(Bloomberg) — Stocks tumbled around the world, with chipmakers leading losses, as investors pulled back on the artificial-intelligence frenzy and earnings disappointed.

Most Read from Bloomberg

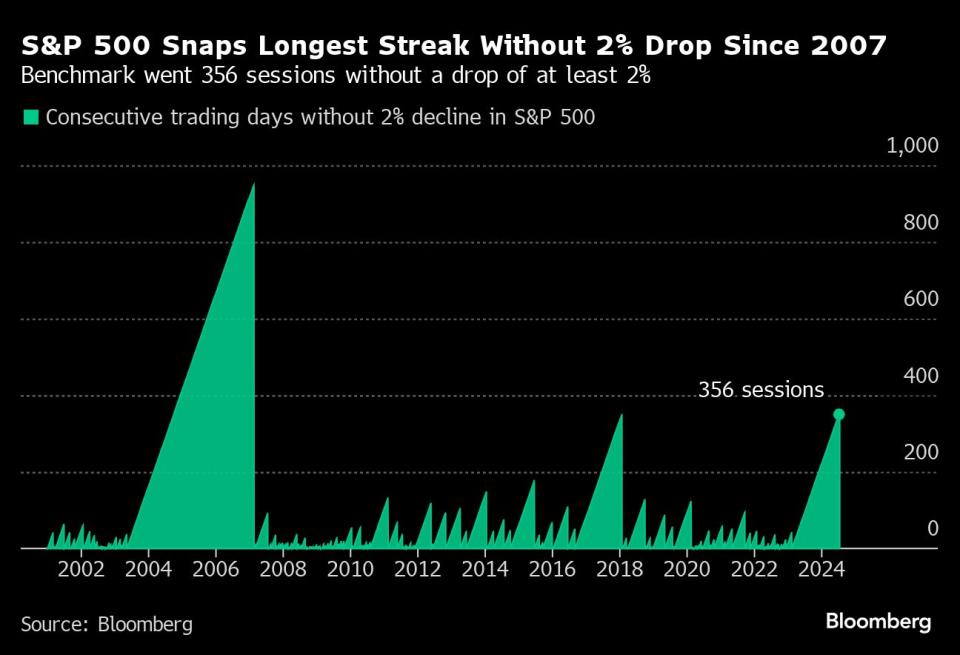

The Stoxx 600 (^STOXX) sank more than 1%, extending the big tech rout on Wall Street. Nestle SA (NESNZ.XC), Stellantis NV (STLAP.PA) and Kering SA (KER.PA) dropped on earnings that missed estimates. French stocks were on the verge of a 10% correction. US stock index futures were little changed after the S&P 500’s 2.3% slump on Wednesday.

“There seems to be a broad reassessment on the cost and benefit calculus for the artificial intelligence ecosystem,” said Homin Lee, senior macro strategist at Lombard Odier Singapore Ltd. “Anxieties about consumer demand also persist due to hints of softening data in the US. These worries could prove temporary in the end, but a collective reappraisal by investors is natural after such a furious rally.”

With earnings season in full flow, investors are watching US data on gross domestic product and initial jobless claims due later Thursday for further evidence of the economy’s health. Former New York Fed President William Dudley called for lower borrowing costs — preferably at next week’s gathering. Such a move could be worrisome as it would indicate officials rushing to avoid a recession, some analysts say.

Yields on two-year Treasuries dropped seven basis points to 4.35% as traders brought forward rate-cut expectations. Meanwhile, the yen rallied more than 1% amid growing expectations that the interest rate gap between Japan and the US is finally set to shrink.

Corporate Highlights:

-

Nestle SA lowered its sales outlook for the year as consumers balked at price increases on branded food, water and pet-care products.

-

Stellantis shares fell after the carmaker’s earnings plunged in the first half of 2024. Morgan Stanley said free cash flow was a key disappointment, while noting the stock’s weak performance this year.

-

Kering shares tumbled 10% after warning profit is set to plunge in the second half of the year, laying bare the challenges the French luxury goods maker is facing in turning around key brand Gucci amid a slowdown for the sector.

-

Universal Music Group slumped as much as 28%, the most on record, following its second-quarter results, which Citi said “undermine” what had been seen as defensive growth credentials.

This year’s rally in tech stocks has hit a wall and disappointing reports from Tesla Inc. and Alphabet Inc. drove a rout in the previous session. Traders have been rotating from the megacaps to lagging parts of the market, spurred by bets on Fed rate cuts and concern AI still needs to pay off.

“Tech’s problem isn’t just that earnings are less than perfect, but the group is still caught up in the violent rotation trade that kicked off with the June CPI,” said Vital Knowledge’s Adam Crisafulli. “Many assumed the anti-tech rotation would be ephemeral and the fact it’s proving durable is compounding anxiety toward the group and spurring additional selling pressure.”

While the drop could argue in favor of dip buying, the earnings season is just getting started. Apple Inc., Microsoft Corp., Amazon.com Inc. and Meta Platforms Inc. are all due to report results next week.

Key events this week:

-

Germany IFO business climate, Thursday

-

US GDP, initial jobless claims, durable goods, Thursday

-

US personal income, PCE, consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 fell 1.1% as of 8:06 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures rose 0.1%

-

Futures on the Dow Jones Industrial Average rose 0.2%

-

The MSCI Asia Pacific Index fell 1.7%

-

The MSCI Emerging Markets Index fell 0.8%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0833

-

The Japanese yen rose 0.8% to 152.71 per dollar

-

The offshore yuan rose 0.3% to 7.2460 per dollar

-

The British pound fell 0.2% to $1.2884

Cryptocurrencies

-

Bitcoin fell 2.6% to $64,325.09

-

Ether fell 6% to $3,172.05

Bonds

-

The yield on 10-year Treasuries declined three basis points to 4.25%

-

Germany’s 10-year yield was little changed at 2.44%

-

Britain’s 10-year yield was little changed at 4.16%

Commodities

-

Brent crude fell 0.7% to $81.12 a barrel

-

Spot gold fell 1.1% to $2,370.79 an ounce

This story was produced with the assistance of Bloomberg Automation.

—With assistance from Winnie Hsu and Richard Henderson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel