(Bloomberg) — A selloff in the world’s largest technology companies sent stocks down, with traders also bracing for central bank decisions that will be critical in shaping the trajectory of global markets.

Most Read from Bloomberg

About 300 shares in the S&P 500 rose, but renewed tech weakness weighed on the gauge — with Nvidia Corp. down 5%. After a $2.3-trillion Nasdaq 100 wipeout, investors awaited Microsoft Corp.’s earnings amid concern that firms aren’t yet seeing returns from investments in artificial intelligence. The software maker’s numbers will set the scene for reports from other heavyweighs, with markets also gearing up for the Federal Reserve decision Wednesday.

“It’s likely the Fed does signal that looming cut and given the recent pullback, that should help this rebound continue,” said Tom Essaye at The Sevens Report. “However, if the Fed does not signal a September rate cut, markets could get a bit ugly given recent tech weakness, especially if earnings underwhelm.”

While the Fed is expected to hold benchmark rates at the highest level in more than two decades this week, traders will be closely watching for any hints that the start of policy easing is near. In the run-up to the decision, data showed US consumer confidence rose on an improved outlook for the economy and job openings beat forecasts.

The S&P 500 fell to 5,430. A gauge of the “Magnificent Seven” megacaps fell 1.4%. The Russell 2000 of small caps was little changed. Microsoft Azure is investigating reports of issues connecting to Microsoft services globally. PayPal Holdings Inc. soared on a bullish outlook. Procter & Gamble Co. sank on a sales miss.

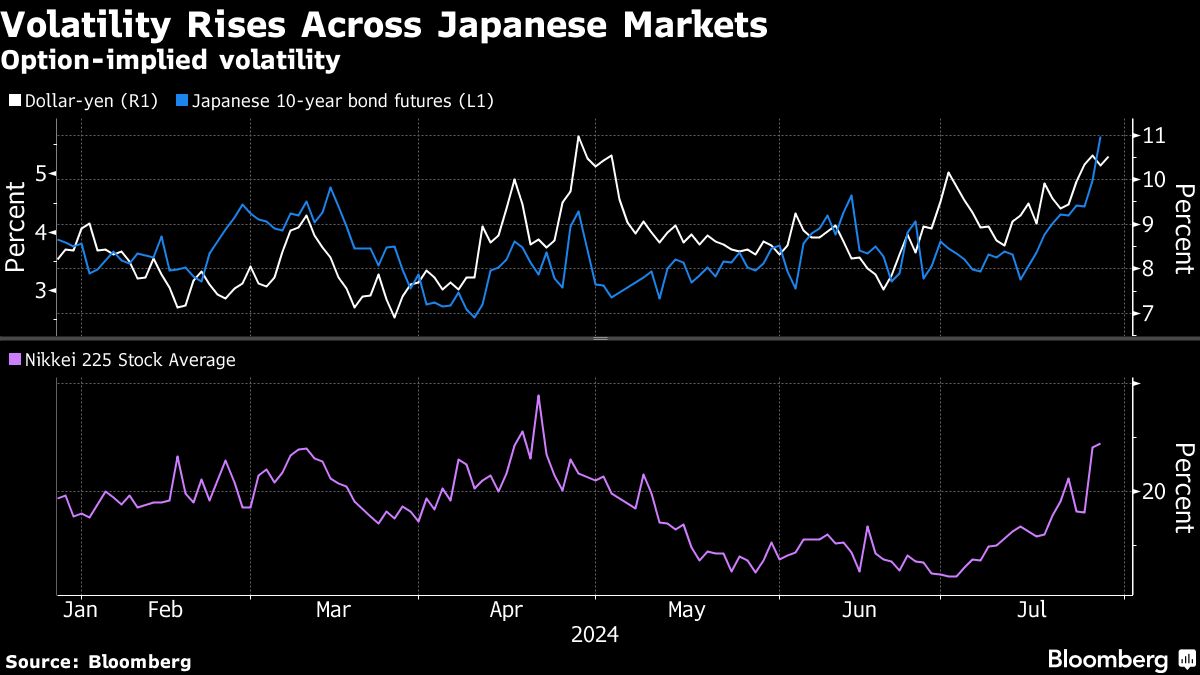

Treasury 10-year yields were little changed at 4.17%. The yen weakened as the Bank of Japan kicked off a two-day policy meeting. BOJ Governor Kazuo Ueda will be under intense scrutiny Wednesday when he unveils his plans for quantitative tightening and delivers a decision on the policy interest rate.

Goldman Sachs Group Inc. Chief Executive Officer David Solomon said one or two Fed rate cuts later this year are looking increasingly likely, after predicting just two months ago there would be no rate reductions in 2024.

“One or two cuts in the fall seems more likely,” Solomon said Tuesday in a CNBC interview from Paris. “There’s no question there are some shifts in consumer behavior, and the cumulative impact of what’s been kind of a long inflationary pressure, even though it’s moderating, is having an effect on consumer habits.”

A year has come and gone since the Fed last raised rates, keeping borrowing costs stable while central bankers wait for signs that inflation is being tamed.

If the Fed is about to begin a rate reduction cycle, stock bulls have history on their side. In the six prior hiking cycles, the S&P 500 has risen an average 5% a year after the first cut, according to calculations by the financial research firm CFRA. What’s more, the gains also broadened, with the small-cap Russell 2000 Index climbing 3.2% 12 months later, CFRA’s data show.

Corporate Highlights:

-

Pfizer Inc. raised its profit expectations for the year, citing new cancer drugs, as it seeks to dig out of a Covid-related hole in sales.

-

Merck & Co. beat Wall Street’s profit and sales estimates for the quarter as the blockbuster immunotherapy Keytruda continued to dominate the market for cancer medicines.

-

JetBlue Airways Corp. will defer $3 billion in spending on new aircraft through 2029 in a sweeping plan by its new chief executive officer to restructure operations and return the beleaguered carrier to profitability.

-

Archer-Daniels-Midland Co.’s quarterly profit shrank more than expected as the grain trading giant faces a downturn in crop markets.

-

SoFi Technologies Inc. raised its forecast for this year’s profit and revenue as the fintech benefits from both its newer technology businesses and its trademark lending operation.

-

BP Plc maintained the pace of share buybacks and increased its dividend as strong second-quarter earnings from pumping crude offset weakness in other parts of the business.

Key events this week:

-

Eurozone CPI, Wednesday

-

Bank of Japan policy decision, Wednesday

-

US ADP employment change, Wednesday

-

Fed rate decision, Wednesday

-

Meta Platforms earnings, Wednesday

-

Eurozone S&P Global Eurozone Manufacturing PMI, unemployment, Thursday

-

US initial jobless claims, ISM Manufacturing, Thursday

-

Amazon, Apple earnings, Thursday

-

Bank of England rate decision, Thursday

-

US employment, factory orders, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.4% as of 11:03 a.m. New York time

-

The Nasdaq 100 fell 0.9%

-

The Dow Jones Industrial Average rose 0.2%

-

The Stoxx Europe 600 rose 0.5%

-

The MSCI World Index fell 0.3%

-

Bloomberg Magnificent 7 Total Return Index fell 1.4%

-

The Russell 2000 Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index rose 0.2%

-

The euro fell 0.2% to $1.0804

-

The British pound fell 0.3% to $1.2828

-

The Japanese yen fell 0.3% to 154.50 per dollar

Cryptocurrencies

-

Bitcoin fell 2.5% to $65,650.13

-

Ether fell 0.7% to $3,297.05

Bonds

-

The yield on 10-year Treasuries declined one basis point to 4.16%

-

Germany’s 10-year yield declined two basis points to 2.34%

-

Britain’s 10-year yield declined two basis points to 4.03%

Commodities

-

West Texas Intermediate crude fell 1.3% to $74.82 a barrel

-

Spot gold rose 0.2% to $2,389.88 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel