It is both alarming and disheartening to learn that Khyber Pakhtunkhwa (KP) is on the brink of being financially crippled, thanks to a decade-long borrowing spree under Pakistan Tehreek-e-Insaf’s (PTI) rule. The recent revelations of the province’s escalating debt are not just shocking—they paint a disturbing picture of the economic future of KP. If current projections hold, the province will be buried under a debt mountain of PKR 2,555 billion by 2030.

For a party that has long claimed to champion fiscal responsibility, PTI’s handling of KP’s finances raises serious concerns. What was the long-term vision behind plunging a resource-strapped province into such unprecedented levels of debt? The agreements made with international financial institutions, particularly the Asian Development Bank (ADB), show that PTI either underestimated or outright neglected the burden these loans would impose on future generations.

A Growing Burden: Was It Worth It?

The debt KP is set to carry isn’t just about the principal amount. Consider this: by the time these loans come due, the province will have paid an estimated PKR 355 billion in interest alone. This is money that could have been used to fund much-needed infrastructure, education, or health services. Instead, a significant portion of KP’s budget will be spent paying off interest—leaving little room for actual progress.

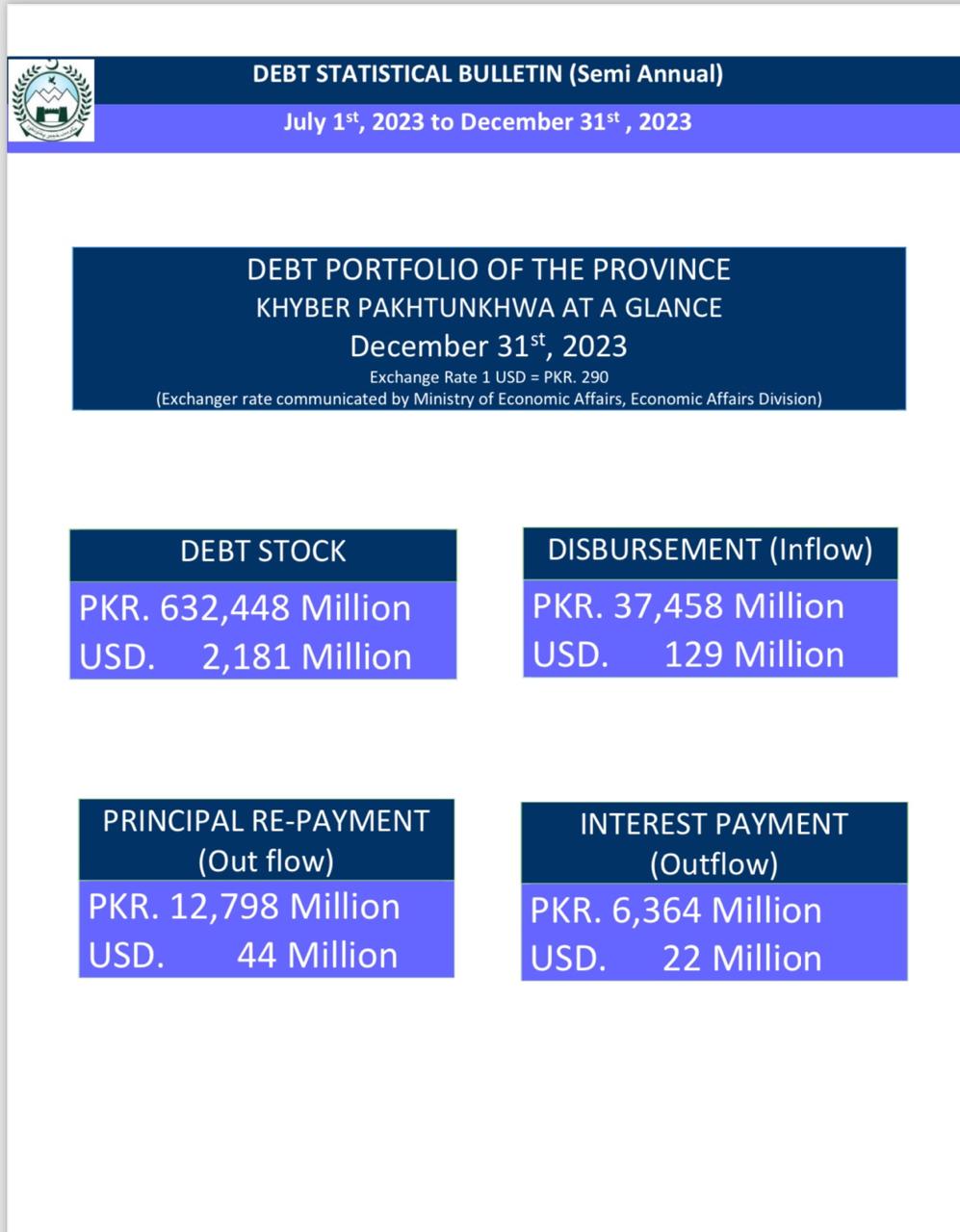

For a province already struggling with economic challenges, taking on such massive debt appears to have been a risky gamble, and it’s unclear if the returns will justify the cost. The current debt stands at PKR 632 billion, and with additional borrowing planned, this figure will only grow. By December 2024, it’s expected to balloon to PKR 725 billion. Where does this cycle end?

Dependency on Foreign Loans: A Recipe for Disaster

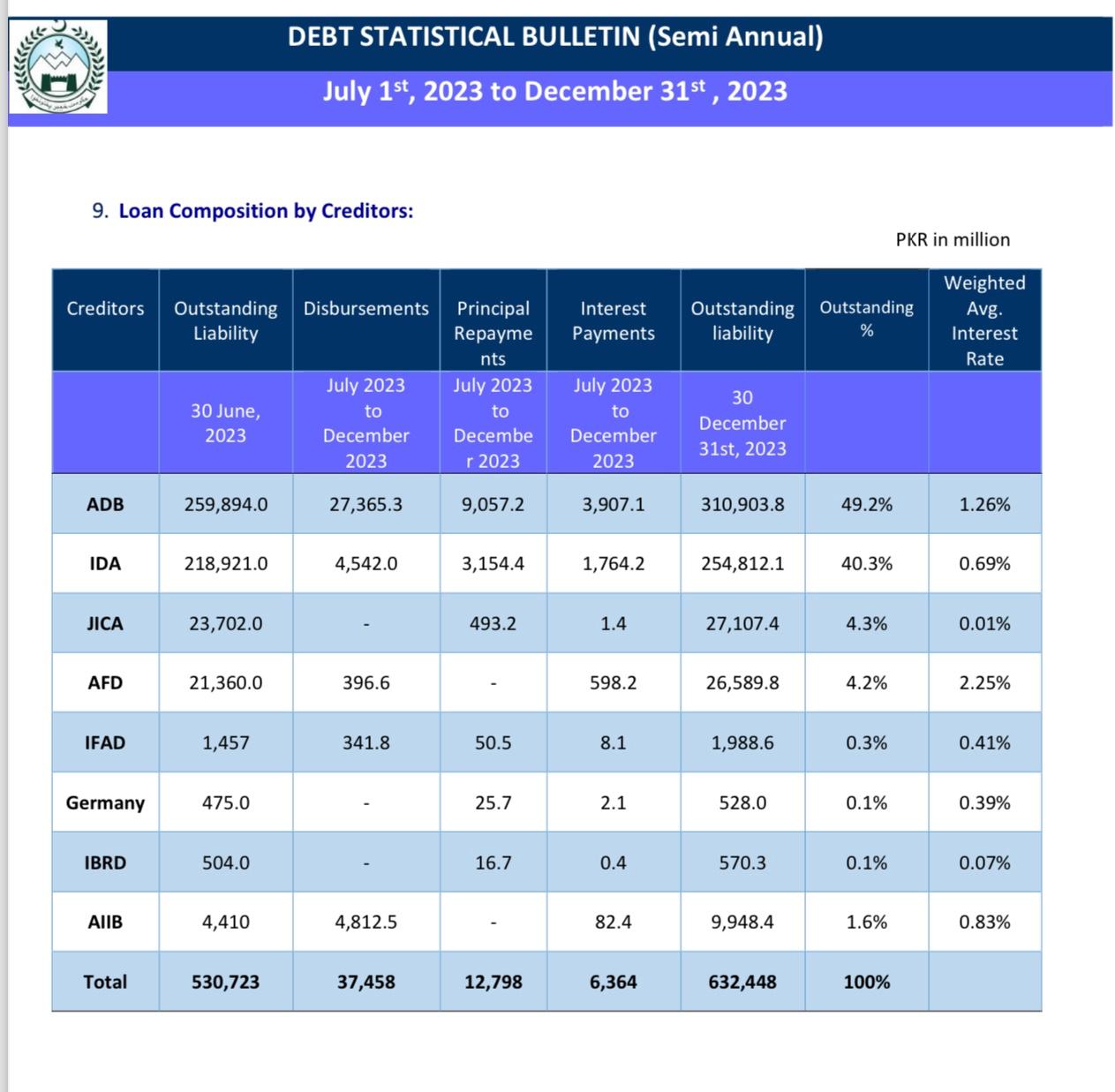

One of the most troubling aspects of this situation is how reliant KP has become on foreign loans to fund its development projects. The province has borrowed heavily from the ADB (PKR 310 billion), the International Development Association (IDA) (PKR 254 billion), and various other international organizations. These loans aren’t free money—they come with strings attached, and when those strings tighten, KP may find itself at the mercy of its creditors.

Was there no alternative? Could the province’s development projects not have been funded through other means? PTI’s financial policies seem to have leaned heavily on external borrowing, with little emphasis on generating internal resources. As a result, KP’s developmental progress is now shackled to the decisions of international financial institutions.

The Price of Short-Term Gains

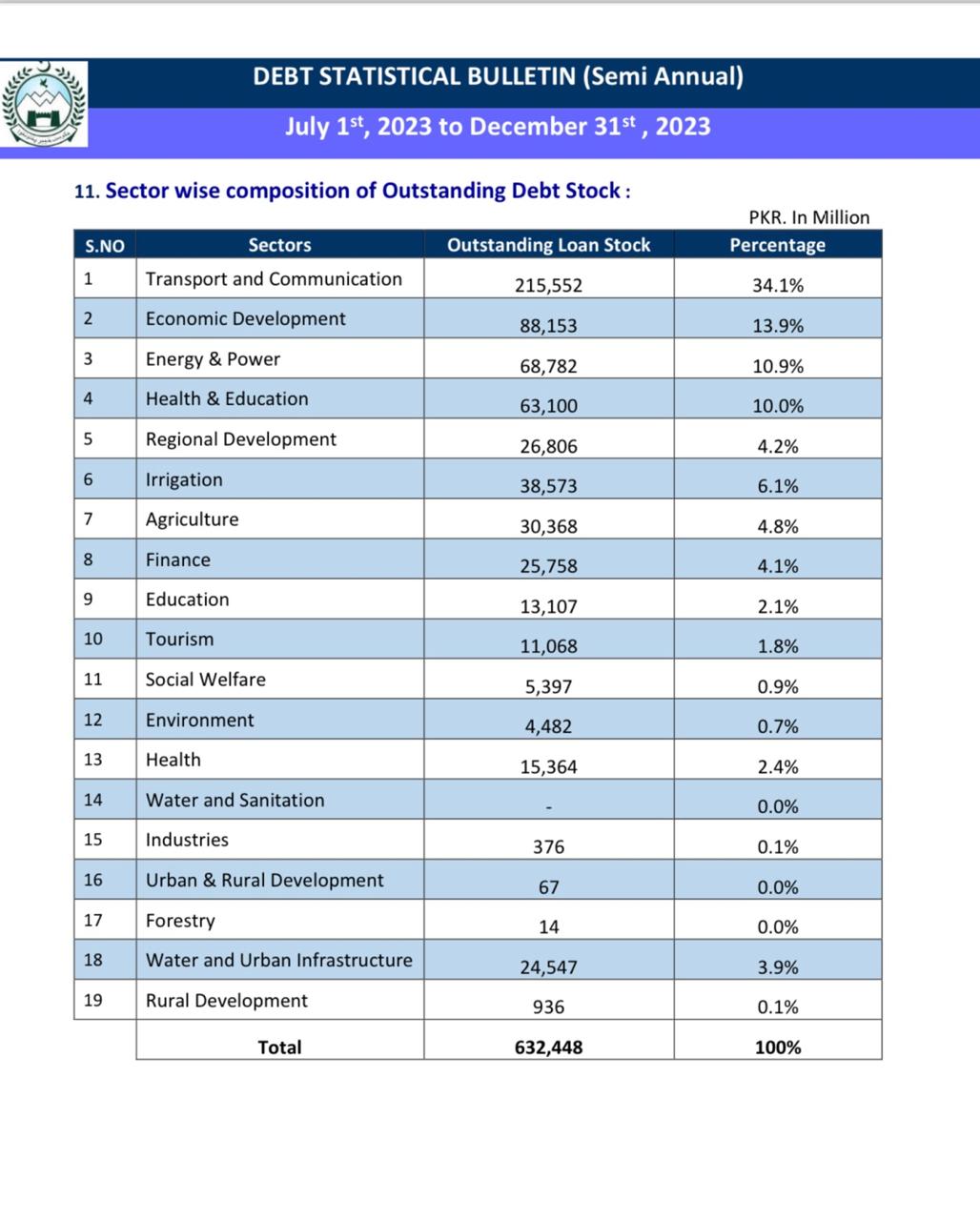

There’s no denying that KP has seen some development over the past decade. But at what cost? Much of the borrowing has been directed toward sectors like transport, communication, and infrastructure. While these are undoubtedly important, the question remains: is it sustainable to fund these projects with foreign debt?

With PKR 215 billion of loans directed toward transport and communication alone, it seems PTI has prioritized flashy development projects over long-term economic stability. These short-term gains may have been politically advantageous, but they have left KP’s financial future in jeopardy. As interest payments continue to rise, the province will be forced to divert funds away from essential services like health, education, and social welfare.

A Financial Time Bomb

By 2030, KP’s debt is projected to hit an astronomical PKR 2,555 billion. This is not just a number—it is a reflection of PTI’s governance approach, one that has prioritized borrowing over sustainable economic planning. The implications of this debt are clear: KP will be grappling with the consequences of this financial mismanagement for years to come.

What is even more concerning is that this debt comes at a time when the Pakistani rupee is rapidly losing value against the dollar. The falling currency means that repaying these loans, many of which are denominated in foreign currencies, will become even more burdensome. In other words, KP’s financial woes are set to worsen, not improve, in the coming years.

The Way Forward: Learning from Mistakes

As KP stands on the brink of financial collapse, it is crucial for future governments to learn from PTI’s mistakes. Borrowing isn’t inherently bad—many countries and provinces rely on loans to fund development. However, what KP desperately needs is a shift from borrowing for the sake of immediate progress to a long-term strategy focused on building internal economic resilience.

Instead of relying on foreign loans, KP should be looking for ways to generate revenue locally. Whether through boosting industry, reforming tax systems, or encouraging investment, the province needs to move away from its dependence on international financial institutions. Only then can it hope to break free from the cycle of debt and develop a truly sustainable economy.

The legacy PTI leaves behind in KP is a cautionary tale for future governments. It’s not enough to build roads and bridges if the cost is mortgaging the province’s future. KP deserves better—its people deserve better. As we move forward, it’s imperative that we prioritize fiscal responsibility, transparency, and, above all, a commitment to long-term economic growth over short-term political gains.