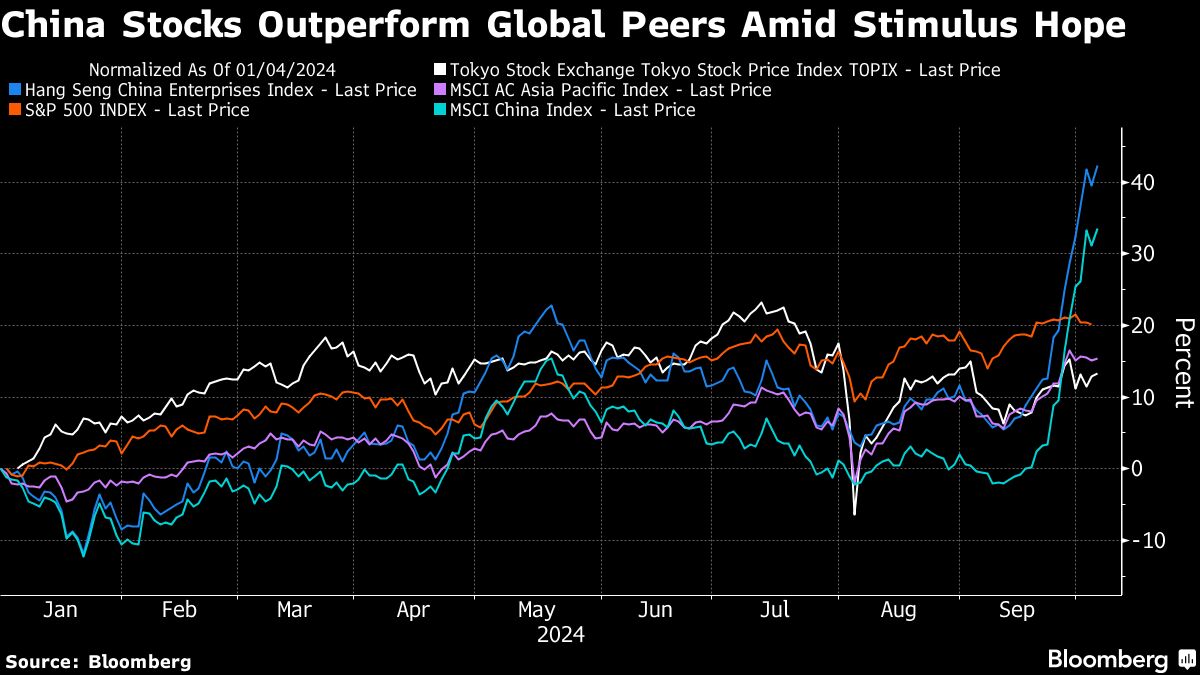

(Bloomberg) — Chinese stocks underperformed the rally that occurred while they were on holiday closure for a week, as investors counting on Beijing to produce more stimulus were underwhelmed. A key gauge in Hong Kong plunged the most in 16 years and European futures declined.

Most Read from Bloomberg

China’s benchmark CSI 300 opened up 11% as trading began after a weeklong holiday. With widely anticipated stimulus measures absent from a press conference in Beijing, the index pared gains to 2%, then rose again. A gauge of Chinese stocks in Hong Kong tumbled the most intraday since 2008 as some investors took profit and rotated to mainland shares.

Broader Asian equities dropped after Wall Street was dragged down by a tech selloff, geopolitical angst and bets on a smaller Federal Reserve rate cut. MSCI’s Asia-Pacific share gauge dropped the most in two months, the Treasury curve steepened and oil fell.

A briefing by China’s National Development and Reform Commission failed to deliver more stimulus measures after policy announcements before the Golden Week holiday break sent shares in China and Hong Kong surging. From JPMorgan Asset Management to HSBC Global Private Banking, numerous investors questioned the sustenance of that rally.

“While the policy tone is still certainly indicating a supportive tone, the limited new measures appear to be disappointing markets for now,” said Lynn Song, Greater China chief economist at ING Bank NV. “Moving forward, the market trend will likely depend on the speed and strength of further policy follow-up from other ministries.”

At the NDRC briefing, Chinese officials said they were confident of reaching economic targets this year and promised further support for growth, although they held back from unleashing more stimulus. They said that China would continue to issue ultra-long sovereign bonds next year to support major projects and invest 100 billion yuan ($14 billion) on key strategic areas.

“I wouldn’t be surprised if we see bigger volatility around events like the NDRC now, because expectations have been raised,” said Phillip Wool, head of portfolio management at Rayliant Global Advisors. “I do believe policymakers are taking a different tack now, and that’s our focus for the medium- to longer-term.”

There’s some convergence in the markets with investors rotating money from Hong Kong to China, benefiting mainland shares, said Marvin Chen, a Bloomberg Intelligence strategist.

Invesco Ltd. and Nomura Holdings Inc. are also among those viewing the recent rebound with skepticism and waiting for Beijing to back up its stimulus pledges with real money.

An overheating of the A-share market and the Chinese government’s delivery on its recently announced policy stimulus are among the risks investors should watch amid the Chinese stock market rally, according to Morgan Stanley.

The S&P 500 fell 1% on Monday after notching a four-week winning run. In the wake of Friday’s solid jobs data, Treasuries continued to drop — with the 10-year yield topping 4%. The Fed is “well positioned” to pull off a soft landing for the economy, New York Fed president John Williams told the Financial Times in an interview.

“Friday’s strong jobs report not only appeared to kill any chance of a 50-basis-point rate cut in November, it kickstarted chatter about the Fed leaving rates unchanged if economic data continues to come in hotter than expected,” said Chris Larkin at E*Trade from Morgan Stanley. “But as last week showed, geopolitics can’t be ignored.”

The crisis in the Middle East continues to unnerve investors, with fighting escalating Monday on multiple fronts after a year of war. The Israel Defense Forces said it intercepted most of a barrage of rockets fired toward Tel Aviv by Hamas and other Iran-backed groups. Brent crude soared to its highest price since August as speculation increased that Israel may attack Iran’s oil infrastructure. West Texas Intermediate rose early Tuesday.

To Dave Sekera at Morningstar, if there is any further geopolitical escalation, that would potentially spur the risk-off trade — with growth shares underperforming value ones.

“Typically, in a risk-off trade, you’re going to see rotation into defense stocks, but I’d be careful if you’re an investor today,” he said. “Some of the defensive sectors today are already overvalued. Unlike a typical risk-off trade, I think oil stocks would go up.”

Key events this week:

-

Fed’s Raphael Bostic, Susan Collins, Philip Jefferson and Adriana Kugler speak, Tuesday

-

Fed minutes, Wednesday

-

Fed’s Lorie Logan, Raphael Bostic, Austan Goolsbee and Mary Daly speak, Wednesday

-

US initial jobless claims, CPI, Thursday

-

Fed’s John Williams and Thomas Barkin speak, Thursday

-

JPMorgan, Wells Fargo kick off earnings season for the big Wall Street banks, Friday

-

US PPI, University of Michigan consumer sentiment, Friday

-

Fed’s Lorie Logan, Austan Goolsbee and Michelle Bowman speak, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 2:01 p.m. Tokyo time

-

Japan’s Topix fell 1.4%

-

Australia’s S&P/ASX 200 fell 0.2%

-

Hong Kong’s Hang Seng fell 5.2%

-

The Shanghai Composite rose 5%

-

Euro Stoxx 50 futures fell 0.8%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0986

-

The Japanese yen was little changed at 148.12 per dollar

-

The offshore yuan rose 0.1% to 7.0612 per dollar

Cryptocurrencies

-

Bitcoin fell 0.5% to $62,703.24

-

Ether fell 0.1% to $2,438.26

Bonds

-

The yield on 10-year Treasuries declined two basis points to 4.00%

-

Japan’s 10-year yield was little changed at 0.925%

-

Australia’s 10-year yield advanced 10 basis points to 4.18%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Shery Ahn, April Ma, Jason Scott and Qizi Sun.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel