In the last week, the Indian market has been flat, but it is up 39% over the past year with earnings forecast to grow by 17% annually. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In India

|

Name |

Insider Ownership |

Earnings Growth |

|

Archean Chemical Industries (NSEI:ACI) |

22.9% |

34% |

|

Kirloskar Pneumatic (BSE:505283) |

30.3% |

30.1% |

|

Jupiter Wagons (NSEI:JWL) |

10.8% |

27.4% |

|

Dixon Technologies (India) (NSEI:DIXON) |

24.6% |

31.3% |

|

Paisalo Digital (BSE:532900) |

16.3% |

24.8% |

|

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) |

10.4% |

32.3% |

|

Rajratan Global Wire (BSE:517522) |

18.3% |

35.8% |

|

KEI Industries (BSE:517569) |

19.2% |

21.9% |

|

Pricol (NSEI:PRICOLLTD) |

25.5% |

24% |

|

Aether Industries (NSEI:AETHER) |

31.1% |

45.8% |

Let’s take a closer look at a couple of our picks from the screened companies.

Simply Wall St Growth Rating: ★★★★★★

Overview: Dixon Technologies (India) Limited provides electronic manufacturing services both domestically and internationally, with a market cap of ₹893.57 billion.

Operations: The company’s revenue is primarily derived from its Mobile & EMS Division at ₹143.16 billion, Consumer Electronics & Appliances at ₹41.21 billion, Home Appliances at ₹12.51 billion, and Lighting Products at ₹7.92 billion.

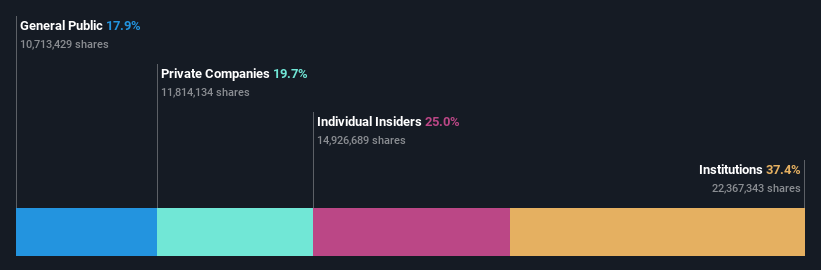

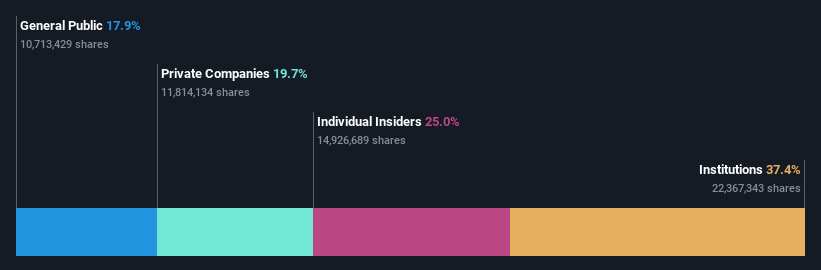

Insider Ownership: 24.6%

Revenue Growth Forecast: 23.9% p.a.

Dixon Technologies (India) is experiencing strong growth, with earnings projected to increase by 31.3% annually, outpacing the Indian market’s 17.3%. Revenue is expected to grow at 23.9% per year, significantly above the market average of 10.1%. The company reported a substantial rise in net income for Q1 2024 to ₹1.34 billion from ₹688 million a year earlier. High insider ownership aligns management interests with shareholders, though recent insider trading data is unavailable.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Entero Healthcare Solutions Limited trades pharmaceutical and surgical products to retail pharmacies, hospitals, healthcare product manufacturers, and clinics in India, with a market cap of ₹57.36 billion.

Operations: The company generates revenue of ₹41.32 billion from its trading operations in pharmaceutical and surgical products.

Insider Ownership: 15.8%

Revenue Growth Forecast: 30.9% p.a.

Entero Healthcare Solutions shows robust growth potential, with earnings forecasted to rise by 53.3% annually, surpassing the Indian market’s 17.3%. Revenue is expected to grow at 30.9% per year, well above the market average of 10.1%. Recent Q1 results revealed revenue of ₹11.10 billion and net income of ₹200.8 million, indicating significant year-on-year improvement. Insider trading activity has been minimal recently, with more shares bought than sold but not in substantial volumes.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PVR INOX Limited is a theatrical exhibition company involved in the exhibition, distribution, and production of movies in India and Sri Lanka with a market cap of ₹157.82 billion.

Operations: The company’s revenue segments include Movie Exhibition, which generated ₹59.48 billion.

Insider Ownership: 10.1%

Revenue Growth Forecast: 12.1% p.a.

PVR INOX is expanding aggressively, recently opening new cinemas in Coimbatore and Mohali, enhancing its footprint in South and North India. Despite current financial challenges, including a net loss of ₹1.79 billion for Q1 2024, the company is expected to achieve profitability within three years. Revenue growth is forecasted at 12.1% annually, exceeding the Indian market average of 10.1%. Insider ownership remains significant with no substantial insider trading activity reported recently.

Make It Happen

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:DIXON NSEI:ENTERO and NSEI:PVRINOX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel