Stock splits often ignite a new interest in some stocks, as a lower stock price makes the investment feel like investors are getting a better deal. While stock splits are mostly a cosmetic effect, their psychological effect on investments is a far bigger deal.

However, two companies that recently have undergone stock splits, Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO), are two that didn’t need more interest sparked in the stock. Regardless, both are some of the hottest stocks on Wall Street after their splits. But of the two, which is the better buy right now?

Both companies have vital AI technology

Nvidia’s 10-for-1 stock split was completed on June 10, while Broadcom’s 10-for-1 split was effective July 15. This slashed the price of each stock by one-tenth, so instead of trading for more than $1,000 per share, each stock is in the $100 range.

Stock splits usually only occur after extreme growth, and both companies have experienced that, thanks to the rise in artificial intelligence (AI).

Nvidia’s graphics processing units (GPUs) are the power behind AI models, as they are used to train and create AI technology. While there are other GPU producers, Nvidia holds a massive market share in the data center market due to its supreme technology.

Broadcom also makes products that go into data centers, including its Jericho3-AI networking switch. This product allows data centers to use up to 32,000 GPUs with near-zero delays. It also designs other semiconductors that are designed for specific applications.

Both companies are vital in AI, although they have different roles.

Nvidia’s growth is outpacing Broadcom’s

In the second quarter of fiscal year 2024 (ended May 5), Broadcom’s revenue grew 43% year over year to $12.5 billion. However, that headline number is misleading because its acquisition of VMware skews it. If you subtract that, its revenue growth falls to 12%. While that’s still healthy growth, it pales in comparison to Nvidia.

In Q1 of fiscal year 2025 (ended April 28), Nvidia’s revenue increased by 262% year over year to $26 billion. Last year’s revenue was $7.2 billion, so Nvidia added $18.8 billion in revenue over the past year — one and a half times what Broadcom brought in this quarter. While this isn’t a nail in the coffin to this comparison, it heavily skews it in Nvidia’s favor. However, this rapid growth is expected to slow down in the next few quarters because Nvidia’s comparison quarters will be much more difficult.

What kind of growth can investors expect in the future? Wall Street analysts expect Nvidia’s sales to grow by 98% this fiscal year and 36% next year. Broadcom’s revenue is expected to rise by 51% this year and 44% next year, so its growth is expected to be better than Nvidia’s next year. This is a key point in Broadcom’s investment thesis, as it could be a better stock to own for the long term versus Nvidia, as some of its tailwinds are starting to kick in.

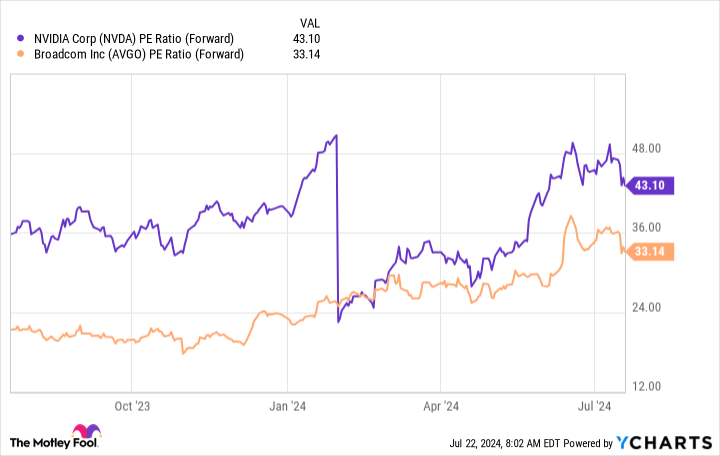

Broadcom’s stock is far cheaper than Nvidia’s

Lastly, let’s look at valuation. This will tell investors how much of a premium they’re paying to own each stock right now. Because each company is fully profitable but undergoing many changes, we’ll look at the forward earnings (P/E) ratio to determine how expensive each stock is based on analyst projections.

From this standpoint, Broadcom’s stock is quite a bit cheaper than Nvidia’s. This is a great argument for ownership, as it hasn’t seen the extreme hype that Nvidia has (even though it has had a fair share of its own).

So, which stock split is the better buy? While Nvidia is all the rage right now, its time has come. I think Broadcom is a better investment due to its lower price and longer-term tailwinds. If you’re sitting on some massive profits from Nvidia, it may be wise to move some of that money into Broadcom to align yourself for the next wave of AI investing.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $700,076!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Better Stock-Split Buy: Nvidia vs. Broadcom was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel