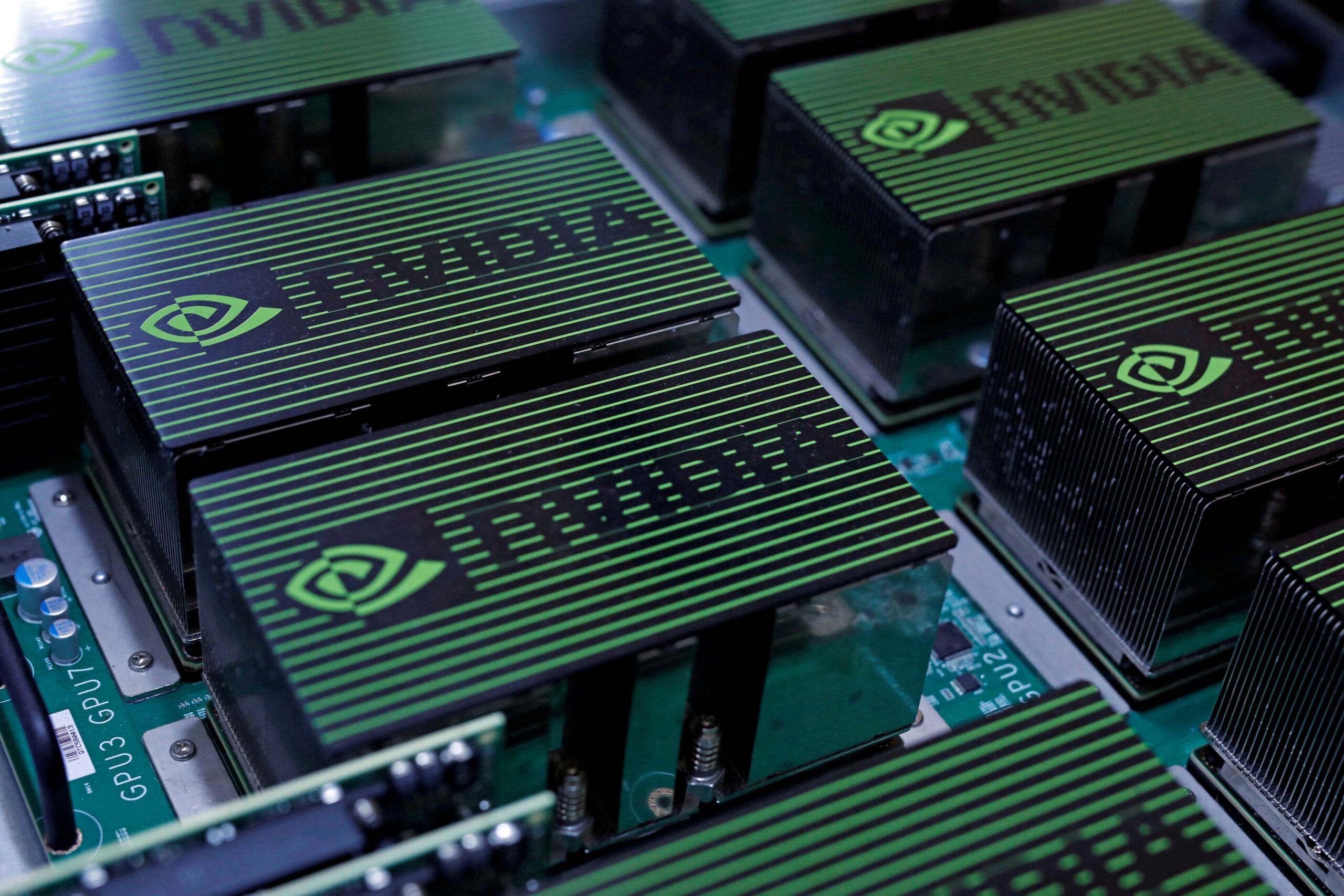

New Street Research is raising the alarm on shares of Nvidia after the chip giant’s June rally. Analyst Pierre Ferragu downgraded the dominant manufacturer of semiconductors used in artificial intelligence to neutral, citing limited upside. “We downgrade the stock to Neutral today, as upside will only materialize in a bull case, in which the outlook beyond 2025 increases materially, and we do not have the conviction on this scenario playing out yet,” he wrote Friday, noting that revenue models show growth slowing to a mid-teen rate, with graphics process unit revenues rising only 35% next year. Shares of Nvidia have surged 159% so far this year, building on an AI-fueled rally that kicked off in late 2022 when ChatGPT debuted. But Nvidia has pulled back in recent weeks as investors locked in some profits. Any negative opinion on Nvidia is pretty much unheard of these days on Wall Street. Of the 41 analysts covering the stock, 38 give it a buy rating, while three say it is a hold, according to TipRanks.com . No analysts say it is a sell. There was only one other downgrade of Nvidia from buy to hold this year, by Germany’s DZ Bank in May. Given this contrarian outlook, New Street set a $135 price target on Nvidia, assuming a 35 times multiple, in line with its 2019 and early 2020 multiple. The target suggests 5% upside from Wednesday’s close. Ferragu added that Nvidia may run the risk of seeing a lower price-earnings multiple, as it currently trades at 40 times the next 12 months’ earnings. That multiple bottomed at 20 times in 2019 when growth eased to 10%. “The quality of the franchise is nevertheless intact, and we would be buyers again, but only on prolonged weakness,” he wrote.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel