(Bloomberg) — Asian stocks regained some ground after a global selloff as traders awaited this week’s US payrolls data to gauge the extent of the Federal Reserve’s easing.

Most Read from Bloomberg

The MSCI Asia Pacific Index rose 0.5% after falling more than 2% on Wednesday, its biggest drop since the Aug. 5 rout. Taiwan’s Taiex index jumped more than 1%, led by a rebound in the shares of chipmakers. Benchmarks in China and Hong Kong traded range-bound.

Treasury yields climbed after the 10-year rate dropped eight basis points in the prior session, as a slowdown in the US labor market bolstered bets on steep rate cuts by the Fed. An index of dollar strength steadied after weakening by 0.3% on Wednesday. The yen, earlier supported by an increase in Japan’s real wages, erased gains.

Global financial markets have displayed outsized reactions to US economic data as doubts grow over the Fed’s ability to engineer a soft landing. Skepticism over the artificial intelligence hype has also hurt risk assets, with Nvidia Corp. seeing its worst two-day plunge since October 2022. Focus now turns to the US payrolls report due Friday, one of the most important data points before the Fed’s decision later this month.

“Financial markets remain in a cautious mood in the lead up to the US payrolls report which can make or break the case for a 50bp FOMC cut,” said Carol Kong, a currency strategist at Commonwealth Bank of Australia. “USD/JPY will be particularly vulnerable to the downside to signs of a deterioration in the US labor market because of the divergent monetary policy paths between the FOMC and the Bank of Japan.”

US futures were little changed in Asian trading after the S&P 500 and Nasdaq 100 ended Wednesday down 0.2%.

Shares of Nippon Steel Corp. snapped a three-day drop. The Japanese steelmaker is in focus after US President Joe Biden was said to block its $14.1 billion takeover of United States Steel Corp.. Shares of US Steel closed 17% lower in New York, the biggest decline since April 2017.

Elsewhere, Bloomberg’s report that China is considering cutting interest rates on as much as $5.3 trillion of mortgages triggered divergent moves in the share market. Stocks of property developers jumped while banks slid. Overall sentiment remains poor with JPMorgan Chase & Co. dropping its buy recommendation for the nation’s stocks, citing weak policy support and potential volatility linked to the US presidential election.

“There is insufficient policy support, both monetary and fiscal,” Claudio Irigoyen, head of global economics research for Bank of America, said on Bloomberg Television. “It is going to be more difficult to achieve the targets of 5% unless we have more policy support.”

With the Fed set to begin cutting rates in a few weeks, monthly US employment data due Friday will help determine how big the move will be. Chair Jerome Powell has made it clear the Fed is now more concerned about risks to the labor market than inflation.

“I think a lot depends on how the jobs data pans out. We don’t rule out more aggressive Fed easing should the jobs data deteriorate,” Eddy Loh, chief investment officer at Maybank Group Wealth Management, told Bloomberg Radio. “Having said that, soft landing in the US is going to be supportive for risk assets.”

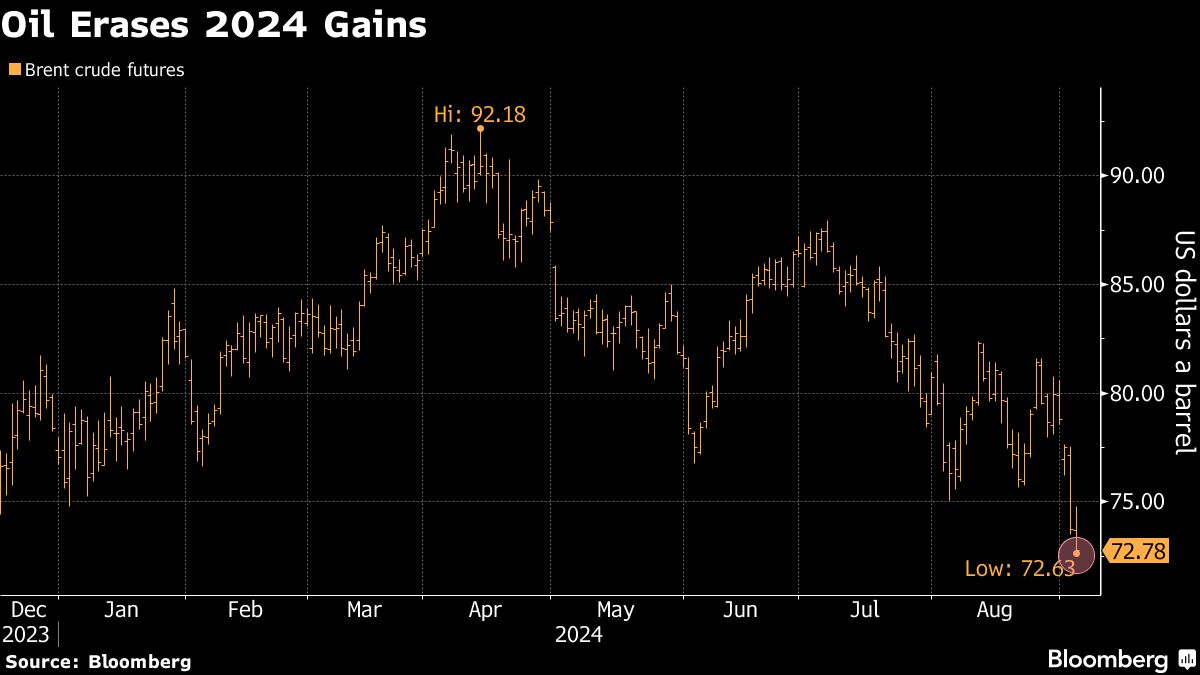

In commodities, oil rose after closing at the lowest level since June 2023 as an industry report pointed to a big draw in US crude stockpiles. Meanwhile, gold traded at around $2,500 after finding support following the US job openings data.

Key events this week:

-

Eurozone retail sales, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 11:38 a.m. Tokyo time

-

Nasdaq 100 futures were little changed

-

Japan’s Topix rose 0.4%

-

Australia’s S&P/ASX 200 rose 0.2%

-

Hong Kong’s Hang Seng rose 0.1%

-

The Shanghai Composite rose 0.2%

-

Euro Stoxx 50 futures were little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was unchanged at $1.1082

-

The Japanese yen was little changed at 143.73 per dollar

-

The offshore yuan rose 0.2% to 7.0976 per dollar

Cryptocurrencies

-

Bitcoin fell 0.5% to $57,780.93

-

Ether fell 0.2% to $2,449.65

Bonds

Commodities

-

West Texas Intermediate crude rose 0.5% to $69.54 a barrel

-

Spot gold rose 0.1% to $2,498.25 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu and Richard Henderson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel