Bank of America analyst Michael Hartnett took a cue from a classic Western film last year when he expanded on the idea of the FAANG stocks, dubbing his new set of the most important companies on Wall Street the “Magnificent Seven.” These commanding megacaps are:

-

Microsoft (NASDAQ: MSFT)

-

Apple (NASDAQ: AAPL)

-

Nvidia (NASDAQ: NVDA)

-

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL)

-

Amazon (NASDAQ: AMZN)

-

Meta Platforms (NASDAQ: META)

-

Tesla (NASDAQ: TSLA)

All of them remain dominant forces in today’s market — other than Tesla, which is struggling with slowing EV sales. Two of them in particular look like top-tier buys preparing to crush the market right now: Alphabet and Meta Platforms.

Generative AI is a new tool for each company

While both Alphabet and Meta are involved in artificial intelligence (AI), their businesses are far more diverse than that. AI may grab headlines, but the bigger business for both companies is the advertisements they serve up along with the content and search results their users are after.

In Q1, 77% of Alphabet’s revenue came from advertising-related sources. For Meta, an incredible 98% came from ad revenue. This makes the advertising market a key factor in both stocks’ investment cases.

Furthermore, each is developing AI technologies to stay at the top of their game. In both cases, that means using generative AI models they have developed in-house to aid advertisers. For example, advertisers on Meta can use its tools to create multiple iterations of the same ad nearly instantly, which allows them to tailor their ads to their viewers. Alphabet offers tools that help advertisers quickly create campaigns that meet all of its internal guidelines. These examples show how each company is trying to stay ahead of its rivals by integrating new AI technologies as quickly as possible.

These innovations may (or may not) bring any new revenue, as the AI upgrades are essentially required for them to stay at the top of their respective industries. However, each company is doing so well right now that new revenue from new technologies isn’t necessarily required for them to excel.

Growth for each business is strong

In Q1, Alphabet’s ad revenue rose 13% to $61.7 billion. In particular, YouTube excelled, with revenue rising 21% to $8.1 billion. While most of Alphabet’s advertising empire is fairly mature, YouTube is still growing quickly. Still, 13% growth companywide is impressive, considering the maturity of the business.

Meta’s growth put Alphabet’s to shame. In Q1, its ad revenue grew 27% to $35.6 billion. And its revenue increased at a healthy pace in all of its regions worldwide.

These strong results aren’t outliers, either. Wall Street analysts project Alphabet’s revenue will rise 13% this year and 11% next year. For Meta, Wall Street expects 18% and 13% growth. Both of these are strong projections (considering the companies’ size) and are great reasons to invest.

However, the last point is just icing on the cake.

You don’t have to pay a fortune to own either stock

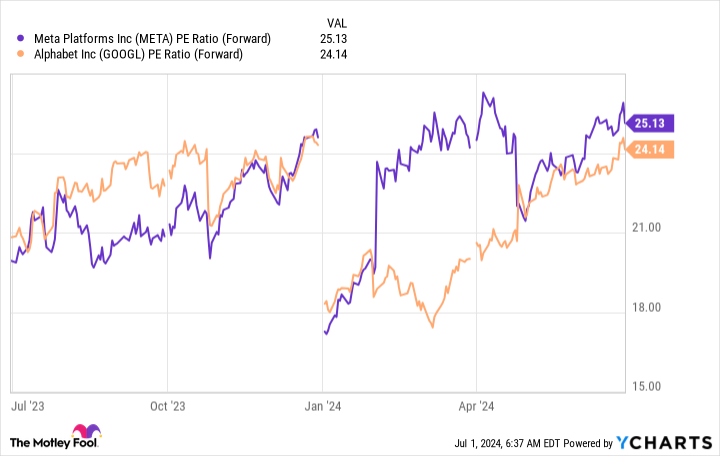

When you look at the rest of the Magnificent Seven — Microsoft, Nvidia, Amazon, Apple, and Tesla — every one of them is expensive from a valuation standpoint. Measured by their forward price-to-earnings ratios (which consider earnings projections over the next 12 months), none trades lower than 30.

That’s a historically expensive price to pay, which should give investors pause. However, Alphabet and Meta don’t command premiums quite that high.

At 24 and 25 times forward earnings, both still command slight premiums to the broader market’s average of 22.3 (using the S&P 500 as a benchmark). However, their execution and market dominance justify those slight premiums.

With both companies excelling, projected to grow at respectable paces, and trading at reasonable valuations, they easily top my list as the best stocks to buy in the Magnificent Seven now.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,046!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 “Magnificent Seven” Stocks to Buy Right Now was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel