It seems that all modern technological innovations undergo a hype cycle of sorts. The most famous is the dot-com bubble of the late 1990s and early 2000s. The Nasdaq more than doubled from the beginning of 1997 through the March 2000 zenith. Many think an artificial intelligence (AI) bubble is forming now; many others disagree. One of the key differences between companies now and those during the dot-com bubble is profitability.

While many tech companies back then had little sales and no profits, dozens of companies in the AI industry today are cash-flow positive, have soaring revenue, or are highly profitable — not just hyped. This is a critical distinction that can help guide your investment strategy. Here are two companies that fit this mold.

Micron Technology

If there is one thing that AI needs, it is data, and this data needs memory — tons of it. Micron (NASDAQ: MU) is a global leader in providing DRAM (dynamic random access memory) and NAND (flash memory), which are used in smartphones, PCs, memory cards, data centers, etc. After a rough fiscal 2023, Micron is back in a major way.

In fiscal 2023, Micron battled geopolitical problems that hampered Chinese sales and a market where its products were not in demand due to oversupply. In other words, many of its customers were using existing inventory rather than purchasing more from Micron. Sales fell from $31 billion in fiscal 2022 to $16 billion in fiscal 2023. The industry is cyclical; in 2023, it was down, but now things are looking up.

AI powers two trends that will be tailwinds for Micron. First, hundreds of data centers are coming online every year, and this trend is expected to continue for many years. Micron’s management says that its HBM (high-bandwidth memory) sales will reach hundreds of millions this fiscal year and “multiple billions” next fiscal year. Next, AI will increase demand for upgrading PCs and smartphones, and these AI-ready systems will require more memory, a direct benefit to Micron.

Micron reported $6.8 billion in revenue in the third quarter of fiscal-year 2024, an 81% increase over the prior year and a significant margin improvement due to high demand. Operating income improved year over year from a loss of $1.8 billion to a profit of $719 million.

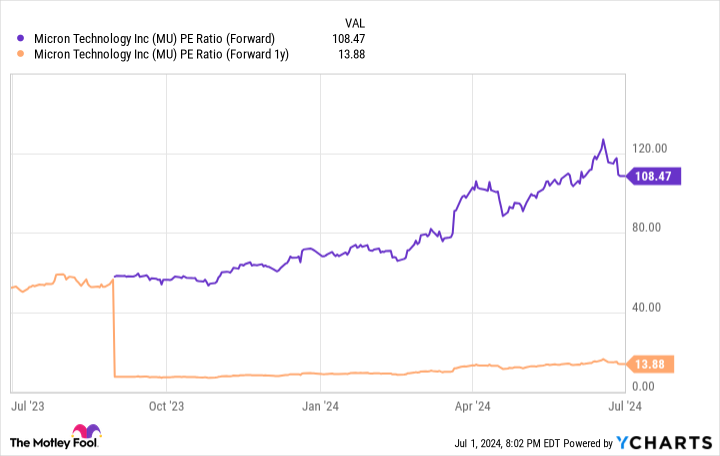

The stock’s valuation is out of whack due to its profitability last year and incremental recovery this year. This year’s average analyst earnings-per-share (EPS) expectations are just $1.23, giving Micron a price-to-earnings (P/E) ratio over 100 at the current price; however, this isn’t the whole story. As shown below, analysts predict a massive EPS jump next year to $9.48, which would make the P/E only 14.

The low valuation based on fiscal 2025 estimates and significant tailwinds make Micron a solid long-term investment.

CrowdStrike

Cybersecurity is always a priority for executives because the costs of breaches, in terms of direct costs, downtime, recovery, etc., can be immense. Most successful breaches occur through endpoints, so companies clamor for protection from AI-powered protection like CrowdStrike‘s (NASDAQ: CRWD) Falcon platform.

Falcon is entirely cloud-based and modular, so companies can add features as needed. Selling additional modules is part of CrowdStrike’s land-and-expand sales strategy, which works well. As of Q1 FY25, 65% of customers used at least five modules, and 28% used seven or more.

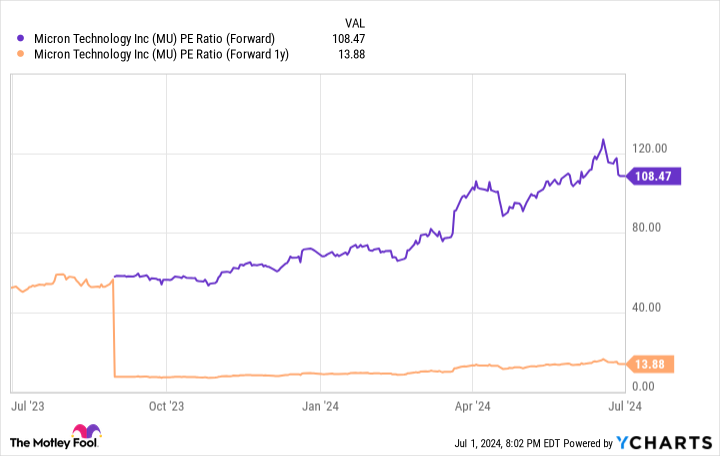

The demand for endpoint protection drives incredible growth for CrowdStrike’s sales and free cash flow, as shown below.

The incredible rise in sales and nearly 32% free-cash-flow margin over the last 12 months show why investors are buying the stock hand over fist. The stock is up 50% so far in 2024 and 500% over the past five years. However, the epic rise has pushed the stock’s price-to-sales (P/S) ratio extremely high.

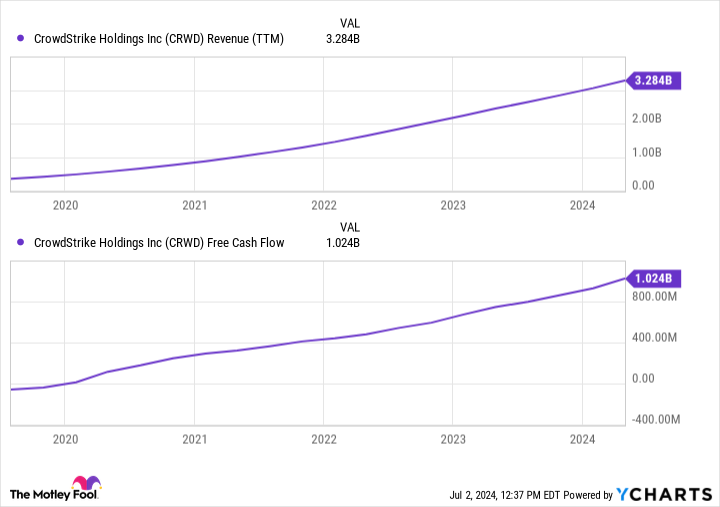

CrowdStrike’s P/S ratio now stands near 29, higher than fellow high-growth software company Palantir and cybersecurity companies like Palo Alto Networks and Zscaler:

CRWD PS Ratio data by YCharts

Investors should be cautious about buying CrowdStrike because of its valuation; however, the company’s results are spectacular, and it has a tremendous future.

The artificial intelligence boom is in full swing, and many companies are reaping the rewards. Tech investors: Keep Micron and CrowdStrike on your radar.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,046!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Bradley Guichard has positions in CrowdStrike, Micron Technology, and Palo Alto Networks. The Motley Fool has positions in and recommends CrowdStrike, Palantir Technologies, Palo Alto Networks, and Zscaler. The Motley Fool has a disclosure policy.

2 Soaring Artificial Intelligence (AI) Stocks That Aren’t Just Hype was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel