With the first three quarters of the calendar year in the books, investors are strolling into October with the major indexes at all-time highs and a more than 20% year-to-date gain in the S&P 500 and Nasdaq Composite. Go back even further, and the S&P 500 is up a staggering 50% since the start of 2023.

Efficiency improvements and artificial intelligence (AI)-powered innovations are sending ripple effects through the stock market — from changing how legacy companies do business to setting the stage for more demand for energy and electricity to power data centers.

The Federal Reserve just announced its first interest rate cut in four years, which was quickly followed by a Chinese stimulus package and rate cuts. With the cost of capital getting cheaper, there’s reason to believe consumer spending could get a much-needed uptick this fall.

Despite all the momentum heading into October, investors should still take a long-term approach. They should only invest in companies that they believe can deliver on promises and navigate the cycle, and that are worth holding for at least three to five years. Here’s why five Fool.com contributors picked Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), Shopify (NYSE: SHOP), Albemarle (NYSE: ALB), D.R. Horton (NYSE: DHI), and Chevron (NYSE: CVX) as top stocks to buy in October.

It’s time to pounce on affordable Berkshire shares

Anders Bylund (Berkshire Hathaway): It’s rarely a bad time to invest in Berkshire Hathaway. Warren Buffett’s insurance-based investing machine almost always looks ready to beat the stock market in the long run.

But you know what Buffett says about pricing. He prefers buying stock in amazing companies at a fair price. That’s his secret recipe for keeping business risks low and investor returns high. That wisdom-packed quote applies perfectly to Berkshire’s own stock right now.

The company is not putting much money in the market these days. Berkshire’s cash and short-term investment reserves have swelled to $277 billion, crushing the former record of $150 billion in the fall of 2021. More than 21% of Berkshire’s assets are held in the form of cash or liquid government bonds. That’s not exactly a record, but it’s the highest ratio seen since the aftermath of the dot-com bubble popping.

That’s exciting to me. I can’t wait to see what the investing legend will invest in when the time is right. But Berkshire’s market makers have a different view, driving the stock 3% lower in September. Whether you’re buying the high-priced Class A shares or the more affordable Class B stock, Berkshire trades at just 14.6 times trailing earnings today.

So Berkshire Hathaway is gearing up for a buying spree in the near to mid-future. Meanwhile, the stock is changing hands well below its 10-year average price-to-earnings (P/E) ratio of 21. It’s the best of both worlds — a wonderful company trading at a wonderful price. The time is unusually right to invest in Berkshire Hathaway.

Shopping for deals

Demitri Kalogeropoulos (Shopify): Investors should take a closer look at Shopify stock right now. The e-commerce platform’s shares have rallied since the company reported excellent operating results in August. It’s easy to see why Wall Street cheered that update. Sales volumes were up a healthy 22% in the period, and there’s room for that figure to expand for many more years as e-commerce rises from its current level of 16% of retail spending. But the stock is still far below its all-time high, and it has trailed the wider market in 2024.

That underperformance shouldn’t last long. Earnings are rising at a faster pace than sales as Shopify benefits from growth in its subscription services and payment processing. It isn’t done reaping the financial rewards from the spinoff of its logistics business, either. Gross profit margin improved to 51% of sales last quarter, from 49% of sales a year earlier.

Shopify executives are calling for another quarter of rising margins and ample cash flow for the selling period ending in late October. That positive momentum helps explain why Wall Street has placed such a premium on this stock, which is valued at over 13 times sales today. Yet for growth stock investors who don’t mind volatility, Shopify looks like a compelling long-term buy.

Buy this stock while there’s still time

Neha Chamaria (Albemarle): 2024 has been a rough year for Albemarle stock — it plunged 50% and hit its 52-week lows by mid-August. Although the lithium stock has rebounded since, it’s still down about 45% this year as of this writing. I still believe the sell-off is overdone, and it’s an opportunity to buy a magnificent value stock that could soar when its end markets recover.

The problem is not with Albemarle. It’s the weakness in lithium markets that sent the stock tumbling. Lithium prices peaked in 2022 and have plunged more than 90% since. The rally of 2022 driven by a supply deficit was unsustainable, as prices shot up too much and too fast. Soon enough, global lithium supply started to catch up with demand in anticipation of a boom in the electric vehicle (EV) market. Lithium prices cooled off, but before they could stabilize, the global EV market began slowing down in 2023. Albemarle’s top and bottom lines were bound to take a hit, as the company is one of the world’s largest producers of lithium for EV batteries.

However, lithium’s long-term growth potential remains intact, as it’s a critical element for the EV industry. Albemarle is taking necessary steps to preserve cash while it awaits a recovery. Albemarle’s financial flexibility has been its biggest strength over the decades, and it should be no different this time around.

When the business cycles turn, Albemarle could become one of the fastest-growing stocks in the industry, given its foothold and financial discipline. The company has also increased its dividend for 30 consecutive years. With recent industry developments renewing hopes of a recovery in lithium prices, now’s the time to load up on Albemarle stock.

A homebuilding homerun

Keith Speights (D.R. Horton): The Federal Reserve is lowering interest rates for the first time in four years. More rate cuts are likely on the way. Mortgage rates are also coming down as a result. If you think this news is great for homebuilders, you’re right. It’s especially great for the U.S.’s biggest homebuilder by volume — D.R. Horton.

Shares of D.R. Horton have soared 25% year to date. All this nice gain, though, has come since July, when anticipation of a forthcoming interest rate cut began to intensify. Investors knew that lower interest rates typically lead to lower mortgage rates, which make it more affordable for Americans to buy new homes.

D.R. Horton has been able to operate successfully, even in the high-rate environment of the last few years. However, the company has had to offer incentives such as mortgage rate buy-downs to help make the homes it built more affordable. Management expects that the Fed’s interest rate cuts could allow it to reduce the use of incentives to some extent, which would improve profitability.

While the rate cuts serve as a near-term catalyst for D.R. Horton, there’s an even more important long-term tailwind for the stock. The U.S. continues to face a major housing shortage. Zillow estimates that the country needs another 4.5 million homes.

Finally, the November U.S. elections could provide another spark for D.R. Horton. Vice President Kamala Harris has proposed tax incentives for homebuilders that sell homes to first-time homebuyers. Should she win the presidential election, D.R. Horton’s shares could soar even higher.

Chevron and its growing dividend are built to last

Daniel Foelber (Chevron): West Texas Intermediate crude oil prices — the U.S. benchmark — have fallen below $70 per barrel, the lowest level in 2024. The sell-off is dragging down the energy sector, including big names like Chevron, which is now less than 9% away from its 52-week low.

Chevron has performed significantly worse than its U.S. peer, ExxonMobil, in 2024, because of uncertainties regarding its acquisition of exploration and production company Hess. Chevron and ExxonMobil both announced blockbuster acquisitions in October 2023 to strengthen their cash flows and boost oil and gas production. ExxonMobil closed its deal in May, but Chevron was caught up in a series of challenges that have prevented the deal from going through.

On Sept. 30, Chevron got some good news: The Federal Trade Commission completed its antitrust review and concluded that the Hess deal could proceed, on the condition that Hess CEO John Hess not be appointed to Chevron’s board (but could serve as an advisor).

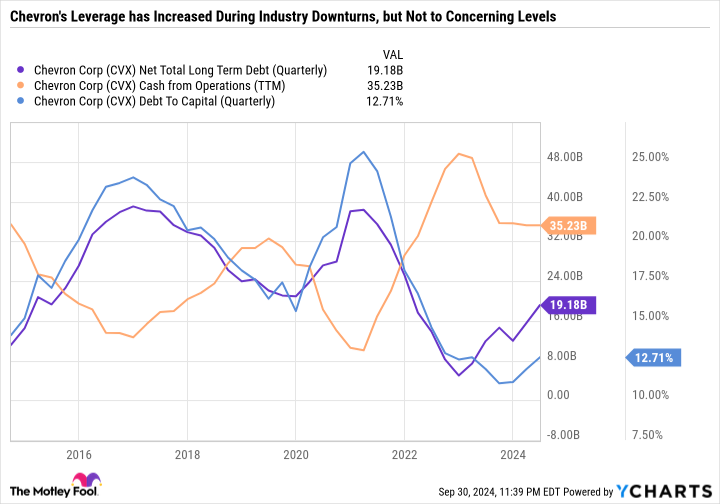

The market hates uncertainty, so the sooner Chevron can move forward with the deal, the better. While Hess would give Chevron better global diversification and access to low-cost reserves in offshore Guyana, it doesn’t really need the deal to go through. Chevron has a highly efficient portfolio and can generate plenty of cash flow to cover its dividend and capital expenditures, even at lower oil prices. It also has an excellent balance sheet with very little debt, given Chevron’s size.

Chevron has paid and raised its dividend for 37 consecutive years — meaning it has raised the dividend even during years when growth has slowed, or it reported a net loss. Chevron has accomplished this feat because it invests through the cycle and doesn’t structure its business to depend on high oil prices. When oil prices are high, Chevron tends to pay down debt and position itself so that it can be more flexible for the next downturn.

In the following chart, you can see that Chevron’s total net long-term debt declined during years of higher operating cash flow, but its debt-to-capital ratio was still at a healthy level even during industry downturns.

Chevron remains one of the well-rounded buys in the oil patch. With a 4.5% dividend yield, it stands out as a great buy for passive income investors in October.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Anders Bylund has no position in any of the stocks mentioned. Daniel Foelber has no position in any of the stocks mentioned. Demitri Kalogeropoulos has positions in Berkshire Hathaway, Shopify, and Zillow Group. Keith Speights has positions in Berkshire Hathaway, Chevron, and ExxonMobil. Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Chevron, D.R. Horton, Shopify, and Zillow Group. The Motley Fool has a disclosure policy.

5 Top Stocks to Buy in October was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel