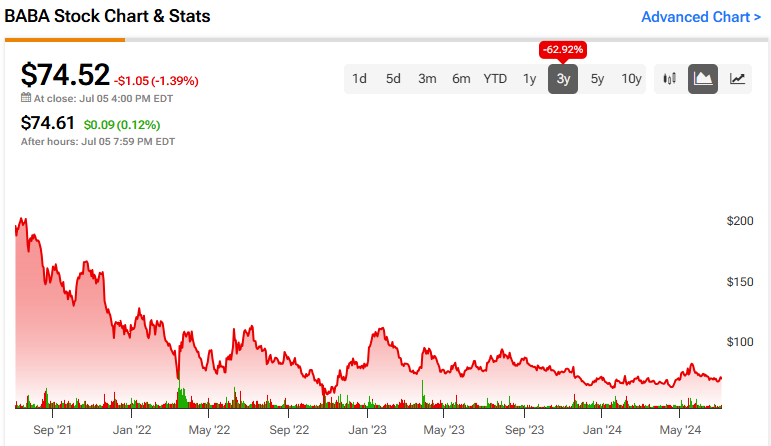

Alibaba stock (NYSE:BABA) remains depressed, showing no signs of a meaningful recovery. Despite major indices climbing to new highs over the past year, investors remain largely uninterested in the Chinese e-commerce giant’s investment case. However, with Alibaba’s growth showing signs of acceleration, as well as management becoming increasingly focused on returning capital to shareholders, particularly through buybacks, the stock could attract the bulls back. Consequently, I have now turned bullish on BABA stock.

Growth Picks Up, Sets the Stage for Robust FY2025

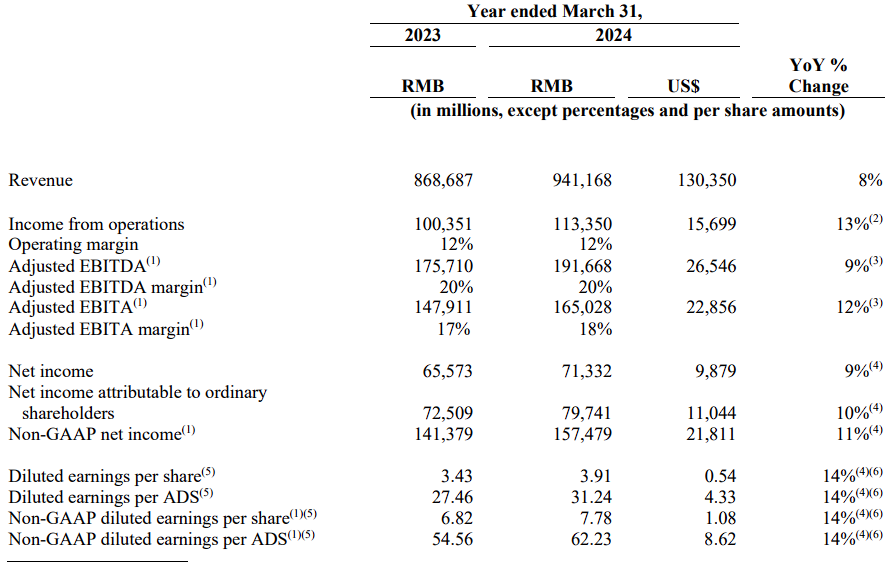

Alibaba’s most recent results marked a return to growth and set the stage for a robust FY2025. For its Q4-2024, ending March 31st, Alibaba posted revenues of $30.7 billion, up 7% year-over-year. This pushed the company’s full-year revenues to $130.4 billion, up 8% compared to FY2023. Notably, this marked a return to growth, as, in the prior year, revenues had grown by just 2%, coming in essentially flat.

Alibaba’s growth was driven by robust traction across the board. The core e-commerce platforms, Taobao and Tmall, saw single-digit growth in revenue, increasing by 4% year-over-year. This growth was driven by an increase in the number of buyers and purchase frequency. Evidently, gross merchandise value (GMV) across both platforms achieved double-digit growth, driven by rapid order growth, improvements in user experience, and price competitiveness.

Internationally, Alibaba International Digital Commerce (AIDC) posted an even more remarkable revenue increase of 45%. Management noted solid combined order growth, revenue contributions from AliExpress’ Choice, and improvements in monetization that strengthened Alibaba’s position outside of China.

Finally, while Cloud Intelligence revenues grew by a more underwhelming 3% compared to last year, the company still made significant developments that could accelerate this segment’s growth in the short-to-medium term. Specifically, Alibaba posted double-digit revenue growth in its core public cloud offerings and triple-digit growth in its AI-related revenues.

Although Alibaba did not disclose its AI-related revenues, this suggests the company is poised to become a dominant player in the AI sector within China. While Western corporations are unlikely to engage with Chinese AI technologies, and vice versa, this creates a significant competitive advantage for Alibaba. Few, if any, companies have the same scale in cloud computing to compete with Alibaba domestically, hence my argument.

Profitability, Valuation, and Capital Returns

Alibaba’s return to growth in FY2024 led to even more impressive improvements in profitability, largely thanks to the company’s incredible economies of scale. The company achieved adjusted EBITA growth of 12% to $22.9 billion, with its adjusted EBITA margin expanding from 17% to 18%. Moreover, Alibaba’s adjusted net income also rose by 11% to $21.8 billion, while on a per-American Depositary Share (ADS) basis, this figure rose by an even more significant 14% to $8.62, aided by a lower ADS count due to Alibaba’s buybacks.

Wall Street expects Alibaba’s ADS to moderate this year, with consensus estimates projecting $8.20 for FY2025, indicating a slight decline of 4.7%. Despite this, Alibaba’s stock still trades at an exceptionally low forward P/E ratio of 9x. Sure, the risks associated with Alibaba are well-known and should not be ignored. Yet, at this multiple, it’s hard to keep dismissing the stock’s investment case, given its moat in the market.

This is particularly true when considering Alibaba’s rising capital returns. Management has made it clear that they are aware of the stock’s undervaluation and have focused on return capital to reward existing shareholders and attract new ones by bolstering confidence in the stock. The company has repurchased and retired nearly 11% of its shares since early 2022, while this year’s regular and special dividends ($1.66 per ADS in total) make for an additional yield of 2.2% at the stock’s current price levels.

With plenty of room for Alibaba to keep growing its capital returns, the combined yield from repurchases and dividends is poised to become increasingly attractive if the stock price remains at current levels. Given that the stock’s total yield is already in the high single digits, I believe this element represents the strongest bullish catalyst. Real, tangible capital returns are a powerful driver that’s difficult to overlook.

Is BABA Stock a Buy, According to Analysts?

Most Wall Street analysts remain bullish on Alibaba, which isn’t surprising, given its depressed valuation. The stock maintains a Strong Buy consensus rating based on 14 Buys and three Holds. At $103.70, the average BABA stock price target has recently widened from the current stock price, implying substantial upside potential of 39.2%.

The Takeaway

Alibaba’s stock has consistently underperformed over the years, including during the recent uptrend of the broader market. That said, recent developments suggest a potential U-turn. With a return to growth in FY2024 and promising indicators for FY2025, Alibaba’s investment case seems increasingly promising. Blended with a recent focus on capital returns, including substantial share buybacks and a growing dividend, Alibaba may be in a position to start attracting the bulls back.

Regardless, at its current valuation, the potential rewards appear to outweigh the risks, even considering the inherent risks associated with a company like Alibaba.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel