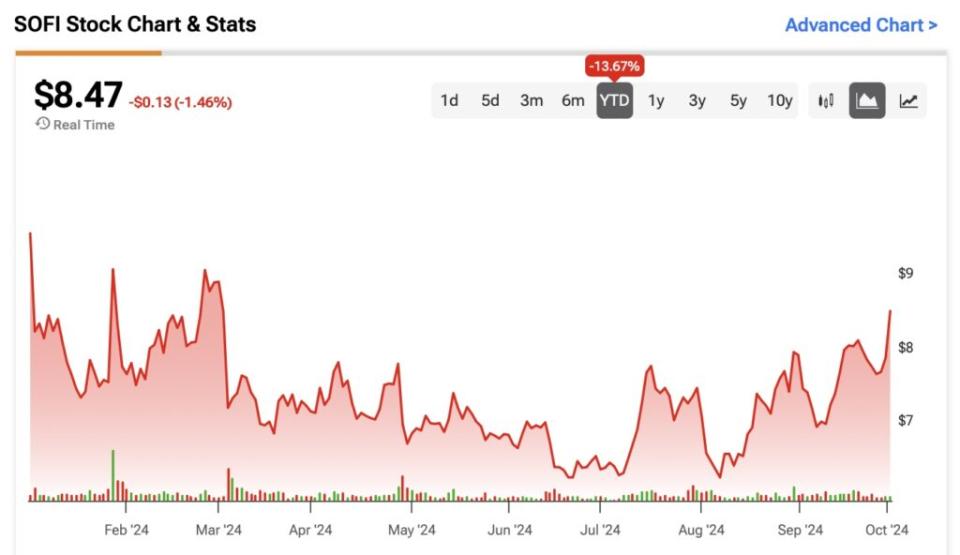

SoFi Technologies (SOFI) has positioned itself as one of the most exciting fintech companies, offering a wide range of services and products that many traditional banks struggle to match. While the stock has declined by about 10% this year, I believe this decline is largely due to investors’ short-term preoccupation with challenges, particularly the high-interest rate environment that is now beginning to change. In this article, I will outline five key reasons that support my bullish view of SOFI stock, especially at current levels.

Strong Revenue Growth and Diversification

The first tenet of my SoFi investment thesis is its impressive top-line growth. In its most recent Q2 results, reported on July 30, SoFi delivered a strong 22% year-over-year increase in adjusted net revenue, reaching a record $597 million. Furthermore, its financial services and technology platform revenue grew by 46% year-over-year and now comprises 45% of total adjusted net revenue, up from just 38% a year ago. This diversification away from lending and toward financial services and technology platforms boosts SoFi’s growth potential and reduces its reliance on a single revenue stream, making the company more resilient.

Additionally, SoFi has carved out a niche in financial services by targeting a high-income, young demographic often underserved by traditional banks. While most large banks offer limited specialized services, SoFi provides a comprehensive range of offerings, from student loans to estate planning, allowing it to cater to the specific needs of this demographic.

SoFi’s Improving Profitability

In addition to strong top-line growth, SoFi has been making significant strides in profitability. The fintech has posted three consecutive quarters of profitability, with $17 million of GAAP net income for the 3 months ending in June 2024, compared to a $40 million loss in the year prior. This meaningful improvement drives investor confidence and demonstrates that SoFi’s business model is sustainable and capable of scaling profitably over time.

Moreover, SoFi’s focus on product development, along with its commitment to operational efficiency, is poised to drive long-term growth and profitability. Wall Street shares this optimism, projecting robust earnings growth over the next 3 years from $0.11 EPS for 2024 to $0.64 of EPS in 2027. This underscores the company’s strong future prospects.

Valuation in Line with Future Growth Prospects

The company’s current valuation is also attractive relative to growth expectations. Currently, SoFi trades at a seemingly stretched forward P/E ratio of 78x. However, if SoFi does reach EPS of $0.64 by 2027, that multiple drops to 13.4x. That valuation is much closer to those of traditional banks, which typically trade at earnings multiples between 11x and 13x.

That said, since SoFi’s business is far from mature, and earnings are just getting started, the current P/E ratio premium makes sense.

Member Growth and Digital-First Strategy

My fourth bullish point is in regards SoFi’s rapid growth of its member base. In the second quarter of 2024, the company added 643,000 new members, representing a 41% year-over-year increase, bringing the total to 8.77 million members. SoFi’s digital-first approach also eliminates the need for brick-and-mortar locations and helps reduce costs while meeting consumer demand for convenient, tech-driven financial services. This strategy positions SoFi well to capitalize on the continued shift toward online banking and fintech innovation.

Resilient Lending Business with Prudent Risk Management

The fifth argument underlying my bullish view of SoFi is potential macroeconomic relief. Management has been concerned over the past few quarters that higher interest rates could dampen economic activity, leading to job losses and missed loan payments. Consequently, management aimed to reduce lending, initially forecasting a decline in revenue of at least 5% for 2024.

However, as the Fed cut interest rates by half a percentage point a few weeks ago, management’s outlook will likely improve. SoFi may have weathered the worst of the rising interest rate cycle. Lower interest rates typically improve economic activity, reducing the risk of loan losses.

Despite diversification efforts, SoFi’s balance sheet remains heavily concentrated in lending, with a loan-to-asset ratio of approximately 77.4%. Management’s caution was justified, as an increase in defaults could seriously threaten results. Notably, the 90-day personal loan delinquency rate fell to 64 basis points in the most recent quarter, down from 72 basis points in Q1, indicating a potential peak in delinquencies.

Is SOFI a Buy, According to Wall Street Analysts?

Despite the bullish arguments presented in this article, Wall Street remains cautious on SOFI stock. Of the 14 analysts covering the stock, only five recommend a Buy, six rate it as a Hold, and three suggest a Sell, resulting in an overall Hold consensus according to TipRanks. The average SOFI stock price target is $8.27, almost 5% lower than the recent market price.

Conclusion

In summary, despite short-term challenges and cautious analyst sentiment, SoFi’s strong revenue growth, improving profitability, and strategic diversification make a compelling case for growth at a reasonable valuation for long-term investors. With a rapidly expanding member base and a digital-first strategy, I believe the company is well-positioned to thrive in the evolving fintech landscape. This warrants a bullish sentiment for SOFI stock at current prices.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel