Deal also signals rise of new power player, David Ellison, Skydance founder and son of Oracle billionaire Larry Ellison.

The entertainment giant Paramount will merge with Skydance, closing out a decades-long run by the Redstone family in Hollywood and injecting desperately needed cash into a legacy studio that has struggled to adapt to a shifting entertainment landscape.

The companies announced their agreement to merge late on Sunday.

They laid out a two-step process through which Skydance and its partners will acquire National Amusements, which holds the Redstone family’s controlling stake in Paramount, for $2.4bn in cash.

Skydance will subsequently merge with Paramount, offering $4.5bn in cash or stock to shareholders and providing an additional $1.5bn for Paramount’s balance sheet.

David Ellison, the 41-year-old son of Oracle billionaire Larry Ellision, founded Skydance in 2010 and will become chairman and chief executive of the new Paramount. Jeff Shell, former chief executive of NBCUniversal, will be its new president.

The goal of the deal is to position the “new Paramount” as a “tech hybrid, to be able to transition to meet the demands and needs of the evolving marketplace”, Ellison told financial analysts on Monday.

The deal represents the end of an era for Shari Redstone, whose father and late patriarch, Sumner Redstone, transformed the family’s chain of drive-in movie theatres into a media empire that included Paramount Pictures, the CBS broadcast network and cable television networks Comedy Central, Nickelodeon and MTV.

“Given the changes in the industry, we want to fortify Paramount for the future, while ensuring that content remains king,” Shari Redstone, chairwoman of Paramount and National Amusements, said in a statement, citing a phrase her father coined.

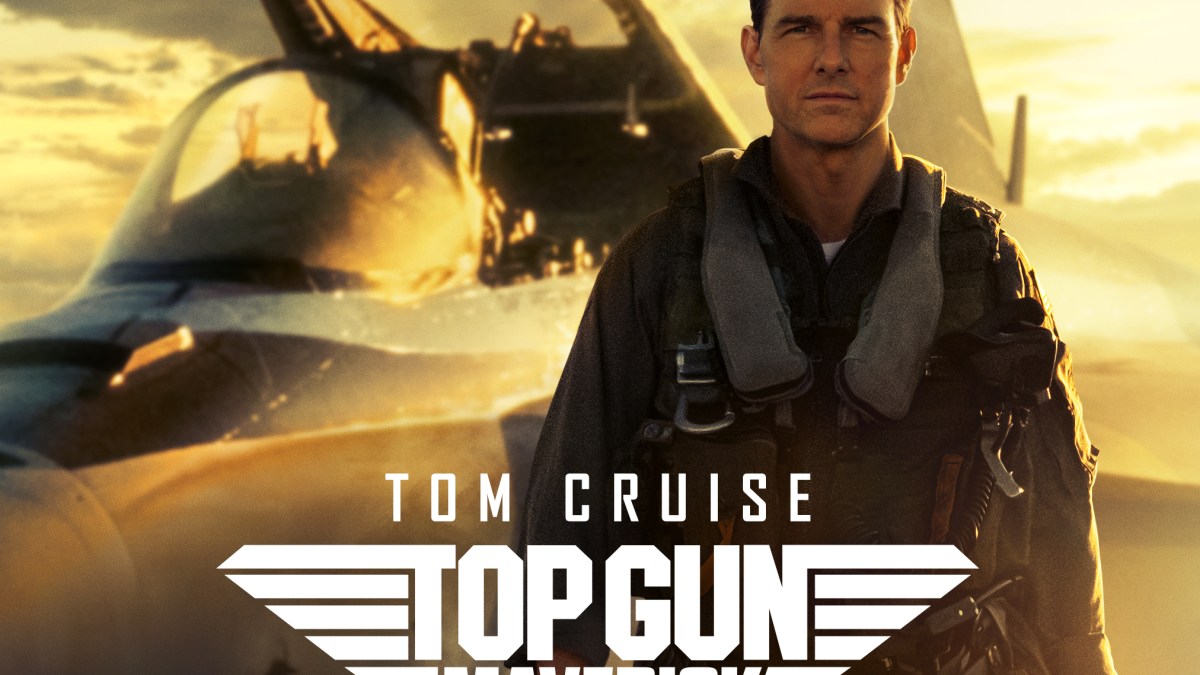

The merger would combine Paramount, home of such classic films as Chinatown, The Godfather and Breakfast at Tiffany’s, with its financial partner on several major recent films, including Top Gun: Maverick, Mission: Impossible-Dead Reckoning and Star Trek Into Darkness.

The new combined company is valued at about $28bn.

Tumultuous time at Paramount

The on-again, off-again merger arrives at a tumultuous time for Paramount, which in an annual shareholders meeting in early June laid out a restructuring plan that includes major cost cuts.

Leadership at Paramount has been volatile this year after its CEO Bob Bakish, following a number of disputes with Shari Redstone, was replaced with an “office of the CEO” run by three executives. Four company directors were also replaced.

Paramount has struggled to find its footing for years, and its cable business has been hemorrhaging money. To capture today’s growing streaming audience, the company launched Paramount+ in 2021, but losses and debts have continued to grow.

While Sumner Redstone built a vast media empire, which included CBS and Viacom, those firms have merged and separated a number of times over the years. Most recently, the companies re-joined forces in 2019, undoing a 2006 split. The company, ViacomCBS, changed its name to Paramount Global in 2022.

Under Sumner Redstone’s leadership, Viacom became one of the nation’s media titans, home to pay TV channels MTV and Comedy Central and movie studio Paramount Pictures.

It is a company with a rich history as well as a deep bank of media assets, and Skydance was not the only company to gun for Paramount in recent months. Apollo Global Management and Sony Pictures also made competing offers.

Late last year, Warner Bros Discovery also made headlines for exploring a potential merger with Paramount. But by February, Warner had reportedly halted those talks.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel