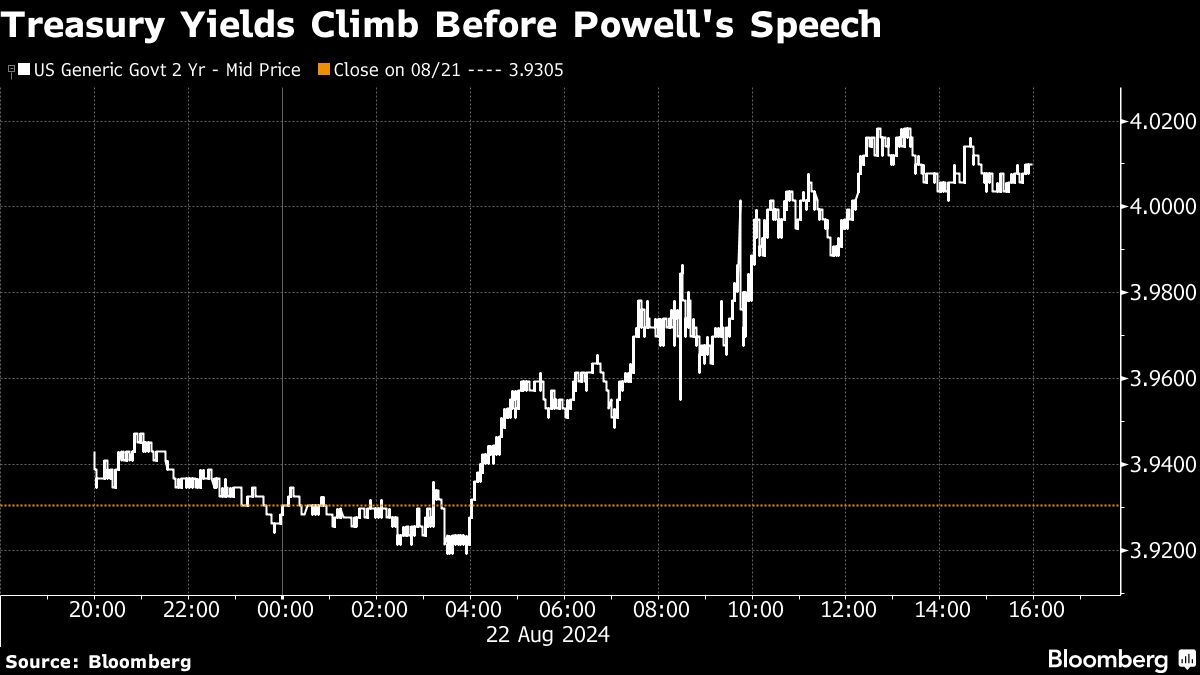

(Bloomberg) — Stocks rebounded as the bond market stabilized, with traders seeking clues from Jerome Powell on how fast and how far the Federal Reserve will cut rates.

Most Read from Bloomberg

Equities rose in early New York trading, following a slide fueled by a tech selloff and speculation that Powell would throw some cold water on market expectations for aggressive interest-rate cuts. The swap market has cemented wagers the Fed will ease policy by about one percentage point this year.

With the central bank approaching a crucial pivot point, it’s difficult to overstate how much attention financial markets will be paying. For starters, they’re looking for confirmation the Fed will lower rates in September. But more drama surrounds what happens after that and the pace of additional cuts over the next several months as the Fed confronts the dual risks to both inflation and employment.

A survey conducted by 22V Research shows 60% of people surveyed think Powell will signal a 25 basis-point cut during his speech scheduled for 10 a.m. New York time. Moreover, 42% of the investors surveyed believe that the market reaction will be “neutral,” 35% think “risk-on” and 24% “risk-off.”

S&P 500 futures rose 0.5%. Treasury 10-year yields were little changed at 3.85%. The dollar fell.

What Will Powell Say?

We remain skeptical that the Chair will offer anything beyond guidance that the target Fed funds rate will be lowered next month and there will be further cuts to follow as the Committee shifts back toward a neutral stance. None of this will be new information. Moreover, the questions regarding the size of the initial cut and the pace of future moves will remain unanswered.

This isn’t to suggest the event isn’t without risk. After all, Powell could decide that more direct guidance is warranted at this stage in the cycle or to push back on the market’s current pricing. He could, but we doubt it, as this would be a departure from the Fed’s recent communications strategy.

I try to put myself in Powell’s shoes and I don’t expect anything special today from him. It could be a non-event in terms of market moves.

He’ll reaffirm market expectations of a September rate cut by again highlighting their shift in focus to the labor market but with more data to absorb before then, he’ll have no interest in leaning to what extent they will cut. As for market expectations past that of a full 100 bps by year and and 200 bps by next year’s Jackson Hole confab, why would he pre-commit to anything today? Play it by year from here I believe is his thought process.

This all said, if he talks down the odds of 50 bps next month by reinforcing his confidence in the economy, regardless of the CPI and payroll data he’ll see soon, we’ll get a selloff in the short end and likely in stocks.

The large amount of Fed communications this week have likely mostly telegraphed Fed Chair Powell’s speech today, so as long as it meets current market expectations (September rate cut and cuts continuing after that) the market reaction shouldn’t be significant. But there’s always the possibility for a surprise.

While we certainly expect the Fed to start cutting rates next month, we are less certain that Powell will feel compelled to underscore the likelihood of lower fed funds in September. Markets are confident in lower rates next month while not pricing in wildly unrealistic expectations for a 50 basis-point cut. What would Powell have to gain by confirming what is already expected?

Judging by recent Fed official comments as well as the FOMC minutes, Powell is likely to set the table for a rate cut in September. However, we expect Powell to stress the data-dependent nature of the Fed’s monetary policy decisions. As such, we believe the risks are tilted towards him pushing back against an aggressive easing path rather than him validating market pricing.

He is unlikely to go much beyond confirming what the market already thinks it knows: namely, that the first rate cut will be delivered next month. By acknowledging that the economy has evolved broadly along the lines the central bank expected, it would be a gently push against speculation of a 50 basis-point move. In the current context, a rate cut will not usher in easy policy, but simply make the current stance less restrictive.

Corporate Highlights:

-

Workday Inc.’s executives said the company would sharply increase profitability over the next three years.

-

Cava Group Inc. raised its full-year outlook after posting second-quarter results that beat expectations, the latest indicator that diners see good value in fast-casual restaurants.

-

Uber Technologies Inc. plans to start offering self-driving Cruise LLC cars to customers on its ride-hailing platform next year.

-

Tactical Resources Corp., a mining company focused on rare earth elements, has agreed to go public on the Nasdaq stock market through a merger with a blank-check firm, according to people familiar with the matter.

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.5% as of 8:28 a.m. New York time

-

Nasdaq 100 futures rose 0.7%

-

Futures on the Dow Jones Industrial Average rose 0.4%

-

The Stoxx Europe 600 rose 0.3%

-

The MSCI World Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro was little changed at $1.1114

-

The British pound rose 0.2% to $1.3118

-

The Japanese yen rose 0.1% to 146.09 per dollar

Cryptocurrencies

-

Bitcoin rose 0.3% to $60,861.36

-

Ether rose 1.2% to $2,657.85

Bonds

-

The yield on 10-year Treasuries was little changed at 3.85%

-

Germany’s 10-year yield was little changed at 2.25%

-

Britain’s 10-year yield was little changed at 3.96%

Commodities

-

West Texas Intermediate crude rose 1.9% to $74.43 a barrel

-

Spot gold rose 0.6% to $2,500.31 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Alex Nicholson, Robert Brand and Lynn Thomasson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel