Artificial intelligence (AI) is by no means a new concept, as the technology was in some form of development for at least the last four decades. However, the debut of OpenAI’s ChatGPT in 2022 brought renewed interest to the industry, triggering a bull run for many tech stocks. As a result, the Nasdaq Composite has spiked 33% over the last 12 months.

Intel (NASDAQ: INTC) was initially left out of the AI rally, as investors were more concerned with recent headwinds. However, it appears Wall Street is beginning to take notice of the company’s expanding role in the budding market.

Intel has released a range of new AI chips since the start of last year and restructured its business to focus on expanding its manufacturing capacity. So despite being down 36% year to date, the company’s shares have trickled up about 6% since the end of May.

The company has made many changes recently that could significantly pay off in the coming years. Here are three reasons to buy Intel stock like there’s no tomorrow in 2024.

1. Playing the long game in AI

Intel has hit many roadblocks in the last decade. The company was once the most prominent name in the chip market, with a leading market share in manufacturing and a lucrative partnership with Apple that made it the primary chip provider for the Mac lineup. However, the loss of both has seen Intel’s stock and earnings take a deep dive. Intel’s annual revenue and operating income have plunged 3% and 100%, respectively, since 2014.

Recent moves have seen the company reorganizing its business to come back stronger over the long term. In April, Intel unleashed a fresh round of layoffs in its sales and marketing department. The decision is part of the tech giant’s plan to cut spending by as much as $10 billion by 2025.

The company is trimming the fat, so to speak, in some areas and throwing everything at AI and its burgeoning foundry business. Intel is sinking billions into building chip plants throughout the U.S. as it seeks to retake the top spot in manufacturing. It expects its internal foundry model to save it “more than $8 [billion]-10 billion exiting 2025” and help it “achieve non-GAAP gross margins of 60%.”

Getting set up in manufacturing requires a hefty upfront investment, but Intel won’t be footing the bill alone. The company is a leading beneficiary of President Biden’s CHIPS Act, an initiative to expand the county’s foundry capacity. Consequently, Intel will receive a grant of $8.5 billion from the U.S. government to aid its manufacturing expansion.

A leading role in the chip fab market will take time but could grant Intel significant gains in the coming years. Chip demand will only likely rise for the foreseeable future as the tech market develops. Meanwhile, manufacturing would allow the company to profit from increased demand as AI chipmakers, like Nvidia and AMD, outsource their foundry needs.

2. Steady improvement in its earnings

Intel still has a lot of work ahead before returning to profitability, but its latest quarterly earnings indicate it’s moving in the right direction. In the first quarter of 2024, its revenue increased 9% year over year. The growth was a stark improvement from the year-ago quarter when revenue plunged 36% year over year.

Most crucially, Intel reduced its operating losses in Q1 2024 by about $400 million. A leading growth driver for the metric was its foundry segment, which hit $625 million in operating income after reporting $880 million in losses the year before.

The financial improvements came alongside a 31% rise in operating cash flow and a 30% increase in adjusted free cash flow. Intel’s business is improving, despite its significant investments in AI and manufacturing, making its stock a compelling buy while it’s inexpensive.

3. Invest in Intel now while it’s cheap

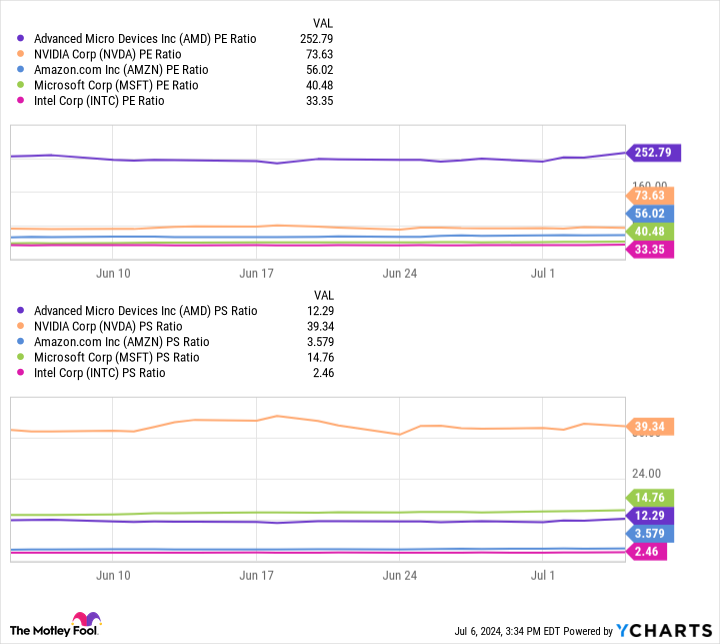

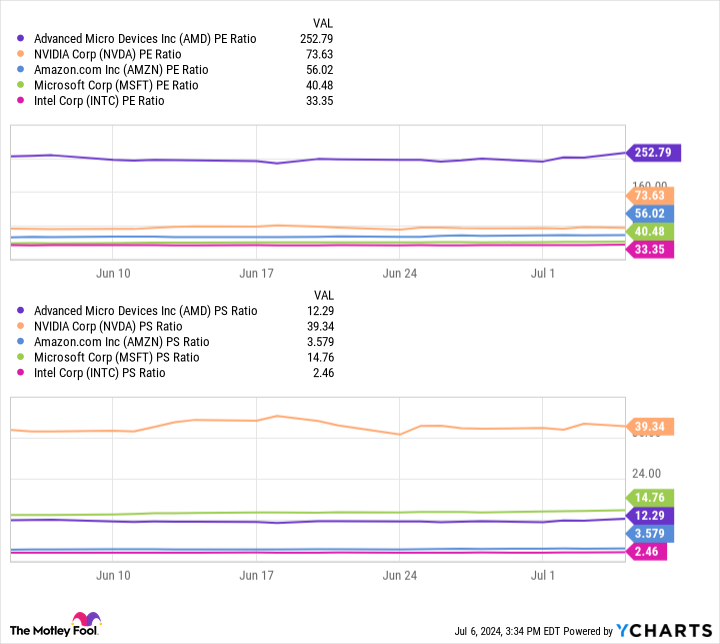

According to some key metrics, Intel potentially has one of the most attractive valuations among AI investments.

This table uses price-to-earnings (P/E) and price-to-sales (P/S) ratios to compare the valuations of some of the most prominent names in AI and tech, in general. For both metrics, Intel comes out on top with the lowest figures among its peers.

In addition to a manufacturing expansion and recent financial improvements, Intel’s stock is one to buy like there’s no tomorrow in 2024.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $785,556!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 Reasons to Buy Intel Stock Like There’s No Tomorrow in 2024 was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel