(Bloomberg) — European stocks and US equity futures struggled to advance ahead of key American jobs data that could clarify the path for interest rates. Oil prices extended their rally as traders tracked the escalation of hostilities in the Middle East.

Most Read from Bloomberg

Rising energy stocks helped Europe’s Stoxx 600 climb 0.2%. Contracts on the S&P 500 were flat. Treasuries were steady after selling off on Thursday, while an index of dollar strength was set for the biggest weekly gain in nearly six months amid trimmed wagers on aggressive US rate cuts.

While they keep a watchful eye over the geopolitical uncertainty, investors are also assessing signals on the health of the US economy, with the monthly payrolls report due on Friday. The unemployment rate is forecast to hold steady at 4.2% in September while payrolls are expected to rise by 150,000.

“Anything that would point to a stabilizing or re-acceleration of growth will force markets to re-consider the current aggressive pricing of interest rate cuts,” said Robert Tipp, chief investment strategist at PGIM Fixed Income.

According to Bank of America Corp. strategist Michael Hartnett, risk assets are likely to rally if the report is within the range of market expectations.

The addition of between 125,000 to 175,000 jobs last month would support a soft economic landing and keep bond yields in a range, sparking a risk-on trade, Hartnett wrote in a report.

A “blowout” jobs report showing greater than 225,000 payrolls and an unemployment rate of less than 4.1% would drive the 30-year Treasury yield above 4.5%, the strategist said. Meanwhile, jobs below 75,000 alongside an unemployment rate of above 4.3% would be “recessionary.”

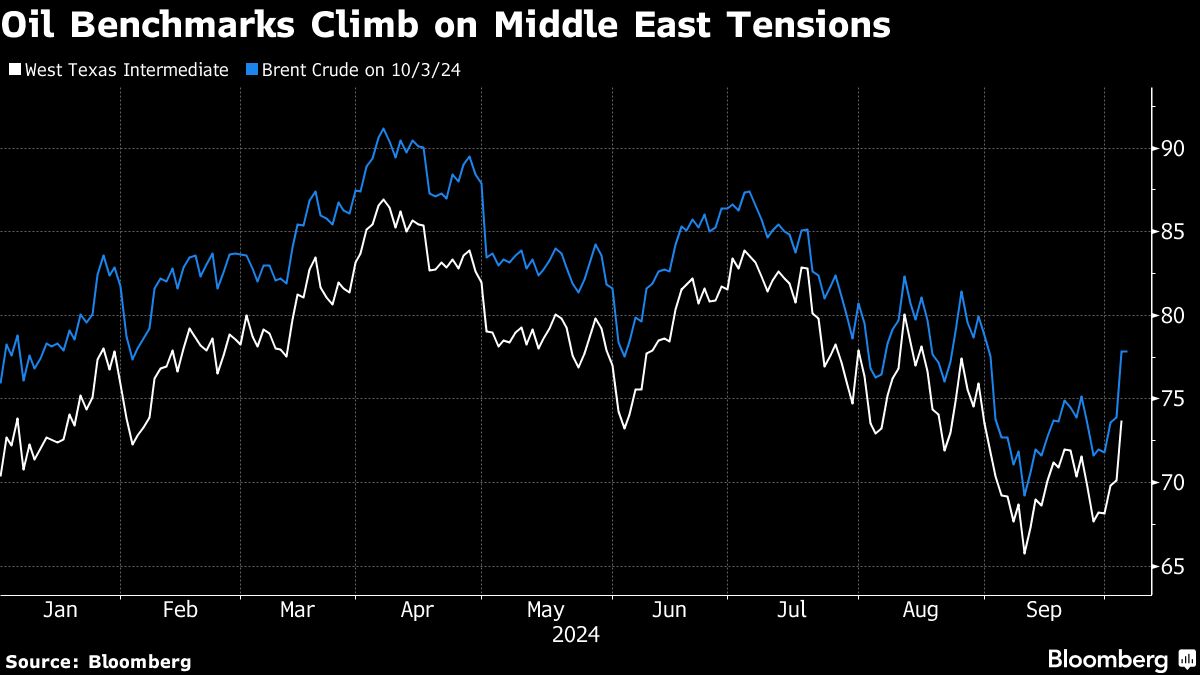

West Texas Intermediate and Brent crude moved higher after surging more than 5% on Thursday. The US and its allies warned of “uncontrollable escalation” in the Middle East after Israel carried out huge bombing raids overnight near Beirut airport aimed at Hezbollah commanders and facilities.

In individual stock moves, European shipping names slumped as US dockworkers agreed to end a three-day strike that had paralyzed trade on the East and Gulf coasts. Maersk A/S dropped 6.8%, while Hapag-Lloyd AG slumped 13%. The stocks had rallied on expectations the strike would lead to increased container rates.

Key events this week:

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 0.2% as of 10:21 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average were little changed

-

The MSCI Asia Pacific Index rose 0.3%

-

The MSCI Emerging Markets Index rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1021

-

The Japanese yen rose 0.3% to 146.44 per dollar

-

The offshore yuan fell 0.2% to 7.0635 per dollar

-

The British pound rose 0.2% to $1.3147

Cryptocurrencies

-

Bitcoin rose 1.2% to $61,486.21

-

Ether rose 1.8% to $2,383.14

Bonds

-

The yield on 10-year Treasuries was little changed at 3.85%

-

Germany’s 10-year yield advanced four basis points to 2.18%

-

Britain’s 10-year yield advanced four basis points to 4.06%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Divya Patil, Richard Henderson and Sagarika Jaisinghani.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel