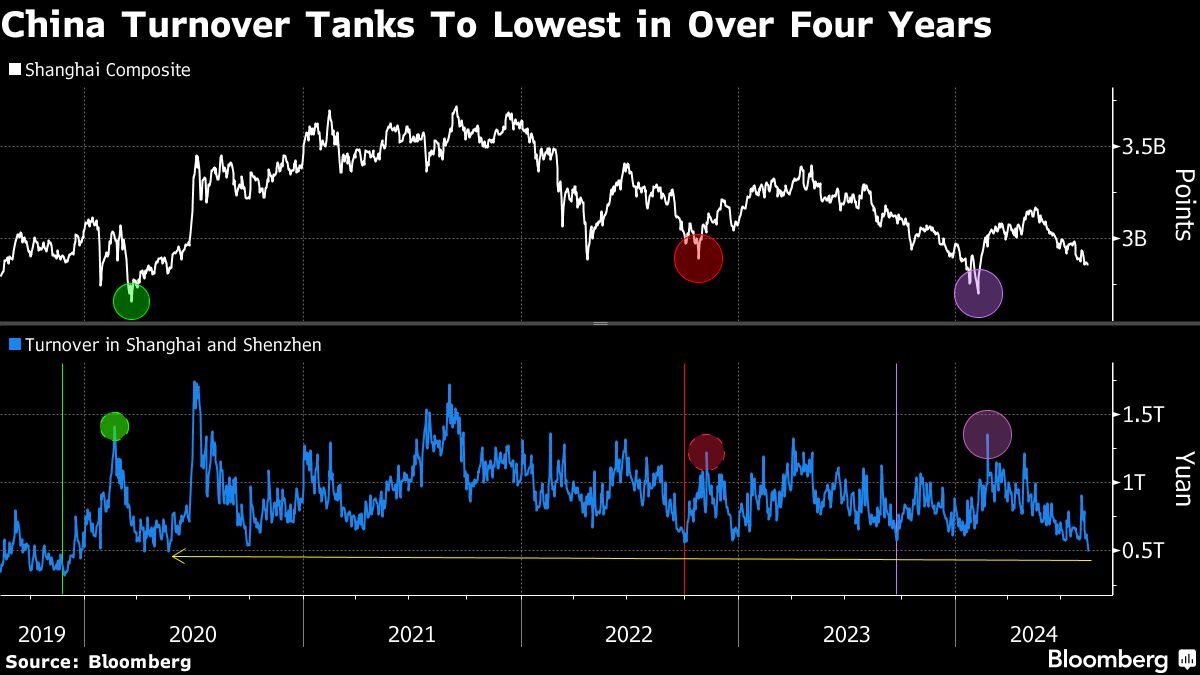

(Bloomberg) — Share transactions in China shrank to their lowest level in over four years, as a local bond rally hit fever pitch in a weakening economy.

Most Read from Bloomberg

Turnover on the Shanghai and Shenzhen bourses fell to a combined 496 billion yuan ($69.1 billion) on Monday, the thinnest since May 2020. That was also the lowest versus China’s entire market capitalization since late 2019.

As the world’s second-largest stock market is on track for its fourth consecutive year of losses, an unprecedented housing crisis has further limited investors’ options, prompting surging demand for government bonds that has alarmed regulators. While a sharp drop in trading volume often signals pessimism is near a bottom, several such episodes in China in the past few years have preceded panic-driven selling that pushed the market to new lows.

“The turnover shows that the market is rife with pessimism,” said Shao Qifeng, chief investment officer at Ying An Asset Management Co., noting the poor returns on stocks versus bonds as a key reason. “But I think things aren’t as bad as currently priced and adding positions if possible at this point is a no-brainer.”

Shao said he remains upbeat on the outlook of Chinese corporate earnings and the country’s long-term growth prospects.

China’s benchmark CSI 300 Index has fallen more than 3% this year, making it the worst performer among the world’s major equity gauges. Down 0.2% at Tuesday’s midday break, it’s edging closer to losing 10% from a high in May.

Meantime, trading volume in Hong Kong, where stocks have fared better than their mainland counterparts this year, has also been contracting in recent days. It dropped on Monday to HK$70.3 billion ($9 billion), the lowest since February.

(Updates with investor’s quote and index performance details)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel