Landlords look set to be exempt from Rachel Reeves’s capital gains tax (CGT) raid after Telegraph Money campaigned for Labour to end its war on property investors.

In a victory for this newspaper, second homeowners and buy-to-let investors will be spared any rises to the levy which instead will target shares and other assets.

It comes after months of uncertainty over how the Chancellor would raise billions in taxes at the Budget, leading to fears landlords would be hit with higher CGT bills.

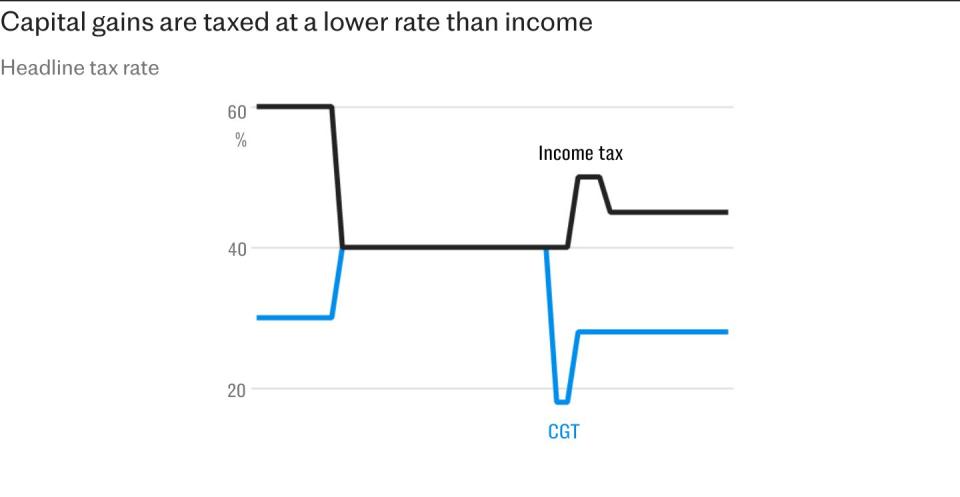

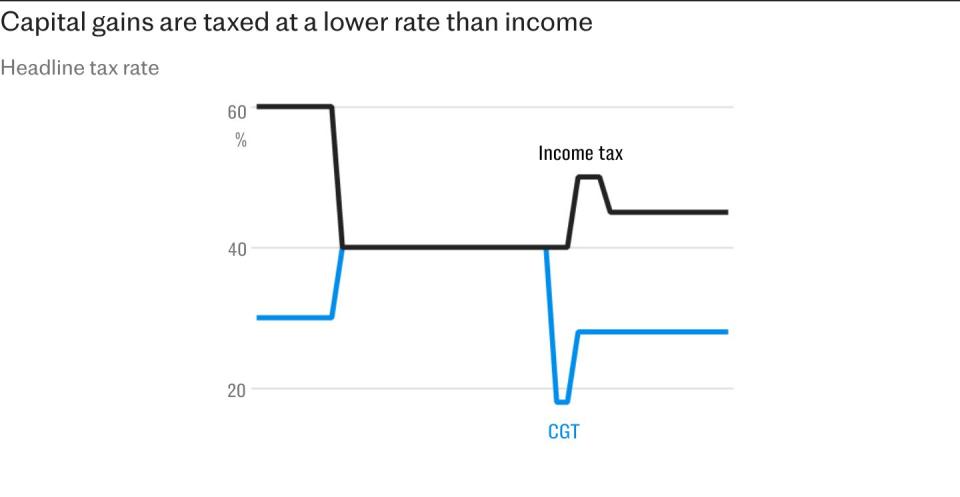

Reports previously suggested the tax could be increased in line with income levies which could have forced higher-earning property investors to hand over as much as 45pc of their profits on homes to the taxman.

However, sources told The Times on Wednesday night that a rise in CGT would apply only to the sales of shares and other assets while second homes will be exempt.

It means the CGT rate paid by these homeowners will remain untouched at 24pc for higher-rate taxpayers.

Reeves is instead poised to raise the current 20pc rate levied on the sale of shares and could target other assets, while some reliefs in the current system are also expected to be axed.

The move is expected to raise an amount in the “low billions”, a government source told the newspaper.

When the last government cut the rate on second homes from 28pc to 24pc in its final budget, the Office for Budget Responsibility said that doing so would in fact raise almost £700m because the number of property transactions would increase.

Revenues from capital gains tax can fluctuate widely because changes in the behaviour of a very small number of people can have a large impact.

Just 12,000 people pay two thirds of the £15bn a year raised from capital gains tax.

HMRC has estimated that increasing capital gains tax by 10 points would reduce Treasury revenues.

“Very large tax rate rises can reduce exchequer yield due to taxpayer behavioural impacts,” it said.

The Institute for Fiscal Studies has said that any increases in capital gains tax should be accompanied by reforms to the system, such as by charging the levy on assets after people die.

Just 12,000 people pay two-thirds of the £15bn a year raised from capital gains tax.

The Telegraph has heard from dozens of buy-to-let investors planning to quit the property market altogether amid the threat of a tax raid and reams of new regulations under the Labour government.

There are signs an exodus of landlords has already begun, increasing demand for housing and driving up rents for tenants. Rightmove figures show that 18pc of homes currently on the market are former rental properties, compared with just 8pc in 2010.

A Conservative spokesman told The Telegraph: “The truth is that during the election we repeatedly warned that Labour’s sums didn’t add up and that they were planning to raise taxes.

“The real scandal is that despite planning these tax rises all along, they didn’t have the courage to front up to it to the public during the election campaign.”

More than half of all capital gains relates to the sale of shares, while just 12pc is from the sale of property.

Last month Lord Wolfson, the chief executive of Next, sold £29m of his shares in the homewares giant, leading City analysts to speculate that the sell-offs were an attempt to sell them before any raid.

Sir Keir Starmer, the prime minister, has signalled that the Government will increase capital gains tax but rejected reports it could rise to as much as 39pc.

He said that the suggestions of such a big rise were “wide of the mark”.

It comes as Ms Reeves prepares to launch the biggest Budget tax raid in history in her maiden Budget later this month.

It will involve as much as £35bn of tax rises – the most on record in cash terms – as she protects her commitment to ending “austerity” and attempts to ensure departments avoid real-terms cuts in spending.

There is also speculation that the budget will include the first increase in fuel duty for 13 years.

Ministers have also refused to rule out raising employers national insurance in a move that is set to raise significant sums.

Critics claim raising employer NICs would breach the spirit of Labour’s manifesto- which pledged not to raise income tax, national insurance or VAT.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel