There are many ways to make a million dollars in the stock market, but one method is more reliable than the rest.

History shows that patient investors can build a million-dollar portfolio with the help of modest annual returns over a long time. This is a good description of master investor Warren Buffett’s strategy, and an even better fit for index fund legend John Bogle. So if you’re looking for a million-dollar investment idea, you should really search for companies and stocks that can stay relevant and financially healthy for decades to come.

On that note, I’d like to introduce you to three tenacious stocks that can carry that heavy weight. Amazon (NASDAQ: AMZN), International Business Machines (NYSE: IBM), and Buffett’s Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) should at least match the stock market’s average returns for the foreseeable future. Making steady investments in these robust stocks could make you a millionaire over time.

The secret sauce of durable winners

The most important quality in long-term business empires is flexibility. My three picks are very different examples of this trait:

-

IBM has been around for more than a hundred years. What started as a maker of punch-card calculators evolved into a mainframe computing powerhouse and a PC systems pioneer. Now, IBM is leaning into the big-ticket opportunities of cloud computing and artificial intelligence (AI) services.

-

Berkshire was once a large manufacturer of fabrics. Buffett liquidated its textile mills to finance takeovers in various fields. Today, it’s a giant of the insurance, manufacturing, transportation, and consumer goods industries with deep interests in other areas. iPhone maker Apple (NASDAQ: AAPL) has been Berkshire’s largest holding since 2018.

-

Amazon started as a pure online bookseller, managed in founder Jeff Bezos’ garage. The company added more products to its catalog until it became synonymous with the concept of e-commerce in North America. Amazon is expanding its operations around the world, adding a world-class shipping network and a massive cloud computing system along the way, and always hunting for the next big idea.

These companies are always ready to change with the times. You will often find them in the vanguard of the next marketwide sea change. That’s exactly what I want to see in my long-term investments.

Smart ways to invest like a future millionaire

Past performance is no guarantee of future results, but these three companies have proven their ability to stay ahead of the times.

Berkshire has built a cross-sector conglomerate for the ages, managed by some of the world’s best business minds. Big Blue is turning decades of AI research into a terrific near-term growth driver, surely to be followed by another unexpected strategy shift that will be helpful in the 2040s and beyond. Amazon has been around for 30 years but is still acting like a hungry little upstart with tons of unexplored markets and business ideas.

You can pick any combination of these stocks to power a diversified investment portfolio in the long run. Getting started with a robust investment today is a good start, but you’ll do even better if you commit to building on that investment for years to come. With a dollar-cost averaging strategy, you can buy more shares when they’re cheap and fewer when they’re not, averaging out market volatility along the way. Automating the process with weekly, monthly, or annual stock buys can help you stay on track.

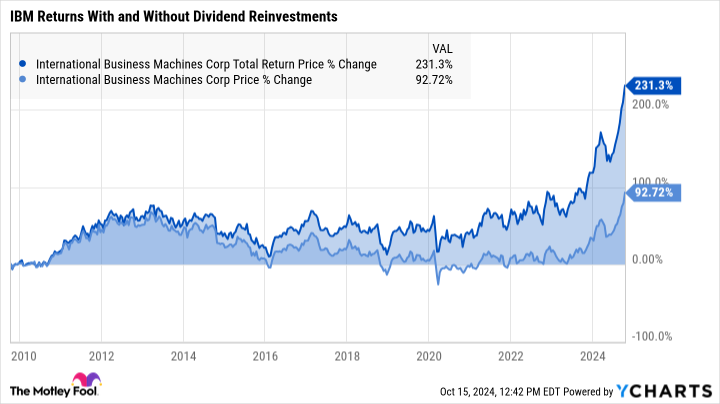

And don’t forget to enable a dividend reinvestment program (DRIP) for IBM, where the generous dividend payments make a big difference to your long-term returns:

There you have it: IBM, Berkshire Hathaway, and Amazon can help you make a millionaire over the next few decades. They may not get the job done quickly, but truly wealth-building investments always take time. You’ll follow in the footsteps of Bogle, Buffett, and many other investing geniuses. They should always be a part of a diversified portfolio, but these ultra-flexible companies are almost single-ticker index funds on their own.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $806,459!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Amazon and International Business Machines. The Motley Fool has positions in and recommends Amazon, Apple, and Berkshire Hathaway. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

3 Tenacious Stocks That Could Make You a Millionaire was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel