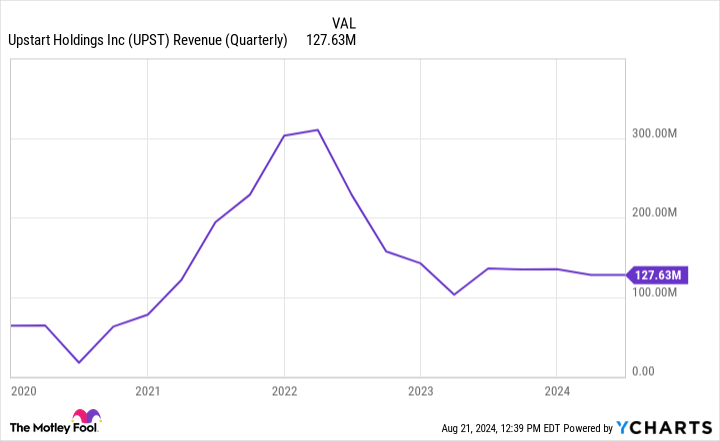

Upstart generated $127.6 million in revenue during Q2, which was a 6% drop from the year-ago period and flat sequentially (from Q1). The company’s quarterly revenue peaked at over $300 million in the early stages of 2022, and despite declining substantially since then, it appears to be stabilizing:

Upstart originated 143,066 personal unsecured loans during Q2, which was an impressive 34% increase from the year-ago period, but the transaction volume of $1.08 billion was actually down 3%. It’s a sign that more consumers are seeking credit, but they are borrowing relatively small sums of money.

Upstart also originated 708 automotive loans, and although that was down 72% year over year as demand for cars has been softening overall, it was a 35% sequential increase. This is a very small business for Upstart, though, with just $18 million worth of originations.

But here’s the great news: Upstart is forecasting $150 million in revenue in the upcoming third quarter (ending Sept. 30), which would represent an 11% increase from the year-ago period. So, $150 million would be a notable uptick and signal a breakout from its recent period of consolidation.

Why Upstart stock is a buy now

One of investors’ biggest concerns over the last couple of years was that Upstart was using its own balance sheet to fund loans. That isn’t supposed to happen — the company is an originator, meaning it uses its AI technology to approve loans on behalf of its partners (banks and financial institutions) in exchange for a fee.

However, those funding issues appear to be resolving, because Upstart added two new credit partners during Q2 (Ares Management and Centerbridge Partners), and the company said some of the institutional partners it used in the past have now returned to the platform. In other words, funds are flowing because Upstart continues to prove its ability to write quality loans, and likely because interest rates are about to fall, which can reduce risk for lenders by easing pressure on borrowers.

That places Upstart in a great position to capture more of its addressable market, which includes $831 billion worth of annual originations across personal loans and automotive loans. Plus, the company recently launched a home equity line of credit (HELOC) product, which unlocks another $1.4 trillion in origination opportunities.

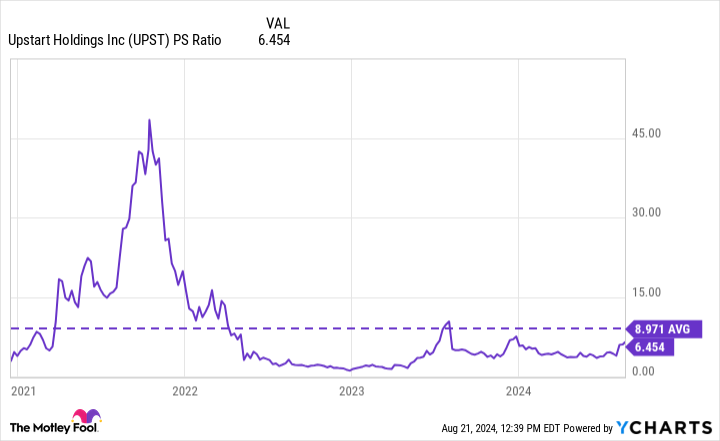

Finally, Upstart stock is relatively cheap. It trades at a price-to-sales ratio of 6.3, which is 29% below its long-term average of 8.9 since it came public in 2020:

So, with Upstart stock trading 90% below its all-time high and with revenue growth potentially around the corner, this could be a great long-term entry point for investors.

Should you invest $1,000 in Upstart right now?

Before you buy stock in Upstart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Upstart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Upstart. The Motley Fool recommends Fair Isaac. The Motley Fool has a disclosure policy.

1 Unstoppable Artificial Intelligence (AI) Stock Down 90% It’s Time to Buy on the Dip was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel