(Bloomberg) — European stocks rose as traders prepared for a week packed with US data that will shed light on the health of the world’s largest economy and the outlook for Federal Reserve interest-rate policy.

Most Read from Bloomberg

Most European equity sectors traded in the green as the Stoxx 600 index advanced for a fifth day. A gauge of Asian stocks was off its highs for the session, while US futures were steady.

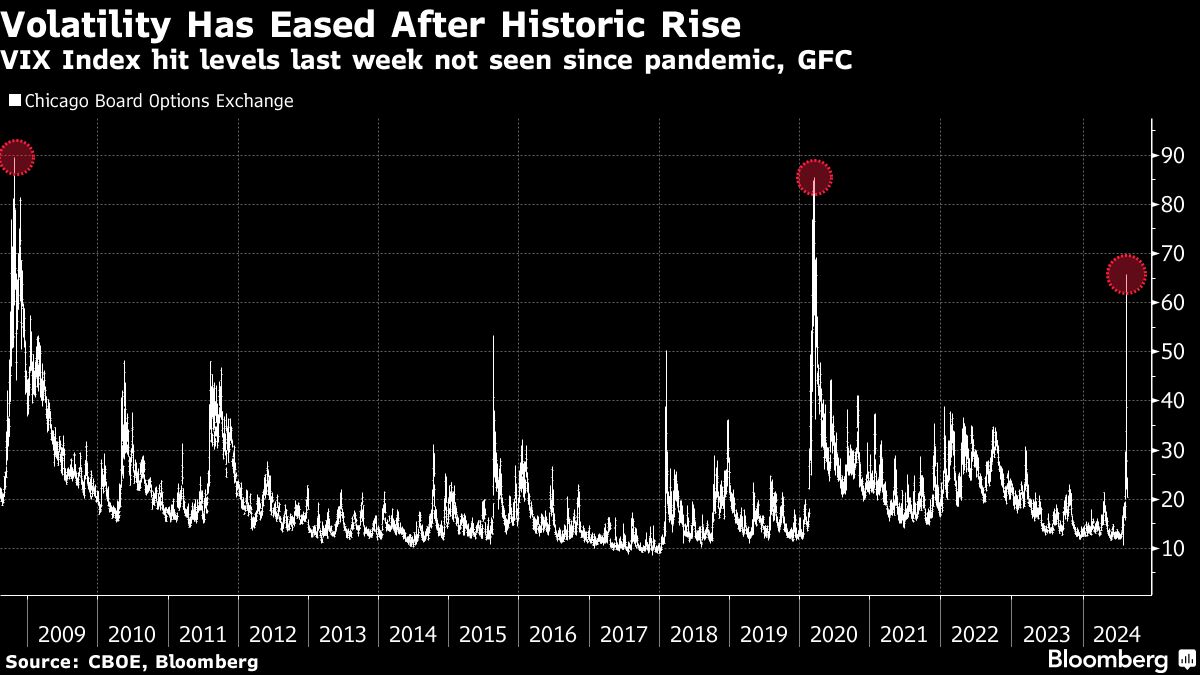

There was some relief from the volatility that ripped through markets last week, fueled by concerns the Fed is waiting too long to cut interest rates. The Cboe Volatility Index — Wall Street’s fear gauge — has retreated from its highest levels since the early days of the Covid-19 pandemic.

“The skies are not fully clear yet, but there are several reasons that suggest to us that some relatively calmer seas are ahead of us,” analysts at Nomura Holdings Inc. said in a note, citing a lessening of fears about a US recession and lower chances of a very hawkish Bank of Japan as among the grounds for optimism.

There’s no certainty the relative calm will continue, with Wednesday’s US inflation data the key volatility event for the week. According to Citigroup Inc., traders are positioning for the S&P 500 to move 1.2% in either direction when the consumer price index report is released.

Meanwhile, while bond markets have moved to price in a Fed that is “behind the curve,” the risk isn’t “priced into current equity multiples,” according to Morgan Stanley strategists. The team led by Michael Wilson says economic growth is the primary concern for investors, rather than inflation and rates.

“Markets are looking for better growth or more policy support to get excited again,” the team wrote in a note. “We don’t see confirming evidence in either direction near term, leaving the index to trade in a tight range for now.”

Bucking the trend of volatility easing is China, where authorities are fighting against a ferocious bond rally. At least four Chinese brokerages have started fresh measures to cut back trading of domestic government debt since last week, people familiar with the matter said, with worries that a sudden reversal may cause financial instability.

The yen surged last week as traders slashed bearish bets following the BOJ’s rate hike, forcing a negative feedback loop as investors dumped carry trades that ricocheted across global markets. The earnings of UBS Group AG are due on Aug. 14, and details on how clients responded to that volatility is likely to be a big focus.

The BOJ and Fed are the biggest variables to drive trading, said Taosha Wang, a portfolio manager at Fil Asia Holdings Pte Ltd. For the US, “I don’t think the market has agreed — either a recession, which we think is excessive, or a soft landing,” she told Bloomberg Television’s Yvonne Man and David Ingles on Monday.

The US consumer price index is expected to have risen 0.2% from June for both the headline figure and the so-called core gauge that excludes food and energy. The modest moves, however, may not be enough to derail the Fed from a widely anticipated interest-rate cut next month.

At the weekend, Fed Governor Michelle Bowman said she still sees upside risks for inflation and continued strength in the labor market, signaling she may not be ready to support an interest-rate decrease when US central bankers next meet in September. Money markets have fully priced a rate cut in September and about 100 basis points of easing for the year, according to swaps data compiled by Bloomberg.

In commodities, oil rose Monday, extending a 4.5% gain last week. Some top US oil refiners are throttling back operations at their facilities this quarter, adding to concerns that a global glut of crude is forming. Gold edged higher.

Some key events this week:

-

India CPI, industrial production, Monday

-

Australia consumer confidence, Tuesday

-

Japan PPI, Tuesday

-

South Africa unemployment, Tuesday

-

UK jobless claims, unemployment, Tuesday

-

Home Depot earnings, Tuesday

-

US PPI, Tuesday

-

Atlanta Fed President Raphael Bostic speaks, Tuesday

-

Eurozone GDP, industrial production, Wednesday

-

New Zealand rate decision, Wednesday

-

South Korea jobless rate, Wednesday

-

Poland CPI, Wednesday

-

UK CPI, Wednesday

-

US CPI, Wednesday

-

Australia unemployment, Thursday

-

Japan GDP, industrial production, Thursday

-

Philippines rate decision, Thursday

-

China home prices, retail sales, industrial production, Thursday

-

Norway rate decision, Thursday

-

UK industrial production, GDP, Thursday

-

US initial jobless claims, retail sales, industrial production, Thursday

-

St. Louis Fed President Alberto Musalem, Philadelphia Fed President Patrick Harker speak, Thursday

-

Alibaba Group, Walmart earnings, Thursday

-

Hong Kong jobless rate, GDP, Friday

-

Taiwan GDP, Friday

-

US housing starts, University of Michigan consumer sentiment, Friday

-

Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 0.4% as of 8:14 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures rose 0.1%

-

Futures on the Dow Jones Industrial Average were little changed

-

The MSCI Asia Pacific Index rose 0.1%

-

The MSCI Emerging Markets Index rose 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0924

-

The Japanese yen fell 0.4% to 147.24 per dollar

-

The offshore yuan fell 0.1% to 7.1818 per dollar

-

The British pound was little changed at $1.2765

Cryptocurrencies

-

Bitcoin fell 0.6% to $58,140.51

-

Ether fell 0.8% to $2,538.39

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 3.96%

-

Germany’s 10-year yield advanced two basis points to 2.25%

-

Britain’s 10-year yield advanced two basis points to 3.96%

Commodities

-

Brent crude rose 0.5% to $80.09 a barrel

-

Spot gold rose 0.3% to $2,437.76 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel