As the U.S. stock market exhibits fluctuations with major indexes like the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite navigating through earnings seasons and economic indicators, investors continue to seek stable returns amidst uncertainty. In this context, dividend stocks emerge as particularly appealing due to their potential to provide regular income streams and relative resilience during market volatility.

Top 10 Dividend Stocks In The United States

|

Name |

Dividend Yield |

Dividend Rating |

|

Interpublic Group of Companies (NYSE:IPG) |

4.41% |

★★★★★★ |

|

Columbia Banking System (NasdaqGS:COLB) |

6.01% |

★★★★★★ |

|

Premier Financial (NasdaqGS:PFC) |

4.84% |

★★★★★★ |

|

Dillard’s (NYSE:DDS) |

5.10% |

★★★★★★ |

|

Resources Connection (NasdaqGS:RGP) |

5.07% |

★★★★★★ |

|

CompX International (NYSEAM:CIX) |

4.98% |

★★★★★★ |

|

OTC Markets Group (OTCPK:OTCM) |

4.46% |

★★★★★★ |

|

Marine Products (NYSE:MPX) |

5.23% |

★★★★★☆ |

|

Union Bankshares (NasdaqGM:UNB) |

5.58% |

★★★★★☆ |

|

Southside Bancshares (NasdaqGS:SBSI) |

4.55% |

★★★★★☆ |

Click here to see the full list of 181 stocks from our Top US Dividend Stocks screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Northwest Bancshares, Inc., serving as the holding company for Northwest Bank, offers personal and business banking solutions with a market capitalization of approximately $1.70 billion.

Operations: Northwest Bancshares, Inc. generates its revenue primarily through its community banking segment, which accounted for $522.96 million.

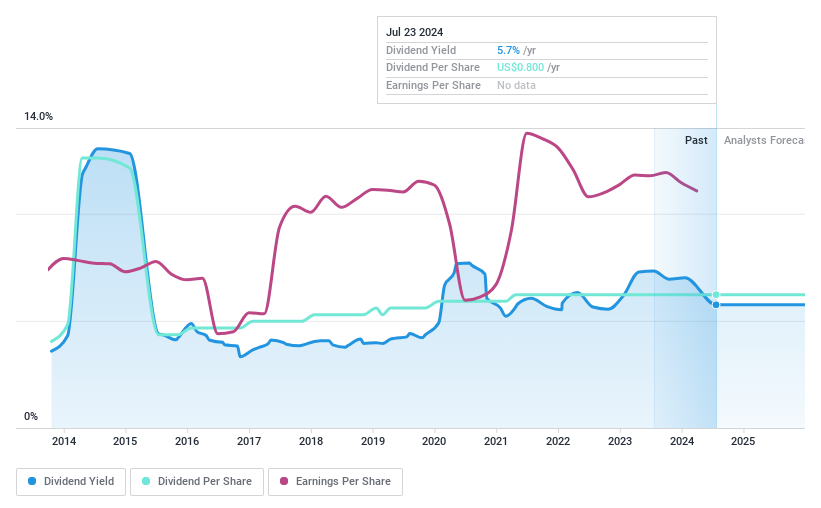

Dividend Yield: 5.7%

Northwest Bancshares has a 77.9% payout ratio, indicating current dividends are covered by earnings, though its dividend history shows instability with significant fluctuations over the past decade. Recently, the company declared a quarterly dividend of US$0.20 per share payable in August 2024 despite reporting a notable decline in net income and earnings per share for both the second quarter and first half of 2024 compared to the previous year. This raises concerns about the sustainability of future dividends given current financial trends.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SpartanNash Company operates in the United States as a distributor and retailer of grocery products, with a market capitalization of approximately $0.68 billion.

Operations: SpartanNash Company generates its revenue primarily through two segments: retail, which contributes approximately $2.78 billion, and wholesale, accounting for about $8.02 billion.

Dividend Yield: 4.3%

SpartanNash offers a 4.25% dividend yield, slightly underperforming against the top US dividend stocks. Despite a stable 10-year history of dividend payments, its dividends are not well supported by free cash flows, with a concerning cash payout ratio of 429.3%. However, earnings coverage remains reasonable at a 54.6% payout ratio. Recent financials show an uptick in net income and earnings per share in Q1 2024 but lowered sales forecasts suggest potential challenges ahead.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Citizens Financial Group, Inc. is a bank holding company in the United States offering retail and commercial banking products and services, with a market capitalization of approximately $18.75 billion.

Operations: Citizens Financial Group, Inc. generates its revenue primarily through Consumer Banking and Commercial Banking segments, with earnings of $5.13 billion and $2.66 billion respectively.

Dividend Yield: 4%

Citizens Financial Group has demonstrated consistent dividend reliability over the past decade, with a recent affirmation of a US$0.42 per share quarterly payout, signaling ongoing commitment to shareholder returns. Despite trading 32.5% below estimated fair value and offering a modest 3.97% yield—lower than the top quartile of U.S. dividends—the dividends are sustainably covered by earnings at 63.7%. However, profit margins have declined from last year’s 27.2% to 16.9%, indicating potential pressures on profitability despite forecasted earnings growth of 22.57% annually.

Seize The Opportunity

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:NWBI NasdaqGS:SPTN and NYSE:CFG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel