To say that Exact Sciences (NASDAQ: EXAS) hasn’t performed well on the stock market this year would be an understatement. Shares of the cancer-focused biotech are down by 41%. However, the healthcare company still has some fans on Wall Street.

Cathie Wood is one of them. The investment firm she heads, Ark Invest, holds over 330,000 shares of Exact Sciences. She isn’t the only one who isn’t giving up on the company. Analysts on Wall Street have set an average price target of $83.46, representing a potential upside of 93% over its current stock price.

Can Exact Sciences bounce back and hit this price target in the next 12 months?

What’s going on with Exact Sciences

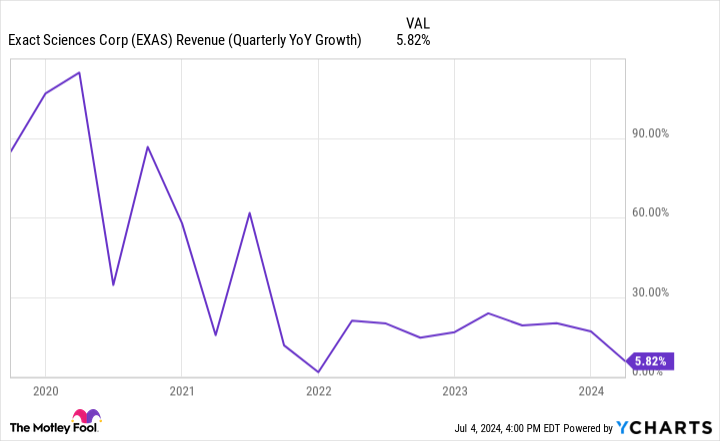

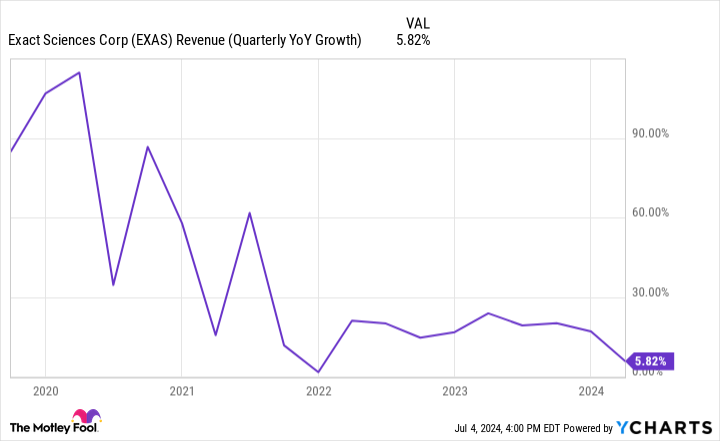

Exact Sciences develops innovative cancer diagnostic tests. The company is best known for its colorectal cancer test, Cologuard, an at-home, non-invasive option for people at average risk of contracting the disease. Though Cologuard has been successful, there are issues with Exact Sciences that investors can’t overlook. First, the company’s top-line growth rate has been decreasing. In the first quarter, Exact Sciences’ revenue of $638 million increased by just under 6% year over year.

Second, the biotech remains unprofitable. Its net loss per share of $0.60 in the period was worse than that of $0.42 reported in the year-ago period. Third, Exact Sciences is getting more competition for its most important product, Cologuard. Guardant Health is racing toward approval from the U.S. Food and Drug Administration for its colorectal blood cancer test. A panel of experts the agency convened recently overwhelmingly backed approval, so it will be a formality unless an unforeseen accident happens.

Guardant Health’s competing colorectal cancer option could eat into Cologuard’s market share, and that’s not good for Exact Sciences. Those headwinds explain why Exact Sciences has significantly lagged the market this year. What’s next for the company?

The short-term view and beyond

Exact Sciences is working on various potentially exciting products, including a multi-cancer screening test. However, the company’s most promising catalysts in the next 12 months will likely still be Cologuard, or more precisely, a new generation of the biotech’s crown jewel. Exact Sciences’ next-gen Cologuard aced late-stage studies, showing a 30% decrease in false positives. Exact Sciences expects this new version of Cologuard to earn approval sometime next year.

It could help increase the company’s revenue growth because, due to its improved performance, more physicians will be more likely to prescribe it than the old version. Exact Sciences estimates there are 60 million eligible patients who aren’t keeping up with their recommended screening schedules. That’s partly why colorectal cancer is the second leading cause of cancer death in the U.S. despite being highly treatable when caught early.

The solution to this problem, besides developing newer and better screening options, is to increase awareness. Exact Sciences is doing precisely that with aggressive marketing and advertising campaigns. That said, even with the potential tailwind Cologuard 2.0 could provide in the next 12 months, Exact Sciences’ shares are unlikely to soar by 93% by next year. That’s too high a bar to clear. That doesn’t mean the stock isn’t worth buying. As the company has pointed out, the newer Cologuard will also be at least 5% cheaper to manufacture, meaningfully decreasing the company’s cost of goods sold.

Meanwhile, advertising and marketing — typically the company’s largest expenses — are making an increasingly small percentage of revenue, from 114% in 2016 to 29.1% last year. These factors will positively impact the company’s margins and bottom line. Further, Exact Sciences’ other products, including those in development, like its multi-cancer screening options, should prove highly lucrative down the road if they earn approval. The company has been an innovative monster over the years.

Though the healthcare stock is risky, it could deliver superior returns to patient investors in five years or more. So, those investors willing to handle volatility should strongly consider buying Exact Sciences’ shares.

Should you invest $1,000 in Exact Sciences right now?

Before you buy stock in Exact Sciences, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Exact Sciences wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $771,034!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Guardant Health. The Motley Fool recommends Exact Sciences. The Motley Fool has a disclosure policy.

This Cathie Wood Growth Stock Could Soar by 93%, According to Wall Street was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel