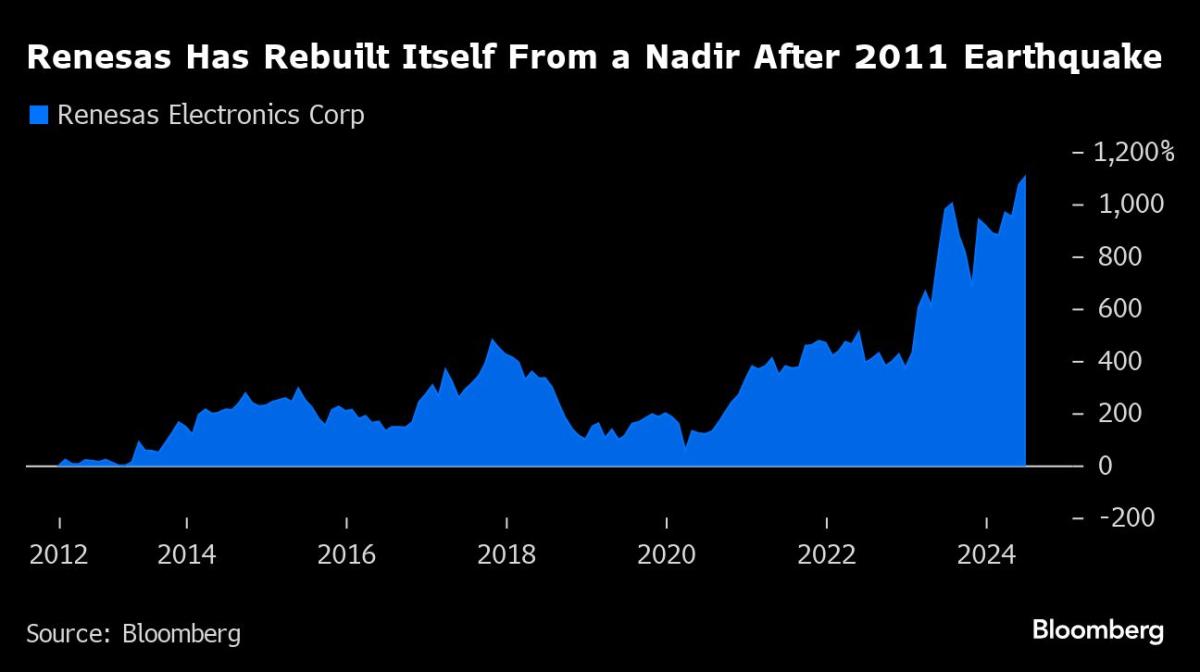

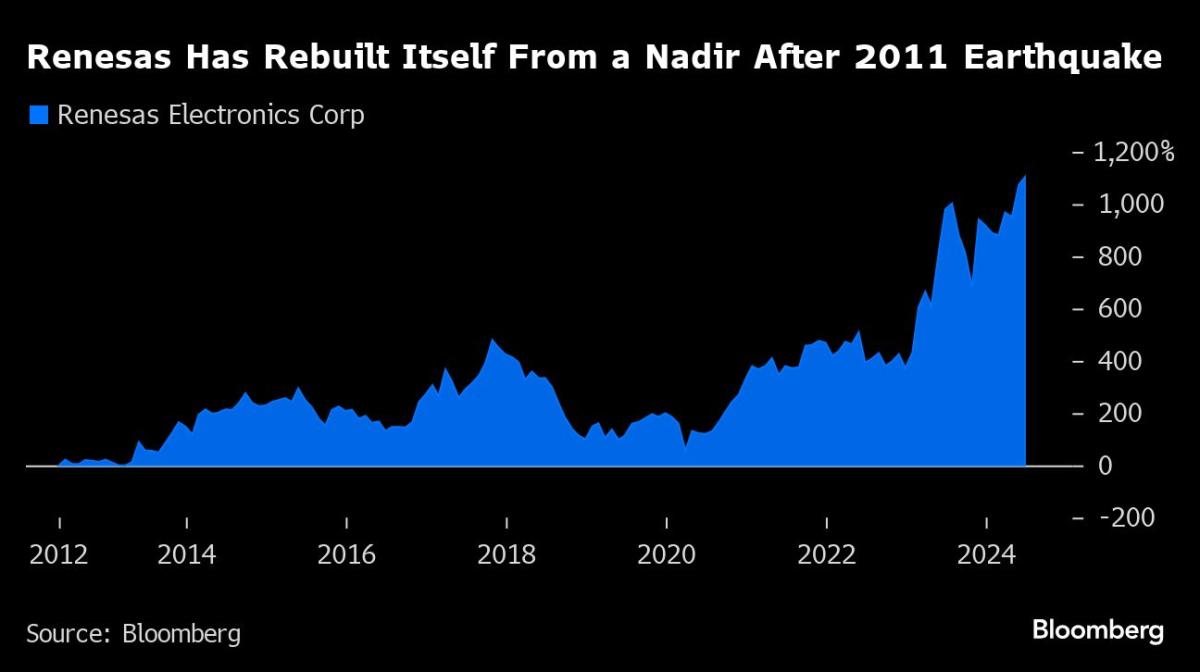

(Bloomberg) — A decade ago, Renesas Electronics Corp. was under government control and bleeding cash. Now worth $35 billion, the Japanese chipmaker is targeting a market value of around $100 billion by 2030, thanks to a string of overseas acquisitions.

Most Read from Bloomberg

Behind those deals is former Merrill Lynch banker Hidetoshi Shibata. Five years into his tenure as chief executive officer, the 51-year-old sees new business in India and in AI-enabling microcontrollers helping the company double annual revenue to a record $20 billion by the end of the decade. His ambition to triple the company’s valuation to ¥16 trillion to ¥17 trillion comes as a fresh surge in AI enthusiasm lifts shares of the chipmaker behind Toyota Motor Corp., Honda Motor Co. and Nissan Motor Co. to their highest since the global financial crisis.

Formed out of the chip arms that originated from NEC Corp., Hitachi Ltd. and Mitsubishi Electric Corp., Renesas in 2009 was the world’s No. 3 chipmaker in sales after Intel Corp. and Samsung Electronics Co. But its fortunes faded alongside its Japanese clients. In addition, damage to a key factory in the March 2011 Japan quake prompted automakers to cut their exposure to any single supplier, and Renesas soon ceded ground to rival NXP Semiconductors NV.

Since joining the company as chief financial officer in 2013, Shibata’s orchestrated a string of acquisitions. This year, Renesas announced a $6 billion deal to buy Australia-listed software firm Altium Ltd. to move upstream in product development and electronics design.

In 2021, the company acquired UK-based Dialog Semiconductor Plc for $6 billion and earlier bought San Jose-based Integrated Device Technology Inc. and Milpitas, California-based Intersil Corp., in part to expand beyond the automotive sector into data centers and consumer devices. Shibata’s also expressed interest in compound semiconductors, which remain popular among electric vehicle makers.

“We need to be a real global player,” Shibata said in an interview last month. “It’s meaningless to be a major player in Japan. We have to be the top, globally. I want to make that happen.”

His buying spree has helped reduce Renesas’ reliance at home and expand abroad. Japan accounted for 26% of total sales last year, down from 44% in 2016. Sales to other Asian countries and Europe and North America have all increased during the same period.

India, which currently accounts for only a fraction of Renesas sales, will be important to future growth, according to Shibata. The company aims to earn at least 10% of revenue from the South Asian nation by the end of this decade, betting on that market’s fast-growing needs for electronics. Renesas plans to increase headcount in India 20-fold to 1,000 employees by 2025.

“For about ten years, Renesas kept on losing market share,” said Masaya Yamasaki, a senior analyst at Nomura Securities Co. “Now they look ready to take thing forward more aggressively – they’ve got quite a good balance in their product portfolio.”

Renesas’ push coincides with an aggressive campaign by Japan to turn the world’s fourth-largest economy into a chip powerhouse. In less than three years, Tokyo has committed to investing ¥4 trillion ($25 billion) in semiconductors and other advanced tech, including as much as ¥15.9 billion to cover a third of the cost to expand capacity at a Renesas plant. The Tokyo government has also encouraged publicly-traded companies to take steps to improve shareholder value, with Shibata’s comments marking a rare example of a Japanese CEO setting out plans to boost the share price.

As of 2023, Renesas was the second-largest maker of automotive processors after NXP, followed by Infineon Technologies AG, according to TechInsights analyst Asif Anwar.

Renesas is incorporating chiplets into its semiconductors, reducing costs while allowing for more customization, he said. The strategy is geared to help Renesas meet growing demand for chip architectures suited for EVs and self-driving and connected vehicles.

“Renesas will say they want to be number one and so will NXP and so will Infineon and so will Qualcomm,” Anwar said. “We’ll see over the next maybe three to four years how that shifts over time and who comes out on top.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel