(Bloomberg) — Stock traders gearing up for Federal Reserve rate cuts sent tech megacaps sinking, with Wall Street also awaiting Nvidia Corp.’s results.

Most Read from Bloomberg

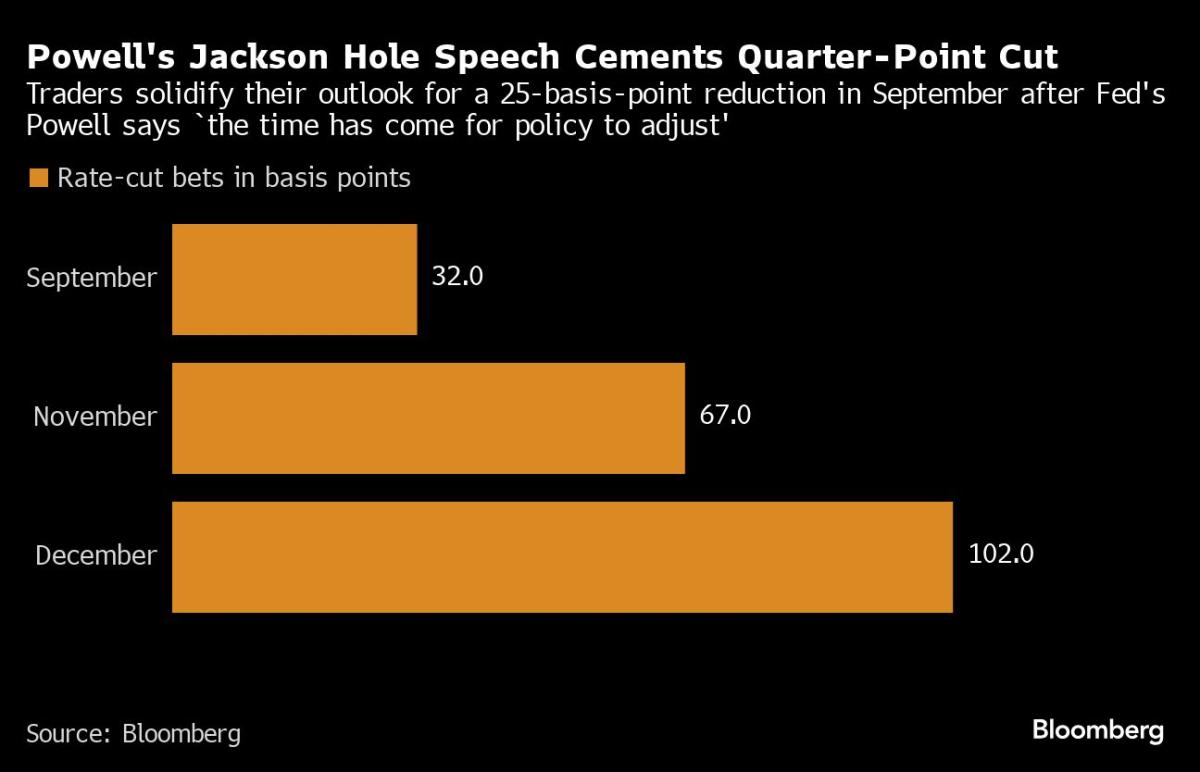

Most shares in the S&P 500 gained — with Wall Street resuming a pattern of money rotating out of the safety of big tech. That’s after Jerome Powell signaled Friday the Fed will slash borrowing costs in September. While the US equity benchmark didn’t do much on Monday, its equal-weighted version — one that gives Target Corp. as much clout as Microsoft Corp. — hit an all-time high amid hopes the advance will broaden out.

“The dovish commentary from Powell supports the narrative that inflation is trending lower, and the Fed would soon be cutting rates, underpinning ‘SMID-cap’ (small-mid) stocks,” said Craig Johnson at Piper Sandler. “The market broadening into ‘SMID-caps’ indicates a positive outlook for the remainder of the year.”

Monday’s action reprised a recent trend in which capitalization-weighted indexes underperformed the average stock, a consequence of weakness in the megacaps that dominate them. With firms such as Apple Inc. and Nvidia Corp. each making up over 6.5% of the S&P 500, losses are hard to offset even when most of the index’s members are up.

Strong flows from corporate buybacks, systematic funds and retail investors are expected to push stocks higher in the coming weeks, according to Goldman Sachs Group Inc.’s Scott Rubner.

He estimates there will be $17 billion of “unemotional demand between robots and corporates every day this week.” Rubner also sees a so-called “green sweep” for commodity trading advisers, or CTAs, over the coming week, which means those funds will likely be buying stocks however the market trades.

The S&P 500 hovered near 5,620, with most of its major groups rising. Trading volume was 25% below the average of the past month. The Russell 2000 of smaller firms added 0.2%. The tech-heavy Nasdaq 100 fell 0.9%. A Bloomberg gauge of the “Magnificent Seven” megacaps sank 1.2%.

Treasury 10-year yields rose one basis point to 3.81%. Oil advanced after an Israeli strike on Hezbollah targets in southern Lebanon raised tensions in the Middle East and Libya’s eastern government said it will halt exports.

To Chris Larkin at E*Trade from Morgan Stanley, in order to push to fresh highs this week, stocks may need to avoid any major surprises from earnings — especially Nvidia — “which has been driving a good deal of the sentiment in the tech sector.”

Expectations heading into the giant chipmaker’s earnings on Wednesday are high, with analysts anticipating another strong consensus beat that could prompt the chipmaker to raise its profit guidance. Trading in the options market suggest investors see potential for a 9% move in either direction on the day following the report, Citigroup Inc.’s Vishal Vivek said last week.

Its report this week will wrap up results for the “Magnificent Seven,” which in combination are on track to post 34% year-over-year growth in earnings for the second quarter — compared to 6% for the rest of the S&P 500, according to Jason Pride and Michael Reynolds at Glenmede.

This comes after a nearly year-long period in which the cohort of megacaps posted earnings growth of more than 40% — while the rest of the index saw outright declines.

“The back half of this year is likely to be the beginning of a process that gives way to broader fundamental improvement,” they said. “Broader earnings growth participation should favor small caps and investment processes that avoid the pitfalls of market concentration.”

“At current valuations, stocks are expensive and any further upside will depend on improving earnings,” said Richard Saperstein at Treasury Partners. “Abundant liquidity coupled with declining inflation and an accommodative central bank will provide the backdrop for higher stock prices.”

S&P 500 returns following the initial Fed rate cut tend to be positive — unless the economy falls into recession, according to Keith Lerner at Truist Advisory Services, who also notes that’s not his base-case scenario.

“Small caps are likely to do better in the near term, but longer term we still prefer large caps,” Lerner said. “Small caps are a greater beneficiary of lower short-term rates, and valuations are cheap. However, historical trends after first Fed rate cut are mixed, earnings trends are still weak, and a cooling economy is historically a headwind for the asset class.”

Key events this week:

-

China industrial profits, Tuesday

-

Germany GDP, Tuesday

-

US Conference Board consumer confidence, Tuesday

-

Nvidia earnings, Wednesday

-

Fed’s Raphael Bostic and Christopher Waller speak, Wednesday

-

Eurozone consumer confidence, Thurrsday

-

US GDP, initial jobless claims, Thursday

-

Fed’s Raphael Bostic speaks, Thursday

-

Japan unemployment, Tokyo CPI, industrial production, retail sales, Friday

-

Eurozone CPI, unemployment, Friday

-

US personal income, spending, PCE; consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.3% as of 11:43 a.m. New York time

-

The Nasdaq 100 fell 0.9%

-

The Dow Jones Industrial Average rose 0.1%

-

The Stoxx Europe 600 was little changed

-

The MSCI World Index fell 0.2%

-

Bloomberg Magnificent 7 Total Return Index fell 1.2%

-

The Russell 2000 Index rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.2%

-

The euro fell 0.2% to $1.1168

-

The British pound fell 0.2% to $1.3190

-

The Japanese yen was little changed at 144.49 per dollar

Cryptocurrencies

-

Bitcoin fell 1.1% to $63,520.51

-

Ether fell 1.6% to $2,726.91

Bonds

-

The yield on 10-year Treasuries advanced one basis point to 3.81%

-

Germany’s 10-year yield advanced two basis points to 2.25%

-

Britain’s 10-year yield declined five basis points to 3.91%

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel