Investors are going like gangbusters for artificial intelligence (AI) stocks such as Nvidia and Microsoft, bidding them up to all-time highs. Now, they are looking at the second-order effects of AI, one of which is data center power consumption. These new AI tools require tons of new infrastructure and electricity generation capacity, which has investors interested in stodgy old utility and energy stocks again.

The stock of the small modular nuclear reactor start-up NuScale Power (NYSE: SMR) is up 300% year to date on the back of this theme. But what are small nuclear reactors, and should you invest in them? Let’s take a closer look.

Small modular reactors and energy demand

Small modular reactors (SMRs) are just what their name implies. Unlike legacy nuclear reactors of immense size, SMR companies want to build smaller power sources that are more flexible for commercial customers.

NuScale Power is one of the developers of this technology with its NuScale Power Module. Its modules are only 76 feet tall and can generate 77 megawatts (MW) of electricity. For comparison, the recent large-scale nuclear plant that opened in Georgia generates 2,234 MW of electricity.

NuScale believes SMRs are better for commercial customers because they don’t require tens of billions in up-front costs, like legacy nuclear reactor projects. It aims to sell its SMRs to commercial utilities.

For example, it has a contract with a Polish company, KGHM Polska Miedz, to repurpose coal power plants. This can be better for the environment and theoretically save on costs if done efficiently.

But why is NuScale stock up so much this year? One answer: AI. The rise of AI tools like ChatGPT is driving electricity demand, which theoretically will drive demand for SMRs from NuScale. Global data center power consumption is expected to more than double to 1,000 terawatt-hours in 2026 from 460 in 2022. That electricity will have to come from somewhere.

Are SMRs actually better?

The problem with SMRs and NuScale Power is that the company will not have any reactors on line until 2026 at the earliest. Building nuclear reactors is a slow process and requires a ton of regulatory paperwork, especially in the United States.

For example, with Polska, the timeline on the contract is for SMRs to be deployed by 2029 at the earliest. Other projects will not be completed (and therefore drive revenue) for NuScale Power until much later. How exactly will this take advantage of the present jump in electricity demand?

SMRs are also seeing the same cost overhangs as traditional nuclear. At a Utah project that was recently terminated, NuScale originally wanted 12 modular reactors generating 600MW each by 2023. It expected this to cost $3 billion. In 2018, this capacity was revised down to 60MW. Delays continued, and the total cost was pushed to an estimate of over $9 billion, which caused the project to be canceled.

During the same time, the large-scale Vogtle 3 & 4 nuclear plants were completed in Georgia and will generate a consistent 2,234MW of power for utilities. These projects aren’t immune from cost overruns. The Vogtle plants were initially scheduled to start operations in 2016 and at half the actual project cost. But, at least they got completed. If SMRs projects can’t actually be built, what is the point of NuScale Power?

Avoid this company: It is in a dire situation

NuScale’s situation looks even worse when you crack open its financial statements. It is pre-revenue and burning over $100 million in cash a year. Since it only had $131 million in cash on its balance sheet as of the end of its last quarter, the company has about a year of runway left — while its projects won’t come on line until the end of the decade under the best-case scenario.

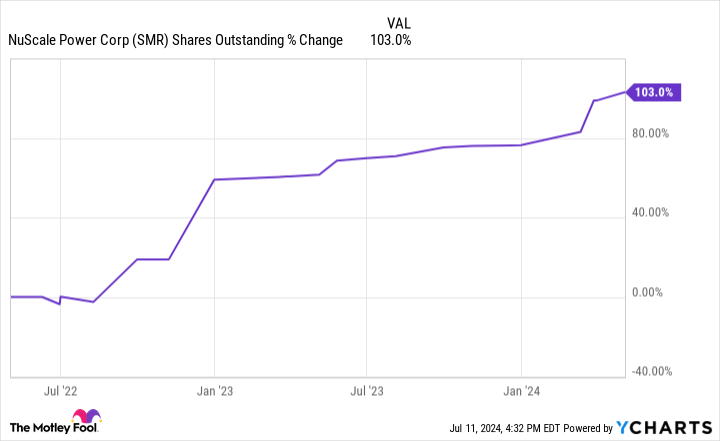

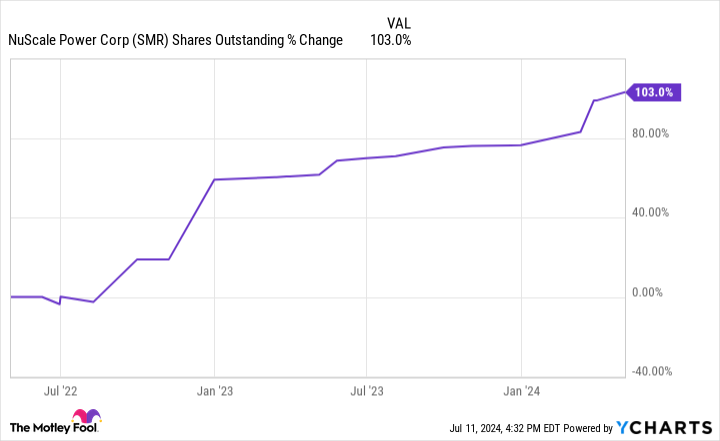

In order to fund itself, NuScale will need to continue to sell its common stock. Over the last three years, shares outstanding are up over 100%. This trend is diluting shareholders and will only get worse.

A bull case for the stock is hard to make, unless you expect the company to pull off a technological miracle sometime soon. Even though shares are up 300% so far in 2024 and could rise more by year’s end, investors should stay far away from NuScale Power and any other SMR stock riding the AI electricity-demand narrative. There is no reason to buy this stock in 2024.

Should you invest $1,000 in NuScale Power right now?

Before you buy stock in NuScale Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NuScale Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool recommends NuScale Power and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

This Hot Nuclear Stock Is Up 300% This Year: Where Will It Land by the End of 2024? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel