-

The Bitcoin profit and loss index is hovering around its 365-day moving average; previous crossovers to the downside have led to major market corrections.

-

Tether’s market cap growth, often considered a key driver of bull markets, has stalled.

-

Large BTC holders, however, increased their stash by 6.3% over the month, the highest since April 2023.

Bitcoin {{BTC}} is it a crucial stage of this market cycle as several factors signal continued downside while others indicate that prices are set to bottom out.

Currently trading at $57,700 having bounced from last week’s low of $53,600, bitcoin remains in a technical downtrend from March’s record high of $73,800, having made consecutive lower highs at $71,300 and $63,900.

Data from CryptoQuant suggests that a major correction or the onset of a sustained bear market could be on the horizon as the profit and loss index is hovering around its 365-day moving average. Previous crossovers to the downside acted as a precursor to deep declines begun in both May and November 2021.

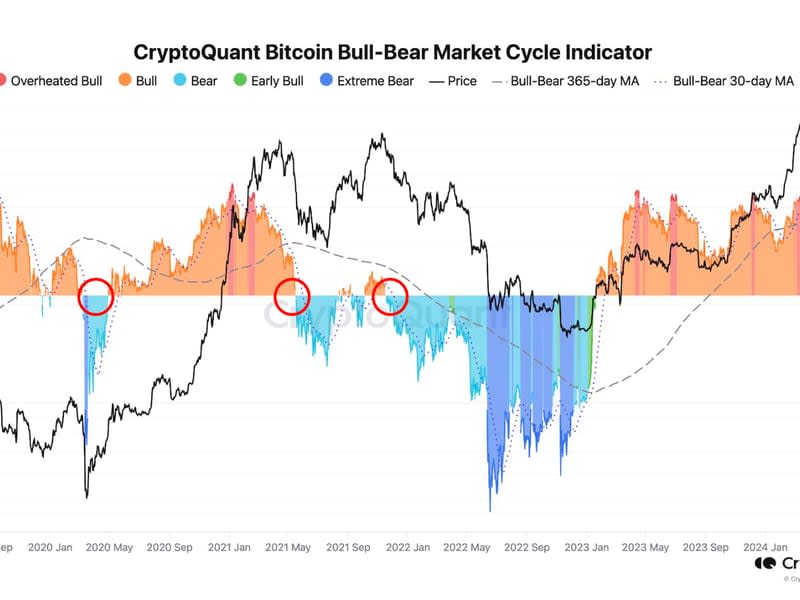

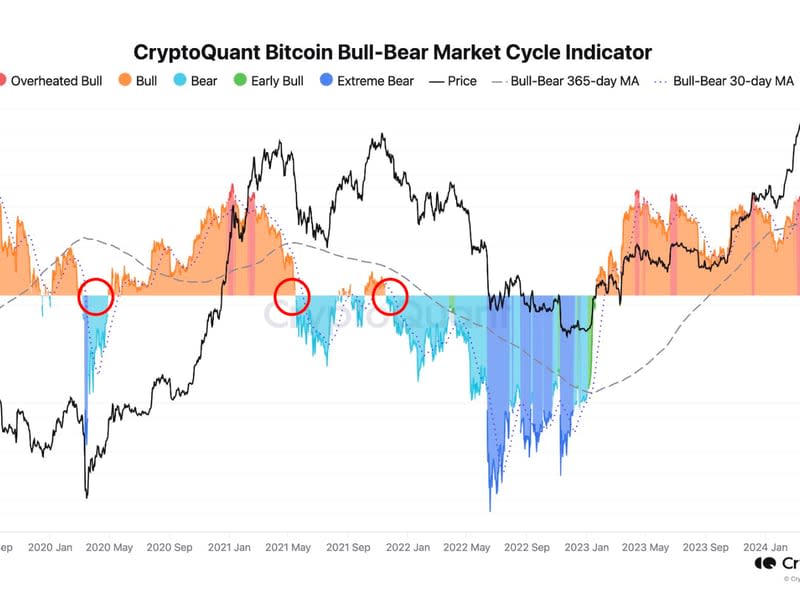

CryptoQuant’s bitcoin bull-bear market cycle indicator is also approaching a key level that suggests descent into a bear market.

A lack of growth in tether’s {{USDT}} market cap also shows that a rally might be hard to come by as historical recoveries can be attributed to a rise in stablecoin liquidity, CryptoQuant added.

However, bitcoin whales have been increasing their stash during the recent downswing, with large holders boosting their stack by 6.3% over the past month, the fastest pace since April 2023.

Germany’s aggressive selling of seized BTC also appears to be coming to a close as it has nearly emptied its wallet after seizing 50,000 BTC from from Movie2k in January.

Several other bullish factors such as an ether ETF being approved in the U.S. and the continued growth of U.S. stock indices, which bitcoin has historically correlated with, signal that 2024 will experience continued upside despite signs of short-term exhaustion.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel