Several artificial intelligence (AI) stocks have gone parabolic in the past few years thanks, in part, to investor excitement about the potential of the technology. Nvidia and Super Micro Computer are two prime examples. Their ability to tap into the current AI zeitgeist has pushed investors to bid these stocks massively higher.

The question for investors only now starting to explore AI-related investing is what other stocks will see such gains going forward. While no company or analyst can say for sure, a few AI stocks are showing potential.

Investors who want to get in on such growth early might want to give added consideration to Chinese tech giant Alibaba (NYSE: BABA) and data engineering company Innodata (NASDAQ: INOD). Here’s why these two AI-related stocks could go parabolic.

1. Alibaba

Amid strained U.S.-China relations, U.S. investors seem to have shied away from Alibaba. Granted, this stock comes with risks. The Securities and Exchange Commission (SEC) considered barring Chinese stocks like Alibaba back in 2022 if government access to account auditing data was not granted. Moreover, investing in Alibaba means buying an American depositary receipt (ADR) rather than an actual share, meaning its stock is an investment in a holding company tied to the parent corporation, rather than the company itself. While such international stocks are generally safe, deteriorating U.S.-China relations could undermine the ADR’s status.

Investors know Alibaba best as a retailing giant. Indeed, it remains one of the top retailers in China, and much of this market of 1.4 billion people remains untapped.

Still, as one of the world’s leading cloud computing providers, it plays a critical role in China’s AI industry. It combines its cloud AI with a data intelligence platform to solve problems through algorithms. It also supports generative AI through its Qwen model, which can process natural language, interpret images, and provide APIs to build generative AI applications.

Thanks to steady improvements across retailing and the cloud, Alibaba earned 71 billion yuan, also known as the renminbi, ($11 billion) in fiscal 2024 (ended March 31, 2024), more than triple the 23 billion yuan ($3.2 billion) in fiscal 2014, the year it IPO’d.

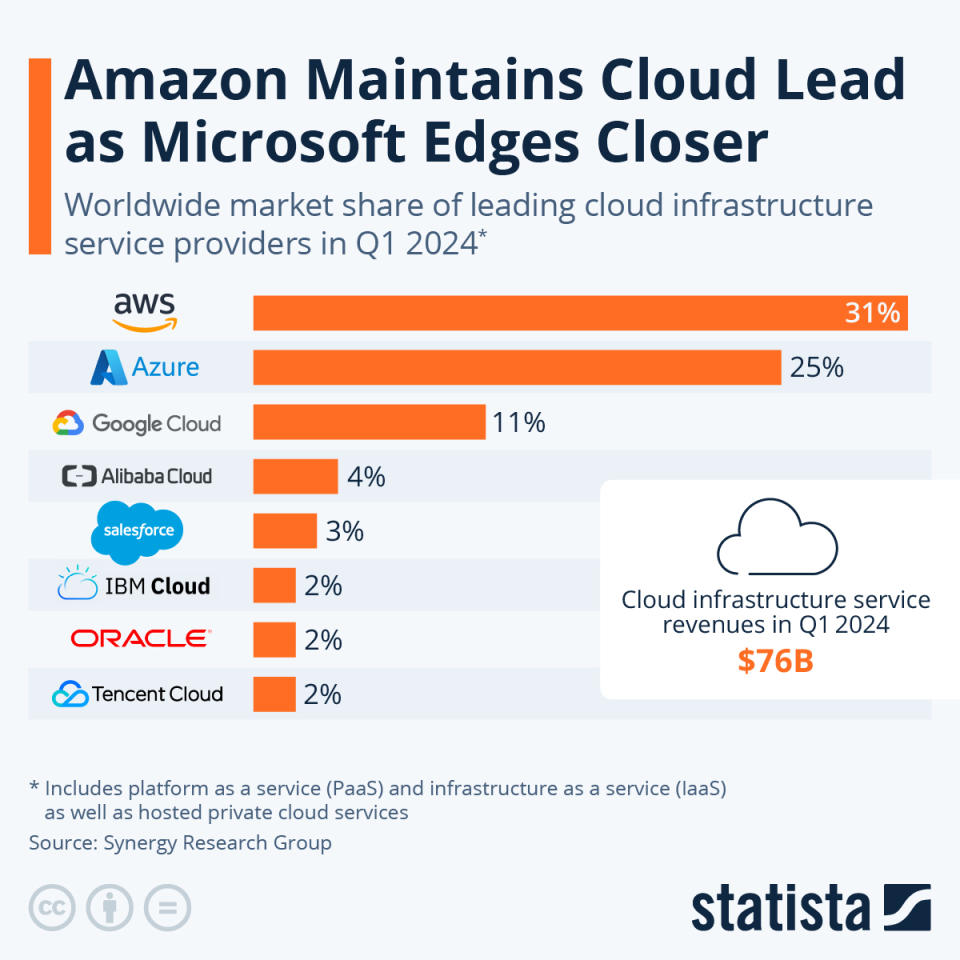

However, on balance, Alibaba stock fell by 20% during its 10 years of trading, meaning the stock price incorporated none of the earnings growth during that time. Additionally, it trades at a P/E ratio of 17, far below peers in other regions such as Amazon, which sells for 56 times earnings.

Indeed, the geopolitical issues tied to Alibaba make it a stock that risk-averse investors should probably avoid. Nonetheless, if the company or various governments can ease concerns about Alibaba, the stock could go parabolic as it prices in years of massive growth. That holds potential for investors with some risk tolerance.

2. Innodata

At first glance, Innodata may look like the software version of Super Micro Computer. It started trading in 1993, and until mid-2020 it struggled to sustain any stock price gains. But like Supermicro, its fortunes changed in the past few years thanks to AI.

The data engineering company develops low-code software platforms that apply AI-driven processes to data collection, digital transformation, and business processes tailored to specific industries. Its software leverages this technology to automate processes, perform manual tasks faster, and free workers to spend more time on creative and analytical work.

Thanks to the optimism surrounding this technology, Innodata stock is up over 1,670% in the last five years and trades near all-time highs set this month. However, at a market cap of just under $500 million, investors still have a chance to get into the stock early.

In the first quarter of 2024, revenue of $27 million rose 41% from year-ago levels. This compares favorably to 2023’s revenue growth of just 10%. Also, thanks to efforts to slow cost and expense growth, the company earned almost $1 million, up from a $2.1 million loss in the first quarter of 2023.

Moreover, Innodata expects these top- and bottom-line improvement trends to continue as it forecasts a minimum of 40% revenue growth in 2024. Such a change likely explains why the stock has roughly doubled in value since the beginning of the year.

Admittedly, that increase has taken its price-to-sales (P/S) ratio to record highs, but at a 5.5 sales multiple, it compares well to most other AI stocks. Considering its growth potential, investors might wish they had bought Innodata at 5.5 times sales if greater awareness continues to push the stock price higher.

Should you invest $1,000 in Alibaba Group right now?

Before you buy stock in Alibaba Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Nvidia, Oracle, Salesforce, and Tencent. The Motley Fool recommends Alibaba Group and International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel