Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that ‘Volatility is far from synonymous with risk.’ So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Intel Corporation (NASDAQ:INTC) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can’t easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company’s debt levels is to consider its cash and debt together.

Check out our latest analysis for Intel

What Is Intel’s Net Debt?

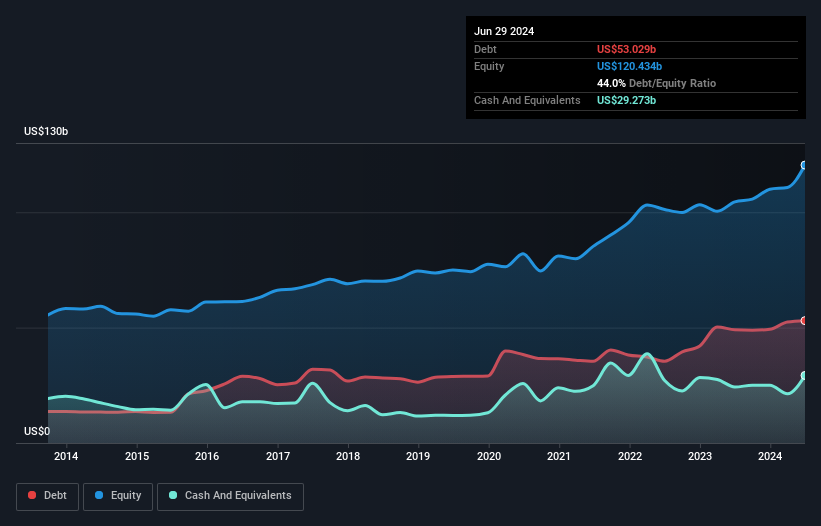

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Intel had US$53.0b of debt, an increase on US$49.0b, over one year. On the flip side, it has US$29.3b in cash leading to net debt of about US$23.8b.

How Strong Is Intel’s Balance Sheet?

The latest balance sheet data shows that Intel had liabilities of US$32.0b due within a year, and liabilities of US$53.7b falling due after that. Offsetting this, it had US$29.3b in cash and US$5.28b in receivables that were due within 12 months. So its liabilities total US$51.2b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its very significant market capitalization of US$84.1b, so it does suggest shareholders should keep an eye on Intel’s use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company’s debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Intel’s net debt to EBITDA ratio of about 2.2 suggests only moderate use of debt. And its strong interest cover of 1k times, makes us even more comfortable. Notably, Intel made a loss at the EBIT level, last year, but improved that to positive EBIT of US$509m in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Intel can strengthen its balance sheet over time. So if you’re focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don’t cut it. So it’s worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. During the last year, Intel burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Mulling over Intel’s attempt at converting EBIT to free cash flow, we’re certainly not enthusiastic. But at least it’s pretty decent at covering its interest expense with its EBIT; that’s encouraging. Once we consider all the factors above, together, it seems to us that Intel’s debt is making it a bit risky. Some people like that sort of risk, but we’re mindful of the potential pitfalls, so we’d probably prefer it carry less debt. There’s no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Intel is showing 3 warning signs in our investment analysis , you should know about…

At the end of the day, it’s often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It’s free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel