Amazon (AMZN) Web Services (AWS) is launching its fourth-generation Graviton processor, the Graviton4 chip, the company shared exclusively with Yahoo Finance.

The new chip promises to deliver substantial improvements in performance and efficiency, including three times the compute power and memory of its predecessor, 75% more memory bandwidth, and 30% better performance, according to Rahul Kulkarni, Amazon’s lead product manager for artificial intelligence infrastructure.

“Collectively it’s delivering more price performance, which means for every dollar spent, you get a lot more performance,” Kulkarni shared with Yahoo Finance at Amazon’s chips lab in Austin, Texas.

Demand for chips is growing as semiconductors continue to play a vital role in the global economy, powering nearly everything we use. The industry is currently valued at $544 billion and is expected to exceed $1 trillion by 2033, driven by increasing demand for AI.

As a result, hyperscalers such as Amazon, Apple (AAPL), Alphabet (GOOG, GOOGL), and Microsoft (MSFT) are creating custom chips to meet their specific needs, cut costs, and offer customers more affordable options.

“All of these companies are spending a lot of money on developing chips,” said Patrick Moorhead, who spent over a decade as a vice president at AMD. “They won’t talk about how much they’re investing, but they have these giant R&D budgets.”

Nvidia (NVDA) remains the dominant player in the AI chips market, with more than 80% share of the market for graphics processing units (GPUs). But there is enough demand to support multiple competitors, according to Moorhead, who currently serves as CEO and chief analyst at Moor Insights & Strategy.

Although the Graviton4 chip is not an AI chip, it supports AWS’s Inferentia and Trainium chips, which are focused on the technology. Trainium competes directly with Nvidia’s AI chips, which are considered the fastest and most powerful in the market.

However, AWS’s goal is not to unseat Nvidia, Kulkarni emphasized. Instead, the cloud service provider hopes to offer a viable alternative for customers focused on price performance, which they hope will allow them to take a profitable slice of the rapidly expanding AI-driven chips market.

“Right now, if a customer is more focused on time to market, Nvidia-based products that we offer are a great option,” Kulkarni said. “There are customers for whom cost becomes a very prohibitive aspect of running their business. If they want to do more cost-optimized AI workloads like training or inference, then our Inferentia and Trainium products become a great alternative.”

How Amazon keeps development costs down

In addition to buying chips from makers like Nvidia, AMD (AMD), and Intel (INTC), Amazon also designs its own chips in-house. AWS currently offers two main types of chips: those designed for AI and those made for general purposes, like the Graviton4.

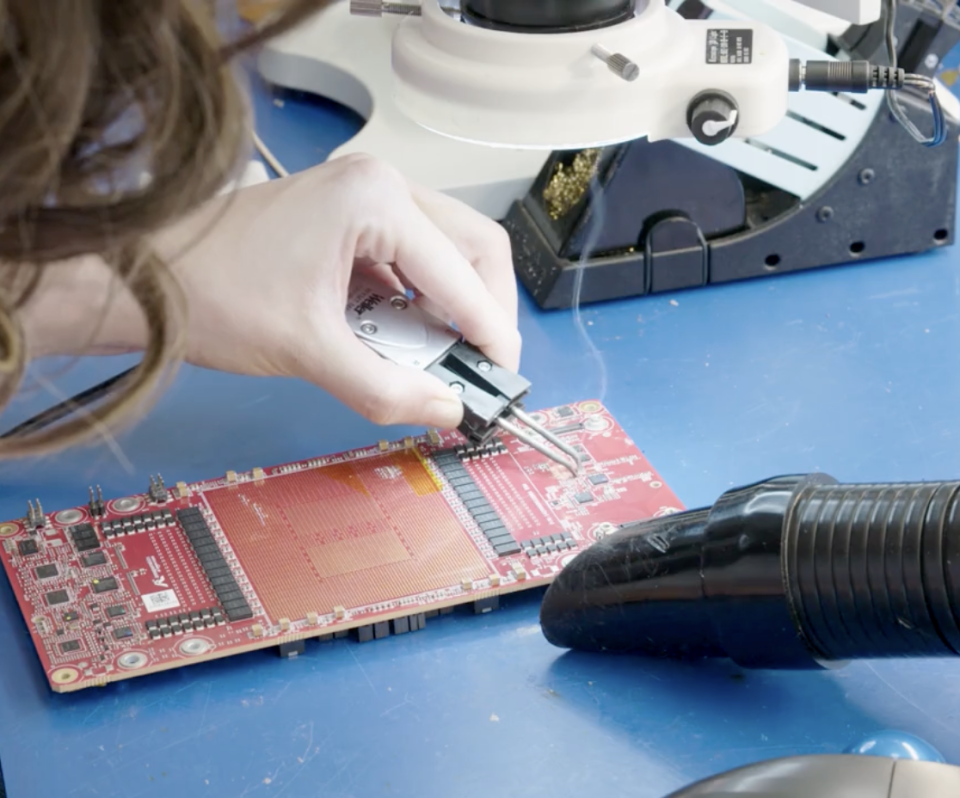

In a rare look at AWS’s lab, Yahoo Finance saw AWS engineers solder and test chip designs, using software to look for performance issues and fix them on site.

It’s one way the company says it drives down development costs.

“We can tune the product, tune this silicon, to just focus on things that really matter for customer workloads,” said Kulkarni.

AWS has not disclosed specific pricing details for the Graviton4, but the processors are rented at $0.02845 per second of compute power. This price-performance ratio is crucial for AWS, as it uses its proprietary chips to power its cloud infrastructure and servers.

“AWS customers can use Graviton4 to cut their bill for IT in half,” said Moorhead.

It’s not just about providing chips to customers — AWS’s chips strategy is also about using all of its chip offerings to power its own efforts, including a new large language model, a potential rival to OpenAI’s ChatGPT.

Moorhead noted that while the development of chips is expensive, it can lead to substantial savings in the long run.

“Let’s say you can save $200 a chip, and you’re buying a million of them a year,” Moorhead said. “That adds up, and that’s a lot of money that you can pour in to do that.”

For investors, earnings expectations from chip development may impact company profits more than actual chip production. As AWS looks to carve out its niche by designing, testing, and validating its chips, analysts have noticed the company’s growing influence in the semiconductor space.

Analyst earnings expectations are higher for Amazon than for Microsoft or Alphabet, and the profit margins for AWS alone reached 38% in the first quarter of 2024.

“AWS has a lot of credibility in the semiconductor space,” Moorhead said. “Ten years ago, I had questions about how a company like this could do chips when you have companies investing multiple billions of dollars to do that. But they are very good at it.”

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel