(Bloomberg) — European stocks retreated from a record high as traders positioned for a data-intensive week that will cast fresh light on the likely pace of monetary policy easing by major central banks.

Most Read from Bloomberg

Europe’s Stoxx 600 fell 0.5% in the first day of trading in a typical volatile month for markets. A gauge of Asian stocks dropped after Chinese factory activity contracted for a fourth straight month and a residential property slump worsened in the world’s second-biggest economy.

US equity futures weakened after the S&P 500 closed within a whisker of an all-time high on Friday. The dollar was steady, while cash Treasuries were closed for the US Labor Day holiday.

September has been one of the worst months for stocks in the past four years, while the dollar typically outperforms, according to data compiled by Bloomberg. Wall Street’s fear gauge – the Cboe Volatility Index, or VIX – has risen each September the past three years, the data show.

This month may be no different with the crucial US jobs report on Friday serving as a guide to how quick, or slow, the Fed will cut rates, and as the US election campaign gets into full swing. Traders are pricing the Fed’s easing cycle will begin this month, with a roughly one-in-four chance of a 50 basis point cut, according to data compiled by Bloomberg.

“This week’s jobs data will likely be a deciding factor for the FOMC to start with a 25 or 50 basis point cut,” Paul Mackel, Global Head of FX Research at HSBC Holdings Plc wrote in a note to clients. “At the recent Jackson Hole symposium, Fed Chair Jerome Powell made specific comments about avoiding a further weakening of the employment situation.”

Two days before Friday’s report, the government will issue figures on July job vacancies. The number of open positions, a measure of labor demand, is seen easing to a three-month low of 8.1 million — just above a more than three-year low.

As for the European Central Bank, Governing Council member Francois Villeroy de Galhau backed a cut in interest rates in September, according to an interview published on Friday, after data showed a marked slowdown in inflation.

Elsewhere, German Chancellor Olaf Scholz’s ruling coalition was punished in two regional elections in east of the country on on Sunday, with the far right clinching its first triumph in a state ballot since World War II. Still, the extreme right is highly unlikely to be able to form a government, as it’s shunned by the other parties represented in parliament.

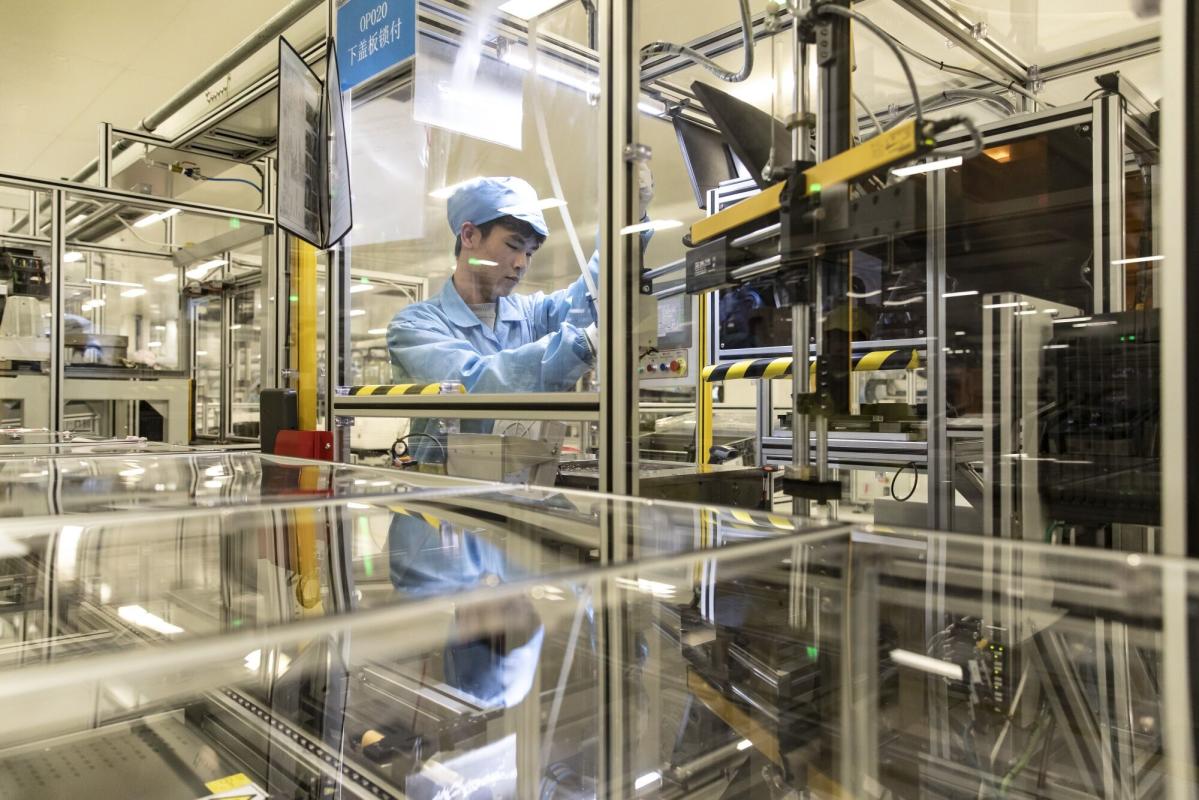

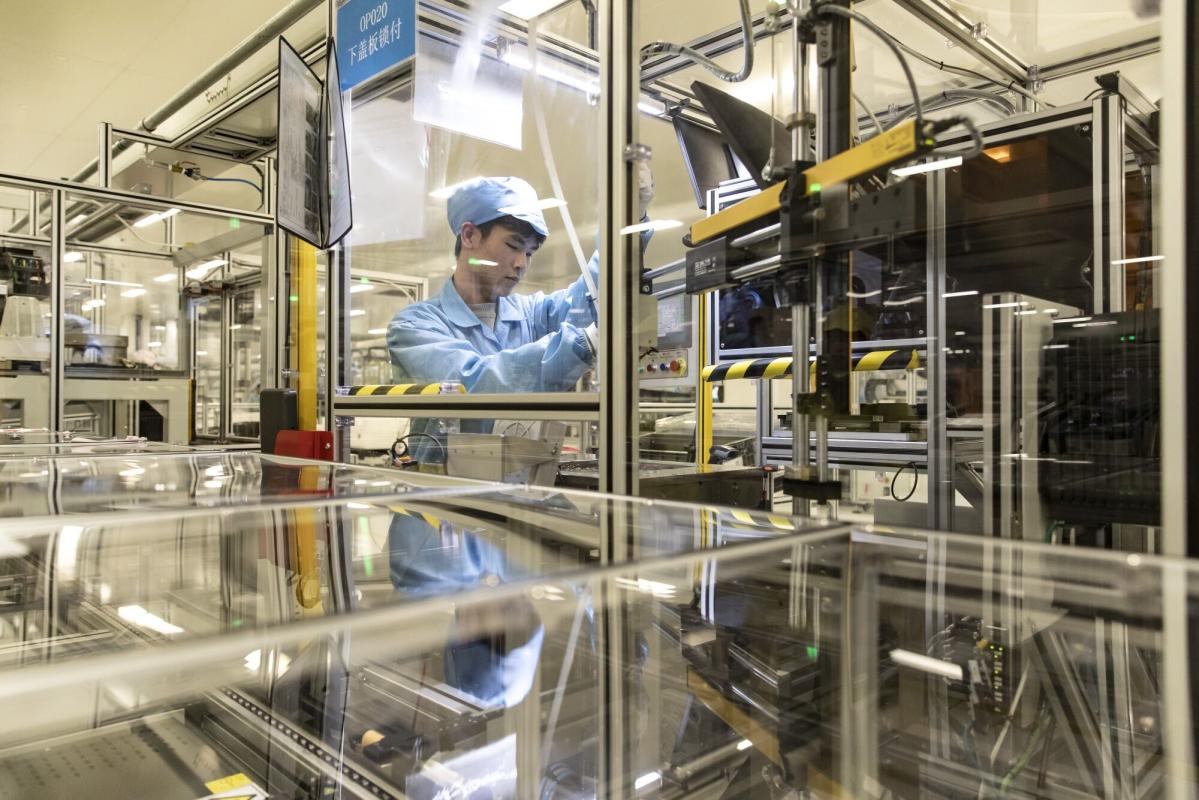

China Woes

In Asian markets, multiple rounds of stimulus have failed to revive growth in China, where a prolonged property market slump is curbing domestic demand in the world’s second-largest economy.

While the Caixin China manufacturing data registered an unexpected increase on Monday, it fell short of reversing sentiment after an official gauge of factory activity contracted for a fourth straight month in August. Latest home sales figures showed a worsening residential slump, after China Vanke Co. underlined the industry’s woes late Friday by reporting a half-year loss for the first time in more than two decades.

“I think there’s a huge problem — by now everybody recognizes that,” Hao Ong, chief economist at Grow Investment Group told Bloomberg’s David Ingles and Yvonne Man in an interview. “The government needs to do substantially more.”

Oil pushed lower on signs OPEC+ will progress with a plan to lift output from October, while the economic headwinds mount in China. Gold and iron ore also declined.

Key events this week:

-

Eurozone HCOB manufacturing PMI, Monday

-

UK S&P Global manufacturing PMI, Monday

-

US markets closed for Labor Day holiday, Monday

-

South Korea CPI, Tuesday

-

Switzerland GDP, CPI, Tuesday

-

South Africa GDP, Tuesday

-

US construction spending, ISM Manufacturing index, Tuesday

-

Mexico unemployment, Tuesday

-

Brazil GDP, Tuesday

-

Chile rate decision, Tuesday

-

Australia GDP, Wednesday

-

China Caixin services PMI, Wednesday

-

Bloomberg CEO Forum in Jakarta, Wednesday

-

Eurozone HCOB services PMI, PPI, Wednesday

-

Poland rate decision, Wednesday

-

Fed’s Beige Book, Wednesday

-

Canada rate decision, Wednesday

-

South Korea GDP, Thursday

-

Malaysia rate decision, Thursday

-

Philippines CPI, Thursday

-

Taiwan CPI, Thursday

-

Thailand CPI, Thursday

-

Eurozone retail sales, Thursday

-

Germany factory orders, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Canada unemployment, Friday

-

Chile CPI, Friday

-

Colombia CPI, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 fell 0.5% as of 8:22 a.m. London time

-

S&P 500 futures fell 0.3%

-

Nasdaq 100 futures fell 0.4%

-

Futures on the Dow Jones Industrial Average fell 0.2%

-

The MSCI Asia Pacific Index fell 0.4%

-

The MSCI Emerging Markets Index fell 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.1% to $1.1062

-

The Japanese yen was little changed at 146.28 per dollar

-

The offshore yuan fell 0.2% to 7.1071 per dollar

-

The British pound rose 0.1% to $1.3141

Cryptocurrencies

-

Bitcoin fell 1.4% to $57,598.28

-

Ether fell 2.4% to $2,442.94

Bonds

-

The yield on 10-year Treasuries was little changed at 3.90%

-

Germany’s 10-year yield advanced three basis points to 2.33%

-

Britain’s 10-year yield advanced three basis points to 4.05%

Commodities

-

Brent crude fell 0.6% to $76.50 a barrel

-

Spot gold fell 0.2% to $2,498 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel