Lit green for July thus far, the S&P 500 SPX faces a big economic and earnings week, kicking off with Fed Chair Jerome Powell this morning.

Our call of the day from Shard Capital’s market strategist Bill Blain warns U.S. stock investors face a “standard triple-whammy threat: overvaluation on over-euphoria, misunderstanding the economic reality, and the political aspect.”

Most Read from MarketWatch

Blain says in a blog post that while markets “seem unstoppable,” history is full of mean reversions as he sees U.S. politics feeding a “volatile” four months ahead.

The strategist compares past treks up a Scottish mountain famed for its false summits to markets now: “Climbing Schiehallion is almost as pointless and foolish as believing stock markets will rally forever. On the basis ‘Markets have no memory’ they are doomed to repeat the same mistakes repeatedly, at some point there will inevitably be a reckoning.”

“Issue no 1 for the U.S. market is the behavioral psychosis driving the market: irrational hopes and expectations trumps rationality at times like these,” with greed continuing to drive money into American stocks and private markets. U.S. are valued much higher than Europe, emerging markets or China partly because it’s awash in so much capital.

He also warns over the impact of what he calls the new normality, of interest rates around 5%. “Central banks and regulators want normalized interest rates, not the monetary and market distortions created by artificially low interest rates,” he says.

And his final concern is over the U.S. election, as he says the election period could become highly unstable, such as calls from some Democrats for President Joe Biden to drop out to the possibility he could stage a comeback against former President Donald Trump, perceived by some as a market friendlier candidate. That’s not to mention, he adds, if demand recounts in some states and other post-election events occur.

Read: Biden has seen neurologist 3 times as president, shows no sign of Parkinson’s, White House says

The takeaway from Blain is summed up in his personal markets mantra: “It’s better to miss the last 5% of the rally than catch 100% of the inevitable downside.” He advises says investors, especially young ones, take a break from TikTok read everything they can about markets right now, like a famed book about the 1929 crash.

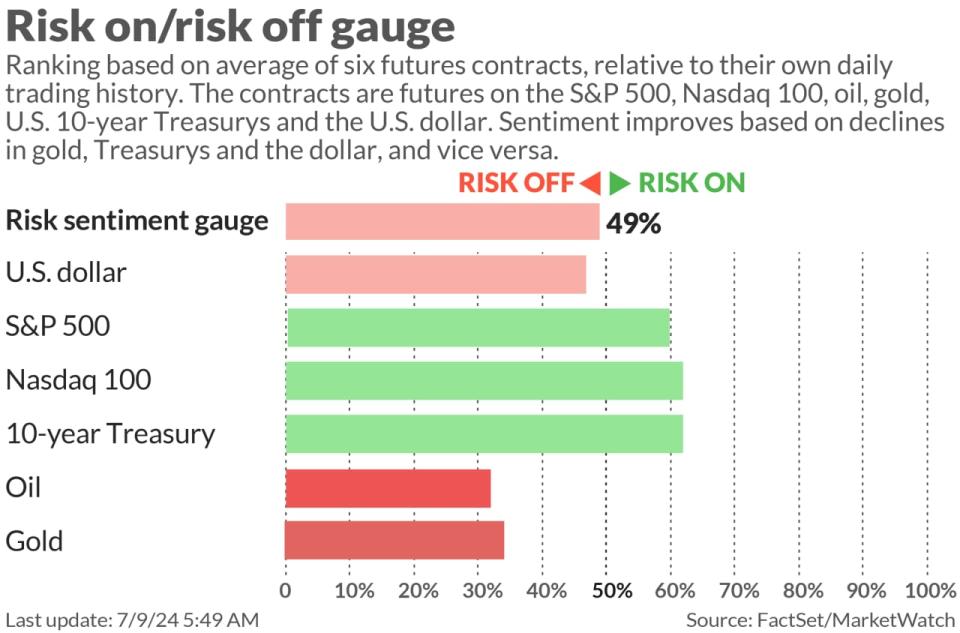

The markets

Stock futures ES00 YM00 NQ00 are higher, with Treasury yields BX:TMUBMUSD10Y BX:TMUBMUSD02Y steady. Crude oil CL.1 is lower and gold prices GC00 are up. Follow MarketWatch’s Live Markets blog.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5572.85 |

1.79% |

3.96% |

16.84% |

26.38% |

|

Nasdaq Composite |

18,403.74 |

2.93% |

7.04% |

22.60% |

34.48% |

|

10-year Treasury |

4.291 |

-14.60 |

-11.40 |

41.01 |

31.70 |

|

Gold |

2369 |

1.16% |

1.76% |

14.35% |

22.70% |

|

Oil |

82.17 |

-1.45% |

5.04% |

15.20% |

12.24% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

The buzz

Fed Chairman Powell will testify in front of the Senate Banking Committee at 10 a.m., with Treasury Sec. Janet Yellen giving separate testimony in front of the House Financial Services Committee. Fed Gov. Michelle Bowman is due to speak at 1:30 p.m.

The NFIB small business optimism reached the highest reading of the year in June.

The Fed is reportedly considering a rule change to potentially save eight big Wall Street banks billions in capital.

Helen of Troy stock HELE is sinking toward a 9-year low after a big earnings miss and outlook cut.

House Democrats are meeting behind closed doors, sans cellphones, to discuss Biden’s path forward.

Best of the web

Why retiring ‘comfortably’ on $100K is a myth for most people.

Japan’s $1.5 trillion pension whale to trigger waves in stocks, currencies.

China’s army shows up on NATO’s border.

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

|

Ticker |

Security name |

|

NVDA |

Nvidia |

|

TSLA |

Tesla |

|

GME |

GameStop |

|

AMC |

AMC Entertainment |

|

MAXN |

Maxeon Solar Technologies |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

AAPL |

Apple |

|

AMD |

Advanced Micro Devices |

|

ZAPP |

Zapp Electric |

|

INTC |

Intel |

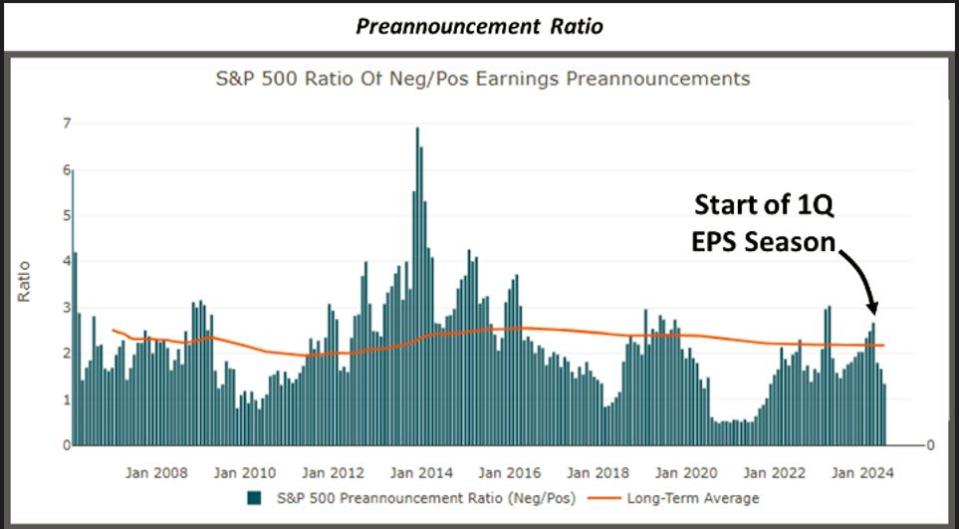

The chart

There have been “significantly fewer negative preannouncements heading into this earnings season” — kicking off Friday with banks — than seen at the start of the first quarter, observed Piper Sandler analysts, who recently provided this chart to clients:

Random reads

Juneau, Alaska is fed up with cruise ships.

‘Mystic meerkats’ predict England soccer win.

Deli addict is now a social-media star.

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.

Most Read from MarketWatch

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel