CrowdStrike Holdings (NASDAQ: CRWD) has been one of the market’s big winners — shares are up over 165% in the past 12 months — and it has arguably become the hottest name in the fast-growing cybersecurity space.

It’s not just hype, though: CrowdStrike is generating profitable, high-speed growth and establishing competitive advantages quarter by quarter. But investors must be careful not to fly too close to the sun. The company may seem destined for greatness, but it’s now fair to question how much of that is priced into shares already.

So is CrowdStrike a buy? Here’s what you need to know.

Durable double-digit growth ahead

CrowdStrike could be a shoo-in for years of double-digit growth. The company’s cloud-based cybersecurity platform uses cutting-edge technology and artificial intelligence (AI) to detect and respond to breaches. Its products are miles ahead of decades-old antivirus technology, which has existed since the personal computer’s early days and predates modern technologies like the cloud.

Additionally, the company has expanded beyond endpoint security to increasingly become a do-it-all security platform that can widely serve a customer’s broader security needs. This gives CrowdStrike multiple ways to grow:

-

Take share in existing markets.

-

Cross-sell products to existing users.

-

Continually launch new products to grow its addressable market.

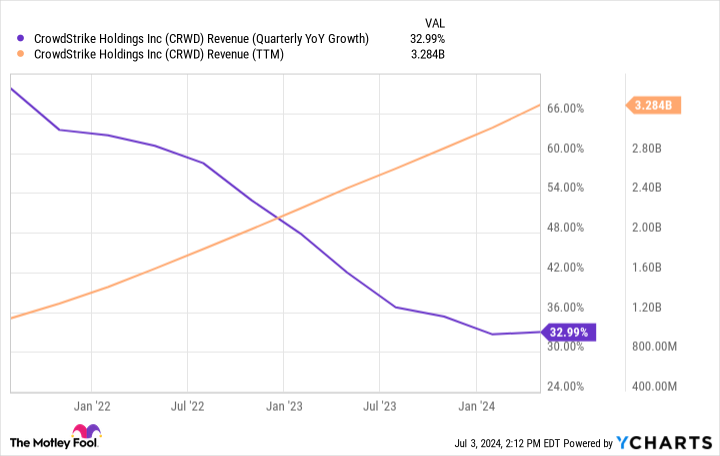

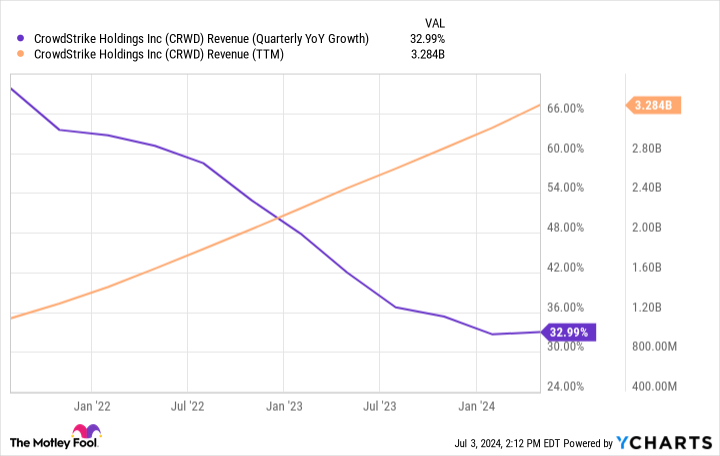

CrowdStrike generated $3.3 billion of trailing-12-month revenue with the latest quarter’s top line growing 33% year over year:

There is also a growing demand for cybersecurity. Experts expect the global industry to grow at a 12% annualized pace through 2030. CrowdStrike’s growth will slow as its business gets bigger, but it still seems poised for many years of double-digit growth.

Building a moat right now

Growing companies don’t roll out of bed with a competitive moat. Instead, they must build it over time.

How is CrowdStrike building its moat? Platform expansion.

CrowdStrike’s endpoint security product is great, but a single offering generally doesn’t create a moat. In this case, SentinelOne offers a comparable endpoint product too. Additionally, customers typically have a wide variety of security needs.

So, CrowdStrike has launched many other product modules to meet more needs, both organically and via acquisitions. Today, 28% of CrowdStrike’s customers have adopted seven or more of its modules. The more cybersecurity needs CrowdStrike’s platform handles for a customer, the harder it becomes to switch to a different provider.

The company’s ability to expand its platform and cross-sell products is key to its growing competitive moat.

Is CrowdStrike a buy?

Even as CrowdStrike rapidly expands its reach, it’s growing more profitable as well. Fiscal 2025 Q1 net income of $42.8 million surged from the year-ago period. Free cash flow also rose 42% during the quarter to $322.5 million.

Yet the company could still be in its early innings. Management believes its addressable market will grow to $225 billion by 2028, meaning CrowdStrike is only capturing a low-single-digit share of that opportunity.

That makes the stock a no-brainer buy, right? Well, not quite. There is a catch.

The stock trades at more than 96 times forward earnings estimates. That’s a steep price, even for a company executing at a high level like CrowdStrike. And it’s still steep when taking into account the 40% annual earnings growth analysts expect from the company over the next three to five years.

After climbing over 165% in the past year, the stock could pull back in the near future. The market’s sky-high expectations mean even the smallest sign of weakness could send the stock tumbling, and the margin of safety is razor-thin.

With that in mind, anyone buying shares of CrowdStrike today must be patient and approach this stock with a long-term mindset.

Should you invest $1,000 in CrowdStrike right now?

Before you buy stock in CrowdStrike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CrowdStrike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $771,034!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Justin Pope has positions in SentinelOne. The Motley Fool has positions in and recommends CrowdStrike. The Motley Fool has a disclosure policy.

Is CrowdStrike Holdings a Buy? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel