Kraft Heinz (NASDAQ: KHC) has been a disappointing investment ever since it was created from the merger between Kraft and Heinz nine years ago. The combined company’s shares opened at $48.55 on July 6, 2015, but they now trade just below $36.

Kraft Heinz was initially considered a stable blue chip consumer staples stock, but it rattled its investors in 2019 with a $15 billion writedown on its top brands, a dividend cut, and the disclosure of an SEC probe related to its accounting practices. Its then-CEO Bernardo Hees stepped down a few months after making those announcements.

Hees’ successor, Miguel Patricio, guided the company through challenges until he stepped down and handed the reins over to Carlos Abrams-Rivera last year. Under those two CEOs, Kraft Heinz’s stock has stabilized and risen about 14%. It’s still well below its debut price, but I believe it’s worth buying for five simple reasons.

1. Kraft Heinz overcame its previous problems

Many of Kraft Heinz’s brands were struggling when Patricio took the helm. Consumers were gravitating toward healthier foods, and big grocery chains were evolving into tough competitors with their own private-label brands. Instead of streamlining its portfolio, refreshing its products, and launching new marketing campaigns to fend off those threats, Kraft Heinz’s management focused too much on cutting costs and buying back its shares to boost its earnings per share (EPS).

But under Patricio, Kraft Heinz divested its weaker brands to raise cash, acquired higher-growth brands, and refreshed its classic brands with new products and marketing campaigns. Those strategies put it in a good position to grow in 2020 and 2021 as the COVID-19 pandemic drove more people to stock up on packaged foods. It also countered the inflationary headwinds in 2022 and 2023 by gradually raising its prices.

2. Its top-line growth has stabilized

Kraft Heinz’s net sales growth — which includes its divestments, acquisitions, and currency fluctuations — was lumpy over the past five years. However, its organic sales stayed positive over the past four years as it reorganized its brand portfolio.

|

Metric |

2019 |

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|---|

|

Organic sales growth |

(1.7%) |

6.5% |

1.8% |

9.8% |

3.4% |

|

Net sales growth |

(4.9%) |

4.8% |

(0.5%) |

1.7% |

0.6% |

Data source: Kraft Heinz.

It expects its organic sales to dip 0% to 2% this year as it runs out of room to raise its prices in its international developed markets. That pressure is offsetting its successful price hikes in North America and its international emerging markets.

That slowdown might seem like a red flag, but its growth should accelerate again as inflation finally subsides. It’s also been expanding its away-from-home segment with new products for restaurants and businesses, refreshing its older brands with new products, and mulling a divestment of Oscar Mayer to further streamline its organic growth. For now, analysts expect its net sales to grow at a slow but steady compound annual growth rate (CAGR) of 1% from 2023 to 2026.

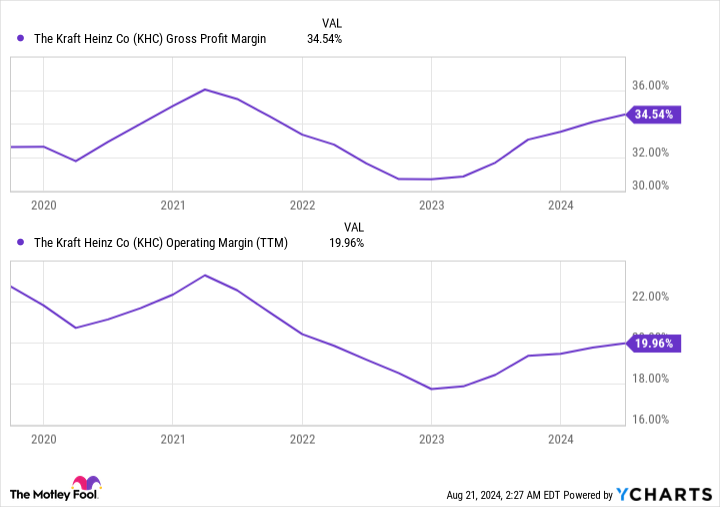

3. Kraft Heinz’s gross and operating margins are rising

Kraft Heinz’s gross and operating margins were both compressed by inflation in 2022, but both metrics have expanded significantly over the past 18 months.

For 2024, the company expects its adjusted gross margin to expand 75 to 125 basis points, and for its adjusted operating margin to rise by one to three percentage points. It also expects its adjusted EPS to grow 1% to 3% to $3.01 to $3.07 per share. Analysts expect its reported EPS to increase at a CAGR of 13% from 2023 to 2026.

4. Kraft Heinz has a low valuation and a high dividend yield

At $35, Kraft Heinz stock trades at just 12 times the midpoint of this year’s earnings. In comparison, its industry peers General Mills and Mondelez trade at 16 and 21 times forward earnings, respectively. Kellanova, which recently agreed to be acquired by Mars, trades at 22 times forward earnings. That low valuation, along with its high forward dividend yield of 4.5%, should limit Kraft Heinz’s downside potential.

5. Warren Buffett still owns this stock

Last but not least, Warren Buffett’s Berkshire Hathaway — which co-orchestrated Kraft’s merger with Heinz — continues to hold 26.9% of the company’s outstanding shares. That $11.5 billion stake accounts for 3.7% of Berkshire’s portfolio, and it wasn’t trimmed or liquidated in its recent sales of several high-profile stocks.

Buffett’s decision to stick with Kraft Heinz suggests its business isn’t headed off a cliff. It certainly won’t blast off anytime soon, but it should be a good place to park your cash and collect some decent dividends until the macro headwinds subside. So if you’re looking for a good blue chip stock to buy as a safe haven play right now, Kraft Heinz checks a lot of the right boxes.

Should you invest $1,000 in Kraft Heinz right now?

Before you buy stock in Kraft Heinz, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kraft Heinz wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Leo Sun has positions in Berkshire Hathaway. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Kellanova and Kraft Heinz. The Motley Fool has a disclosure policy.

5 Reasons to Buy Kraft Heinz Stock Like There’s No Tomorrow was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel