It’s not just one of the world’s most iconic brand names: The Coca-Cola Company (NYSE: KO) has also been one of the world’s most rewarding stocks. Oh, it’s a slow mover to be sure. It’s been a consistent winner for decades, though, with those gains augmented by lots of reliable dividend growth along the way. Plenty of investors have become millionaires by patiently holding onto their stakes in this company.

Coca-Cola isn’t the beverage sector’s most rewarding long-term investment, however. That honor actually — and quietly — belongs to rival PepsiCo (NASDAQ: PEP).

That information can certainly catch investors off-guard. After all, Coca-Cola is the bigger player. Perhaps even more surprising is the fact that PepsiCo could continue to be the better performer of the two.

The same, but different

Yes, they’re both in the beverage business. And Coca-Cola is more than its namesake soda. It also owns brands such as Gold Peak tea, Minute Maid, Powerade, and Dasani water, just to name a few. PepsiCo, of course, owns the Pepsi brand, as well as Gatorade, Bubly Sparkling Water, and Mountain Dew, and is licensed to sell branded beverages from the likes of Starbucks and Lipton. PepsiCo is also parent to Quaker Oats and snack chip brand Frito-Lay, which owns Lay’s, Doritos, Rold Gold, and others.

These aren’t the two outfits’ defining differences though. In fact, in terms of product lines and their target customers, the two companies are more alike than different — even when including PepsiCo’s Frito-Lay arm.

And yet, the two stock’s performances are strangely different.

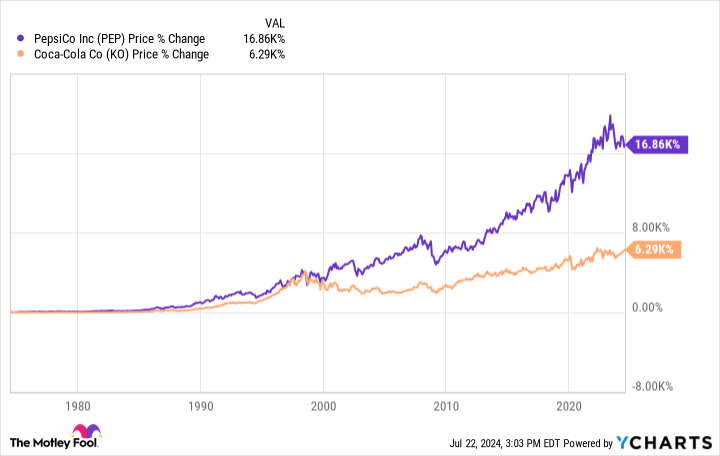

The chart below tells the tale. Over the course of the past 50 years, PepsiCo shares have gained nearly three times as much as Coca-Cola shares.

And that comparison is just of each stock’s price change. Adding reinvested dividends to the mix, since 1994, PepsiCo shares boast an annualized return rate of 11% versus Coke’s 8.7%.

Credit their differing dividend growth rates for most of this sizable performance disparity. Although Coca-Cola has raised its payouts every year for the past 62 years, it has not raised them by as much as PepsiCo has for the past 20.

Little things like that — and like a stronger stock-buyback program, as well — add up to big things over time.

Look for more of the same going forward, too, due to the differences in how each of these organizations is structured.

Why PepsiCo is outperforming Coca-Cola

As a consumer, you neither know nor likely care who’s responsible for the physical process of bottling your beverages. As an investor though, you should understand that Coca-Cola probably didn’t bottle the Coke-branded beverage you regularly enjoy. It outsources most of that work to licensed third-party bottlers that purchase concentrated flavored syrups from the company. This approach means that Coca-Cola brings in less overall revenue, but has higher profit margins on that revenue.

In contrast, PepsiCo handles the production of most of its products in-house. In fact, it’s even a licensed manufacturer for rivals like Keurig Dr Pepper, monetizing equipment that would sometimes sit idle otherwise.

The difference has a clear impact on each outfit’s profit margins. By offloading the risks and headaches of owning cost-intensive facilities and capital-intensive assets, Coca-Cola regularly turns nearly 30% of its revenue into net income versus PepsiCo’s more modest net margin of only about 15%.

Yet there’s more to the story, because Coca-Cola’s business model leaves it reliant on partners that are trying to turn profits of their own. As such, they may not be focused on the same priorities that Coke targets.

PepsiCo doesn’t face this same sort of potential problem, though. While operating its own production facilities eats into margins, it also provides the company with complete control of the integrated operation, giving it more flexibility than Coca-Cola.

There’s also the not-so-small matter of Coca-Cola’s cost bloat. For a company that doesn’t actually produce much, it’s still huge, with lots of overhead, and steep personnel expenses in particular. Consider that nearly 40% of PepsiCo’s revenue goes toward the selling, general, and administrative expenses of its integrated operation; Coca-Cola dishes out a little more than 30% of its revenue on that expense category even though its bottling partners handle the bulk of the production.

Long live the difference

Nothing is etched in stone, of course. The Coca-Cola Company could evolve again, or PepsiCo could follow in its rival’s footsteps, offloading production to third parties in an effort to widen its profit margins. It’s also possible either or both companies could simply drop the ball and lose customers.

Also, keep in mind that even though PepsiCo stock has been the better overall performer, it’s not like Coke has been a disaster. It’s still been a great-performing ticker.

The details that make these two companies distinctly different, however, aren’t the kind of nuances that quickly or readily change. That’s why PepsiCo is apt to continue minting more millionaires than Coca-Cola.

Should you invest $1,000 in PepsiCo right now?

Before you buy stock in PepsiCo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PepsiCo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $751,180!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Starbucks. The Motley Fool has a disclosure policy.

Forget Coca-Cola: This Stock Has Made Far More Millionaires was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel