Super Micro Computer (NASDAQ: SMCI) is a pretty complicated investment right now. On one hand, it makes server components and entire servers that are in massive demand thanks to artificial intelligence (AI). On the other hand, there are accounting malpractice accusations and a Department of Justice (DOJ) probe that is investigating those concerns.

Right now, the bear case outweighs the bull one, which is why shares of Supermicro (as the company is known) are down 60% from their all-time high set in March. Furthermore, the company has recently undergone a 10-for-one stock split, a catalyst that usually causes a stock price to rise, not fall.

So, is this a stock to stay away from? Or is it a chance to own an undervalued and potentially massive winner?

Supermicro’s product is at risk of being commoditized

Let’s start with the business itself — and there may be other concerns to consider here, too. The space for Supermicro’s products is rather saturated today as a result of many competitors.

However, Supermicro has one key advantage: It has the most energy-efficient technology available. With energy being a significant operating cost for these servers, companies are considering the total cost of operation for them. This is pushing a massive amount of demand Supermicro’s way.

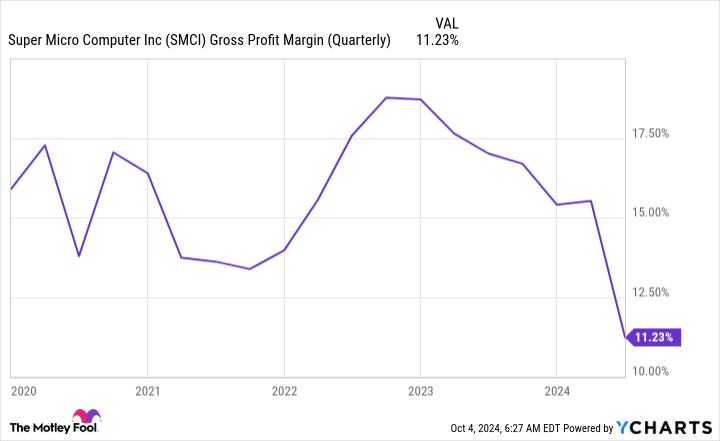

However, this isn’t without its own problems. Supermicro’s gross margin has collapsed due to its new liquid-cooled technology, as its supply chain has been bottlenecked for key components in these new systems. Management expects its gross margins to increase throughout fiscal 2025 (ending June 30, 2025), driven by its customer mix and manufacturing efficiencies as it scales up manufacturing in Malaysia and Taiwan, which should alleviate the bottlenecks it’s currently experiencing.

While this may be true, something else could be happening here. When a product becomes commoditized, companies that make it have to start cutting margins to compete. This could be happening with Supermicro’s business, which wouldn’t bode well for the company, even if it has best-in-class products.

This will be an important trend to watch over the next year as a low gross margin could break the Supermicro investment thesis.

Accounting malpractice allegations have triggered a government probe

Then there are the allegations and government probe. Well-known short seller Hindenburg Research released a report in late August alleging account malpractice at Supermicro, something the Securities and Exchange Commission already fined Supermicro $17.5 million for in 2020. While Supermicro’s management has denied these allegations, it didn’t do itself any favors when it announced it was delaying filing its end-of-year form 10-K with the SEC the day after Hindenburg’s report was published due to assessing “internal controls over financial reporting.”

It’s worth remembering that Hindenburg is a short seller, and so it benefits when the stock price falls. However, these allegations were serious enough that the DOJ initiated a probe into Supermicro to determine whether they had merit. It will be some time before we know the results of this investigation, so investors have a tough choice to make.

I wouldn’t blame anyone for throwing Supermicro into the “too hard to understand” pile. There’s no shame in this conclusion. One of the greatest investors of all time, Warren Buffett, often does this with businesses he doesn’t understand. With shrinking gross margins and an ongoing DOJ probe, there are certainly a lot of negatives surrounding Supermicro.

But there are some positives too. In fiscal 2025 (ending June 30, 2025), Supermicro expects its revenue to grow between 74% and 101% year over year. That’s massive growth, yet the stock is priced at a dirt cheap level.

At just 14.2 times forward earnings, Supermicro may be one of the cheapest companies you’ll ever find that’s posting growth rates like that. So, if Supermicro’s management is right and it improves its gross margin and delivers strong growth throughout FY 2025, the stock has massive upside, as it’s far below where the S&P 500 trades (at 23.7 times forward earnings).

I think there’s enough of a compelling investment thesis here that I bought the dip on the stock. However, I only let it take up around 1% of my portfolio, as there’s a lot of risk involved. Supermicro is all about risk tolerance and management. If you’re not OK with this stock losing money on the potential for strong gains, there are still plenty of other AI stocks that are great picks.

But there’s a strong chance this stock could double — if it works out some of its flaws.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Keithen Drury has positions in Super Micro Computer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Super Micro Computer: Is This Stock-Split a Buying Opportunity or a Trap? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel