India intends to grow foreign direct investment (FDI) from China despite a fraught political relationship since border clashes in 2020.

At the country’s annual Economic Survey presentation, Nirmala Sitharaman, India’s Finance Minister, said: “India faces two choices to benefit from China plus one strategy: it can integrate into China’s supply chain or promote FDI from China.”

Given the country’s large trade deficit with China, Sitharaman said increasing FDI seems “more promising for boosting India’s exports to the US”.

India needs this investment to grow its manufacturing capacity, one of the government’s goals.

Currently, the manufacturing sector makes up 17% of the economy. Its goal is to increase this to 25% by 2025.

A violent border clash

The mostly peaceful relationship between China and India was thrown into a tailspin in 2020.

During a set of border clashes at the disputed Himalayan border, at least 20 Indian and four Chinese soldiers died.

It was the first fatal border clash in 45 years and has marked a before-and-after in the relationship between the huge trading partners.

Modi’s government responded with a wave of anti-China measures – it banned 320 Chinese apps, raised taxes on Chinese companies and increased red tape for any Chinese investment.

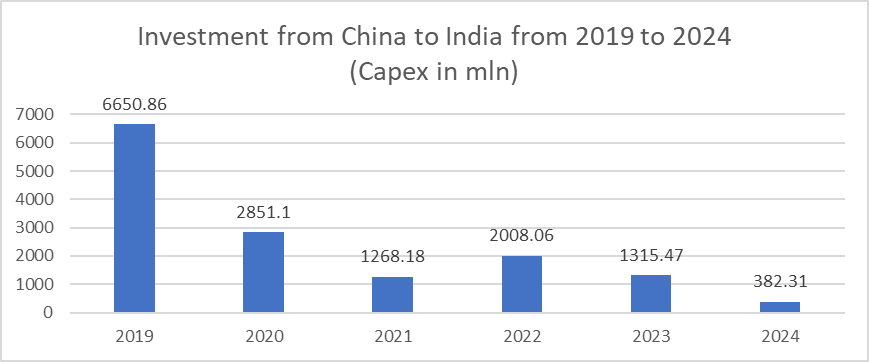

Between the violent crisis and a brutal global pandemic, Chinese investment in India plummeted.

Shifting the approach

According to The Economist, a year ago, there was an impetus to pull back from the economically dependent relationship with China.

However, as shown by Sitharaman, the winds seem to be changing. Demand for Chinese technology and expertise has increased and is seen as necessary to grow the manufacturing sector.

In 2023-2024, China surpassed America to once again become India’s top trading partner.

Persistence despite a global downturn in FDI

The shift comes amidst a downturn in global FDI.

The World Investment Report, conducted by UN Trade and Development, found that FDI fell by 2% in 2023. It cited economic slowdown and geopolitical tensions as major contributors to this decline.

It highlighted that, excluding a few European economies, the downturn is closer to 10%.

Amid a grim FDI horizon, India’s intention to facilitate international investments is significant.

This shows that, despite geopolitical tensions, China’s and India’s economies are so embedded that staying away is not a real option.

“India sets its eyes on Chinese investments despite political tensions ” was originally created and published by Investment Monitor, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel