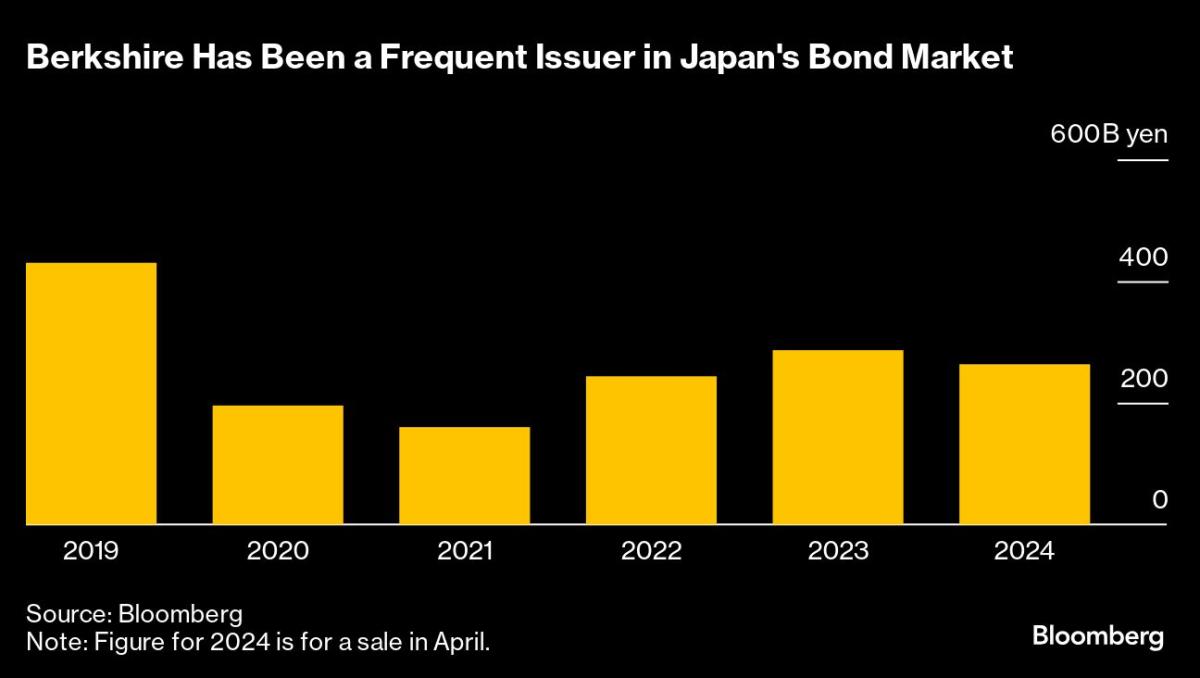

(Bloomberg) — Warren Buffett’s Berkshire Hathaway Inc. is poised to sell multi-tranche yen bonds on Thursday amid growing speculation whether the legendary investor is increasing his exposure to Japanese assets.

Most Read from Bloomberg

The firm marketed a seven-part bond deal this week with tenors spanning three to 30 years. All maturities except the three year tranche offer higher premiums relative to its corresponding yen-note offering in April. A 10-year deal would offer a spread of 82 basis points over mid swaps compared with 71 basis points in April, while a 20-year note would carry a premium of 91 basis points versus 78 basis points in the last yen debt deal.

The billionaire’s fundraising in Japan is closely watched by equity-market investors because Buffett has used yen funds raised in the bond market to purchase holdings in Japanese companies. His stake increases in the five major trading houses helped drive up the Nikkei 225 Stock Average to a record high earlier this year. Should Berkshire’s investment choices widen to other stocks such as banks, insurers and shippers, as some analysts speculate, that may lead to more gains for the Japanese market.

The deal was also a key test of investor demand for yen-denominated bonds. The wider premiums in long-term debt reflect investors’ caution about Japan’s interest-rate environment.

The Bank of Japan is widely expected to hold its policy settings steady when it next sets policy on Oct. 31., and some economists pushed back their forecasts for a year-end hike after new Prime Minister Shigeru Ishiba said last week that conditions are inappropriate for such action.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel