(Bloomberg) — European stocks rose, tracking a record S&P 500 close, on optimism about US interest-rate cuts after Federal Reserve Chair Jerome Powell said inflation is getting back on a downward path.

Most Read from Bloomberg

Shares in most European industry groups were in the green as the regional Stoxx 600 index advanced 0.5%, led by miners and technology companies. The spotlight continues to be on politics, on the eve of elections in the UK. In France, the benchmark CAC 40 index rose as anti-National Rally parties attempt to prevent Marine Le Pen’s far-right group from achieving an absolute majority in the next round of legislative voting.

US equity futures were steady ahead of a session on Wall Street that will be shortened because of the July 4 holiday. The S&P 500 closed above 5,500 for the first time on Tuesday, its 32nd record this year. The Nasdaq 100 also set an all-time high with its first close above 20,000.

US stocks keep defying doomsayers amid solid corporate earnings, AI mania and expectations that interest rates will drop, adding more than $16 trillion to the S&P 500’s value from a closing low on October 2022. A lack of any meaningful pullback has given bulls conviction that the rally is sustainable.

The new record high close in the S&P 500 and Nasdaq “could also be taken as another win given the psychological significance that ‘round numbers’ hold,” said Chris Weston, head of research at Pepperstone Group in Melbourne.

Investors are looking to US initial jobless claims and ADP employment data due Wednesday to gain more clues on the policy outlook. Fed Chair Powell acknowledged the central bank has made “quite a bit of progress” in reducing inflation but emphasized officials need more evidence before lowering interest rates.

Markets are also gearing up for the all-important US payrolls reading due Friday. Economists expect the report to show employers added about 190,000 workers in June and the unemployment rate likely held at 4%.

Asian stocks headed for their longest stretch of gains since May. Japanese equities climbed, with the benchmarks now less than 1% from their record highs. In China, services activity expanded at the slowest pace in eight months in June, a private gauge showed, a slowdown that may add to worries over the economy’s outlook. Stocks in Hong Kong gained, while those on the mainland fell.

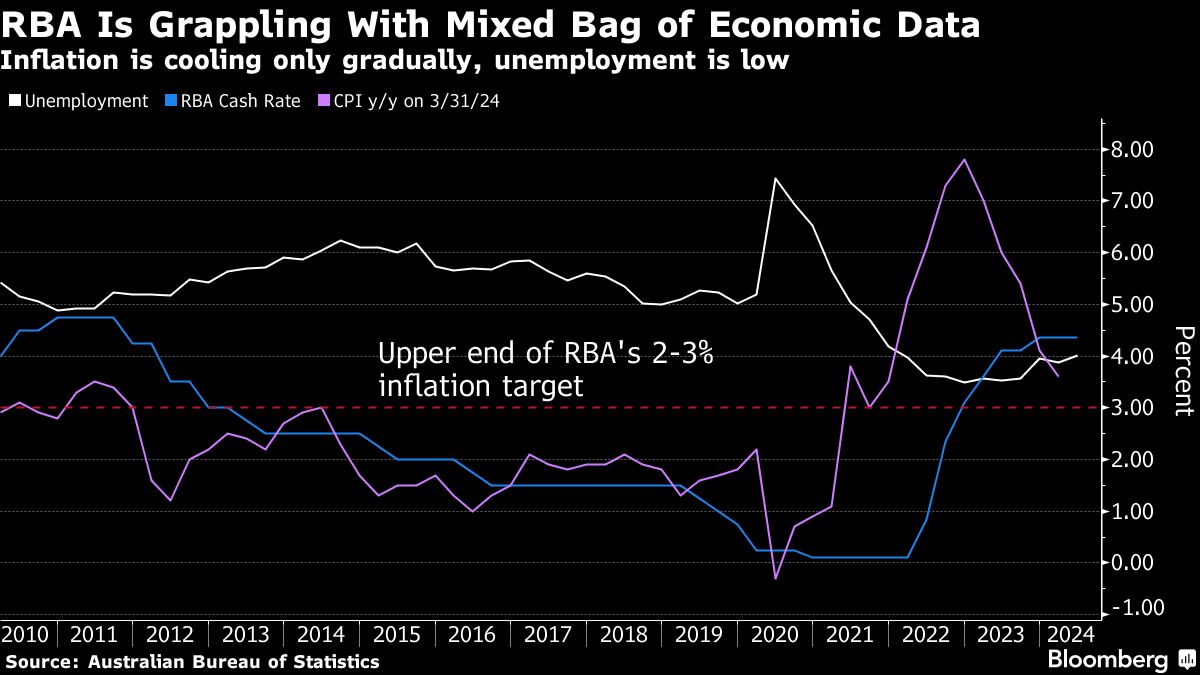

In other markets, Australia’s three-year bond yield extended its rise after better-than-expected retail sales data reinforced the case for a rate hike.

Elsewhere, oil climbed to near a two-month high, while the Bloomberg Dollar Spot Index and Treasury yields were little changed.

Key events this week:

-

Eurozone S&P Global Eurozone Services PMI, PPI, Wednesday

-

US Fed minutes, ADP employment, ISM Services, factory orders, initial jobless claims, durable goods, Wednesday

-

Fed’s John Williams speaks, Wednesday

-

UK general election, Thursday

-

US Independence Day holiday, Thursday

-

Eurozone retail sales, Friday

-

US jobs report, Friday

-

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 0.5% as of 8:22 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average were little changed

-

The MSCI Asia Pacific Index rose 0.7%

-

The MSCI Emerging Markets Index rose 0.8%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0753

-

The Japanese yen fell 0.3% to 161.86 per dollar

-

The offshore yuan was little changed at 7.3074 per dollar

-

The British pound was little changed at $1.2694

Cryptocurrencies

-

Bitcoin fell 1.6% to $60,922.44

-

Ether fell 1.7% to $3,357.45

Bonds

-

The yield on 10-year Treasuries was little changed at 4.43%

-

Germany’s 10-year yield advanced two basis points to 2.62%

-

Britain’s 10-year yield declined two basis points to 4.22%

Commodities

-

Brent crude rose 0.5% to $86.67 a barrel

-

Spot gold rose 0.6% to $2,343.79 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Rob Verdonck.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel