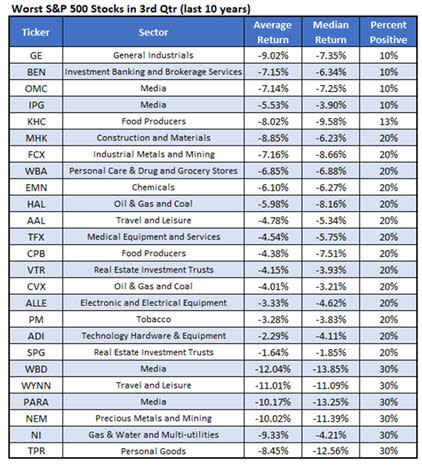

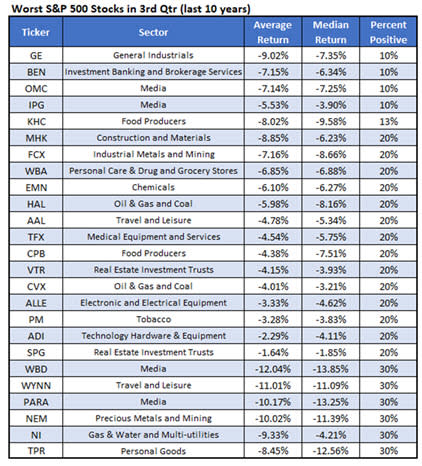

With the third quarter currently underway, traders may be looking to protect their gains after a strong first half of 2024. Freeport-McMoRan Inc (NYSE:FCX) and Newmont Corporation (NYSE:NEM) are stocks to avoid in the three months ahead, as they are historical underperformers.

According to Schaeffer’s Senior Quantitative Analyst Rocky White, FCX and NEM are the worst mining stocks on a list of 25 underperforming S&P 500 Index (SPX) stocks to own in the third quarter, going back 10 years. The former finished the quarter lower 80% during the past decade, while the latter was lower 70% of the time, averaging 7.2% and 10% losses, respectively.

Freeport-McMoRan stock is up 4.2% to trade at $50.75 at last check, though the company said it expects lower copper and gold sales for the fiscal second quarter. Shares have cooled from their May 20, 13-year high of $55.23, and despite today’s gains are running into familiar pressure at their 40-day moving average, which emerged back in June. So far in 2024, FCX added 19.3%.

Last seen up 4% to trade at $43.37, Newmont stock is attempting to shatter a ceiling that emerged after it cooled off from its May 20, 2024 peak of $44.59. The equity sports a slim 4.6% year-to-date lead, but over the past nine months has garnered a 22% lift.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel