(Bloomberg) — European and US equity futures rose on Friday, building on gains in Asian stocks as traders piled into risk assets amid growing optimism that the US economy will avoid a recession. The yen is set for its worst week since May.

Most Read from Bloomberg

Contracts on the Euro Stoxx 50 rose 0.3% and those on the S&P 500 added 0.2%, extending Wall Street’s overnight gains. Asia’s benchmark equity gauge is poised for its best weekly performance in over a year, led by Japanese shares as a weak yen boosted exporters’ earnings. The currency fell 1.3% versus the dollar Thursday, and was trading around the 149 level, easing fears of a massive carry trade unwind.

A slew of US data this week, from inflation to jobless claims to retail sales, has reassured investors, supporting the view that the world’s biggest economy is heading for a “Goldilocks” scenario where inflation is contained without stalling growth. Global stocks have largely erased last week’s losses, when traders were worried the Federal Reserve won’t cut rates fast enough to prevent a recession.

“Asian equities are enjoying an impressive run today, driven by a renewed sense of ‘perfect balance’ thanks to recent well-anticipated economic releases,” said Hebe Chen, an analyst at IG Markets Ltd. “Japanese stocks, in particular, continue their robust recovery with no signs of slowing down yet.”

Treasuries in Asia were steady after Thursday’s dip as signs of a resilient US economy in the latest data releases prompted traders to dial back bets for a jumbo September rate reduction. They are now pricing in less than a 30-basis point cut next month, with a total of 92 basis points of reduction expected for the remainder of 2024.

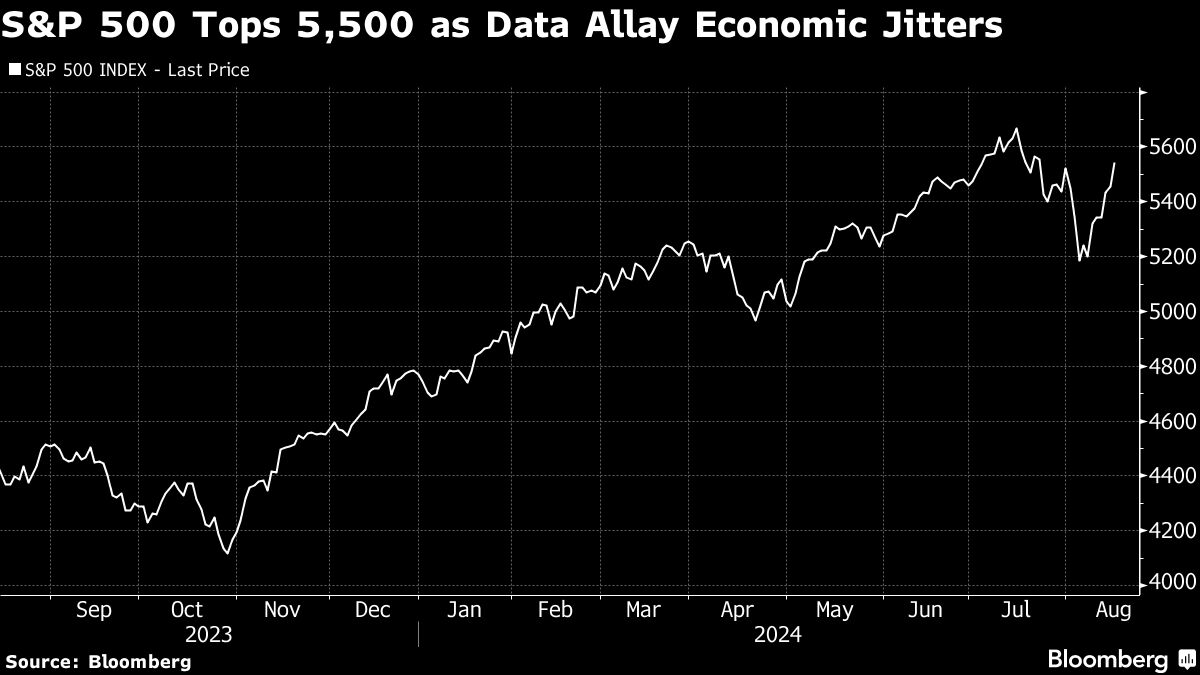

As fears around the US economy eased, equities continued a rebound from last week’s meltdown that rattled global markets. The S&P 500 extended a six-day rally to 6.6% on Thursday, marking the best performance in such a span since November 2022. Walmart Inc., often seen as a barometer of growth, jumped on a solid outlook.

Meanwhile, Wall Street’s “fear gauge” — the VIX — dropped around 15 after spiking to 65 last week. This rebound for US stocks from the heavy selling last week suggests that trend-following quant funds may soon return, which could provide further support to stocks.

In Japan, stocks headed for their biggest weekly advance since April 2020, driven by renewed weakness for the yen. This weakness may even attract some hedge funds back to the carry trade that blew up two weeks ago.

“Exporters are gaining on a weak yen and solid US economic figures,” said Hiroshi Namioka, chief strategist at T&D Asset Management Co. “Stocks that saw a huge selloff in the past month are being bought back as the market calms down from the rout.”

Elsewhere in Asia, China’s central bank chief pledged further measures to support the country’s economic recovery, while cautioning that it won’t adopt “drastic” measures.

Alibaba Group Holding Ltd. rose as optimism over tech stocks outweighed concerns about its earnings. JD.com Inc. gained the most since March after beating net profit estimates in results released late Thursday.

Soft Landing

US officials have been trying to use higher rates to ease inflation without causing the economy to contract — a scenario known as a “soft landing.” Fed Bank of St. Louis President Alberto Musalem said the time is nearing when it will be appropriate to cut rates. His Atlanta counterpart Raphael Bostic told the Financial Times he’s “open” to a reduction in September.

“A soft landing is no longer a hope. It’s becoming a reality,” said David Russell at TradeStation. “These numbers also suggest that recent market volatility wasn’t really a growth scare. It was just normal summer seasonality amplified by moves in the currency market.”

In commodities, gold was on track for a small weekly gain. Oil edged lower as the market weighed strong US economic data and a possible attack by Iran or its proxies on Israel against a lackluster Chinese demand outlook.

Key events this week:

-

US housing starts, University of Michigan consumer sentiment, Friday

-

Fed’s Austan Goolsbee speaks, Friday

-

Canada housing starts, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.2% as of 6:40 a.m. London time

-

Nikkei 225 futures (OSE) rose 3.5%

-

Japan’s Topix rose 2.8%

-

Australia’s S&P/ASX 200 rose 1.1%

-

Hong Kong’s Hang Seng rose 1.9%

-

The Shanghai Composite was little changed

-

Euro Stoxx 50 futures rose 0.3%

-

Nasdaq 100 futures rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1%

-

The euro rose 0.1% to $1.0984

-

The Japanese yen rose 0.2% to 149.01 per dollar

-

The offshore yuan fell 0.2% to 7.1766 per dollar

-

The Australian dollar rose 0.3% to $0.6631

-

The British pound rose 0.2% to $1.2878

Cryptocurrencies

Bonds

-

The yield on 10-year Treasuries declined one basis point to 3.90%

-

Japan’s 10-year yield advanced 4.5 basis points to 0.875%

-

Australia’s 10-year yield advanced six basis points to 3.94%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel