(Bloomberg) — US stocks were set for a steady open after days of volatility as uncertainty persists over the health of the American economy and the pace of possible Federal Reserve interest-rate cuts.

Most Read from Bloomberg

S&P 500 futures were little changed as Nvidia Corp. and Tesla Inc. rose in premarket trading. Europe’s Stoxx 600 index dropped 0.2%, with tech heavyweight ASML Holding NV and luxury stocks among the biggest losers. London-listed miners BHP Group Ltd. and Rio Tinto Group fell after iron ore sank to the lowest since 2022.

Traders are looking to weekly jobless claims data due later today and Friday’s nonfarm payrolls reports to assess whether the US economy is heading for a soft-landing as the Fed prepares to start easing policy. Global stocks suffered their worst losses earlier this week since the Aug. 5 meltdown, with the Cboe Volatility Index remaining elevated at 20.

Swap traders have ramped up bets on the pace of rate cuts after a Wednesday reading on US job openings trailed estimates and the Fed’s Beige Book survey showed flat or declining economic activity. Rates pricing foresees at least 100 basis points of easing this year, including one jumbo cut of 50 basis points.

“We think that the US soft landing scenario is intact but acknowledge that the next two-three months could be a tricky period,” Eddy Loh, chief investment officer at Maybank Group Wealth Management, said on Bloomberg Television. “If the Fed were to cut 50 basis points, the market could perceive it as a negative because that means the Fed is seeing something in the economy.”

The yield on two-year Treasuries advanced one basis point after tumbling Wednesday on the data showing a slowdown in the US labor market. The dollar held steady.

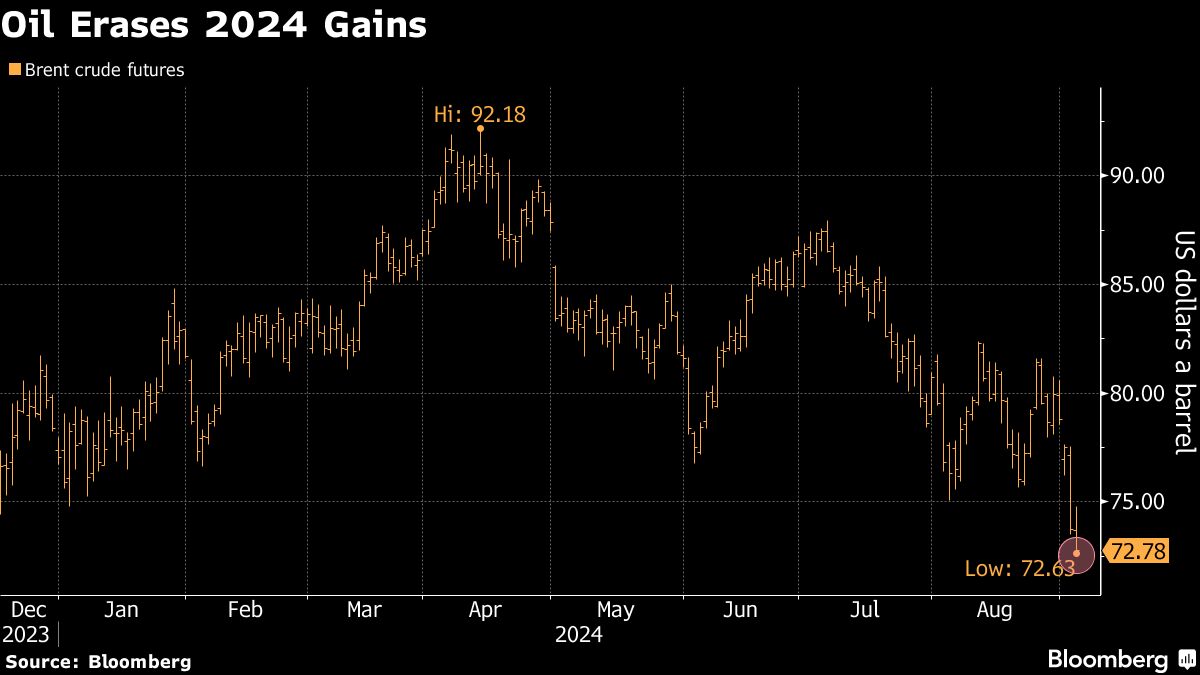

Iron ore slumped to trade near $90 a ton as China’s main steel industry group advised mills to be cautious in boosting output too quickly to avoid snuffing out a post-summer recovery. Brent futures were heading for the first day of gains in five, with OPEC+ getting closer to an agreement on delaying an increase in oil production.

Corporate Highlights:

-

Tiffany & Co., LVMH’s leading jewelry maker, is planning to downsize a flagship store of more than 12,000 square feet in Shanghai.

-

Nvidia, responding to a Bloomberg News report about the US Department of Justice sending out subpoenas as part of an antitrust probe, said it has been in contact with the government agency but hasn’t been subpoenaed.

-

Volvo Car AB scaled back its outlook as rising tariffs hurt some of its models made in China, a day after abandoning a target to only sell electric cars by 2030.

-

Police in China have detained five current and former employees of British drugmaker AstraZeneca Plc for questioning about potential illegal activities.

Key events this week:

-

Eurozone retail sales, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 6:06 a.m. New York time

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average were little changed

-

The Stoxx Europe 600 fell 0.1%

-

The MSCI World Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1093

-

The British pound was little changed at $1.3157

-

The Japanese yen was little changed at 143.62 per dollar

Cryptocurrencies

-

Bitcoin fell 2.1% to $56,825.68

-

Ether fell 2.4% to $2,395.17

Bonds

-

The yield on 10-year Treasuries advanced one basis point to 3.77%

-

Germany’s 10-year yield was little changed at 2.23%

-

Britain’s 10-year yield was little changed at 3.93%

Commodities

-

West Texas Intermediate crude rose 0.7% to $69.71 a barrel

-

Spot gold rose 0.8% to $2,515 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Chiranjivi Chakraborty.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel