The “Magnificent Seven” is a term that describes seven of the world’s largest tech companies, many of which have been among the best-performing stocks over the past few years. The companies are Apple, Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), Meta Platforms, Nvidia, and Tesla.

Each Magnificent Seven company is an industry leader in its own right and at the forefront of many innovations. However, the following three companies stand as particularly good buys in July and going forward. If you’re looking for tech stocks with appealing growth opportunities to add to your portfolio, they’re well worth considering.

1. Microsoft

Nvidia’s stock surge over the past two years has gotten a lot of attention (rightfully so), but Microsoft has also experienced significant growth. It’s the second-best performing Magnificent Seven stock over the past three years and up over 22% in 2024 (as of July 12).

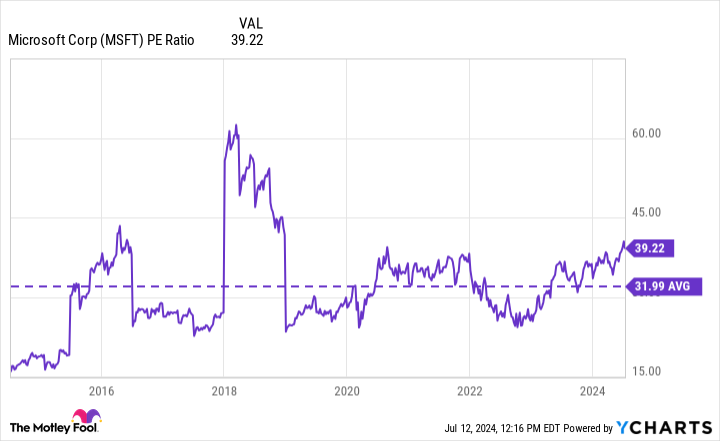

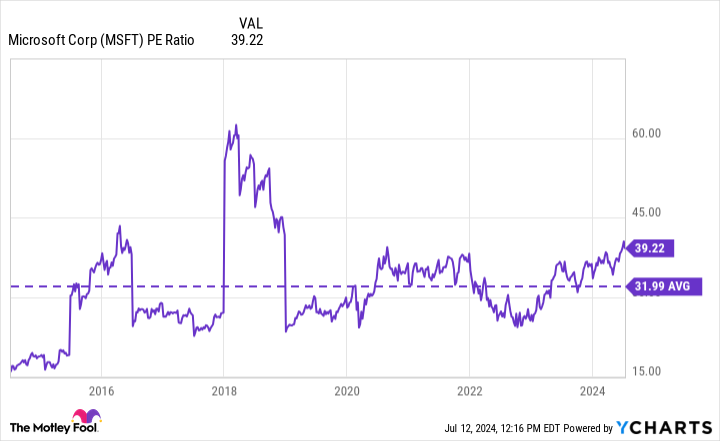

A lot has been said about the rising valuations of big tech companies, and many of them are warranted. With a price-to-earnings (P/E) ratio of around 39, Microsoft is expensive by virtually all standards, leaving it susceptible to a market correction.

Thankfully, the one thing Microsoft has going for it that other Magnificent Seven stocks don’t is the vast ecosystem it has developed through the years. And it’s not just the ecosystem, it’s the customers that Microsoft serves in this ecosystem: other businesses.

Countless businesses globally count on Microsoft’s products and services to run their businesses. Between PCs, Office software, cloud service Azure, and recruiting hub LinkedIn, Microsoft has its hand in multiple crucial enterprise-focused industries.

This helps shield it a bit against downturns because it’s not as easy for businesses to abandon Microsoft’s services or products as it is for consumers of other tech companies. By no means does it make Microsoft a foolproof investment, but you can almost be certain of its long-term stability and growth trajectory. If its valuation worries you, I’d recommend dollar-cost averaging your way into a stake.

2. Alphabet

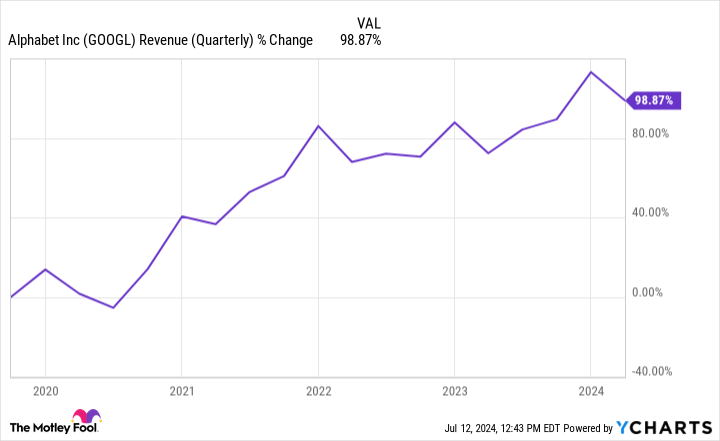

Despite surging over 34% this year, Alphabet still seems like a bargain compared to other Magnificent Seven stocks.

When it comes to market dominance, there may not be a more clear example than Google’s search business. Google search has around a 90% market share globally, and it’s maintained this dominance for quite some time. And although you never want to make assumptions, it’s safe to assume it’ll continue this dominance for the foreseeable future.

Its leadership position in search has led to a bustling advertising business. In the first quarter (Q1) of 2024, Google advertising generated $61.7 billion in revenue, with Google search specifically bringing in $46.2 billion. Google advertising accounted for over 78% of Alphabet’s revenue in Q1 and was up 13% year over year.

Advertising will continue to keep Alphabet’s lights on, but the growth of its cloud platform, Google Cloud, shouldn’t be overlooked. Google Cloud has turned the corner on profitability, and in Q1, its operating income (profit from its core operations) grew 371% to $900 million.

With a dominant search business, a fast-growing cloud business, and a newly announced dividend ($0.20 quarterly), Alphabet is in a great position for sustained long-term growth.

3. Amazon

Amazon became the company it is today because of its e-commerce business, but it has done a great job at branching out and ensuring its business isn’t too dependent on just that segment.

Having the foresight to see the role cloud services would eventually play has worked wonders for Amazon and its bottom line. Amazon Web Services (AWS) is the global leader in cloud computing, with a lead it should manage to hold on to for a while, barring a major competitive disruption.

In Q1, AWS generated just over 17% of Amazon’s revenue but over 61% of its operating income. Cloud computing is a much higher-margin business than e-commerce, so its growth will continue to boost Amazon’s profitability. Add in the emerging AI innovations, and AWS is becoming a one-stop shop for cloud and AI solutions.

Amazon has spent billions building out its e-commerce and cloud infrastructure, and it’s now at the point where it can leverage these investments to generate new revenue streams. Take Supply Chain by Amazon, for example, an end-to-end set of supply chain services that allows sellers to take advantage of Amazon’s logistics network.

Amazon is a company built for sustained growth, and investors can feel confident holding on to it for the long haul.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 “Magnificent Seven” Stocks That Are Screaming Buys in July was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel