Sir Keir Starmer, Rachel Reeves et al have done a brilliant job of keeping their real plans for the next five years under wraps.

They managed to keep their lips sealed throughout the interminable election campaign – but now, finally, Labour’s ambitions on tax are beginning to seep out.

The Love Supreme Jazz Festival perhaps isn’t the obvious place for the new Government to launch a major tax raid. But then it was held near historically iconoclastic Lewes, East Sussex – famed for its annual burning of effigies of the Pope and Conservative politicians.

Imagine my surprise when, one foggy-headed morning, Neil Kinnock, the Welsh Windbag himself, popped up in a tent for a panel discussion on what Labour would do now it was in power, with a massive majority.

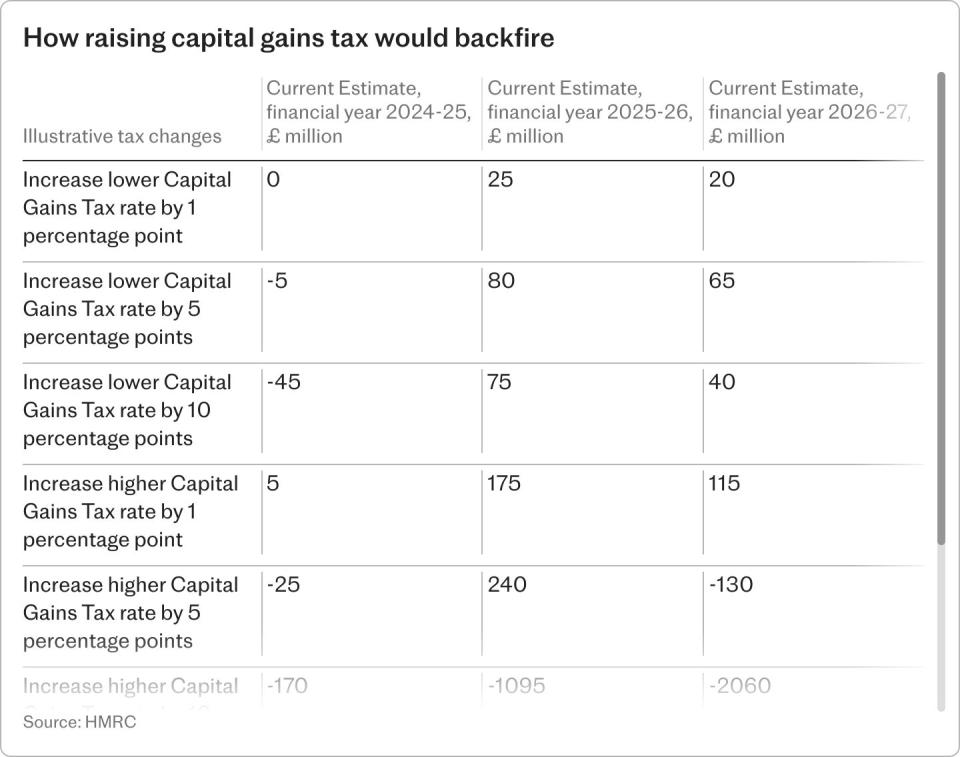

Lord Kinnock, who lost the “unlosable election” to John Major in 1992, said he “would be astounded” if Rachel Reeves didn’t use her first Budget, expected this autumn, to equalise capital gains and income tax rates.

The former leader has no official position with Labour, but remains highly influential within the party, and was seen embracing Sir Keir at the election victory party.

An attack on capital gains, so-called “unearned” income, has long been a target of Labour politicians. They would argue, as Lord Kinnock did, that huge increases in the value of assets such as rental properties have largely been down to luck, not hard graft. Others say that in many cases those assets have already been taxed when they were bought (through stamp duty and so on) and that much of the gain is purely inflation.

A higher-rate taxpayer is charged 45p on their income, but only 24pc on gains from second homes or 20pc on other assets like shares held outside of Isas. Basic-rate payers are charged 18pc or 10pc, respectively.

It’s easy to see why politicians – of all colours – eye up capital gains. The levy brings in serious amounts of cash, £16.7bn in the 2021-22 tax year (the most recent available figures).

It’s also a tax that’s paid by relatively few people. Nearly half of that £16.7bn in tax came from those who made gains of £5m. A rise therefore won’t be as unpopular with the majority of the public as if Labour went after income tax, National Insurance or VAT, and the effects won’t be felt as immediately – after all, you’ll only be faced with a CGT bill after you’ve sold an asset.

It’s not just Labour that wants a bigger bite of your gains. It was a Tory chancellor, Nigel Lawson, who equalised the rates on capital and income back in the 1980s.

And don’t forget it was Rishi Sunak and Jeremy Hunt who have most recently had a go. They slashed the tax-free CGT allowance from £12,300, to £6,000, to just £3,000 from April this year. It makes their bleating over Labour’s tax plotting during the election campaign all the more galling.

There are a few tricks you can do to shield your gains from a tax raid (assuming Labour doesn’t make more drastic changes to the tax system).

Most simply, you can share assets between your husband or wife, stuff your Isas and pensions, or buy Premium Bonds, all of which offer tax-free gains. More sophisticated investors can look at Venture Capital Trusts and Enterprise Investment Schemes. Both offer a CGT exemption in return for backing higher-risky fledgling companies.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel