(Bloomberg) — Asian equities rose as investors digested China’s better-than-expected economic data and a brightened outlook for chipmakers following Taiwan Semiconductor Manufacturing Co.’s earnings.

Most Read from Bloomberg

Shares in China and Hong Kong extended gains after the central bank gave details for a stock buyback program. Earlier, data also showed that the nation’s latest gross domestic product, industrial production and retail sales figures beat estimates on a year-over-year basis. Shares in Japan climbed, helped along by a weaker yen.

TSMC jumped as much as 6.3% in opening trade, following a sharp rally Thursday after an upward revision of its 2024 revenue target. A gauge of the region’s semiconductor makers rose as much as 3.7%.

The chipmakers’ gains helped lift an Asian stocks gauge and placed the benchmark on track for its first daily advance since last week. US futures were flat after the S&P 500 retreated from an intraday record Thursday to end the session little changed. Australian and South Korean shares fell.

“The earnings revision trend is still very positive,” Kinger Lau, chief China equity strategist for Goldman Sachs, said on Bloomberg Television. “The large companies — Tencent, Alibaba — are still receiving earnings revisions. We are starting to see that broadening out to the financial sector, banks, brokers — given the strong performance in the equity market.”

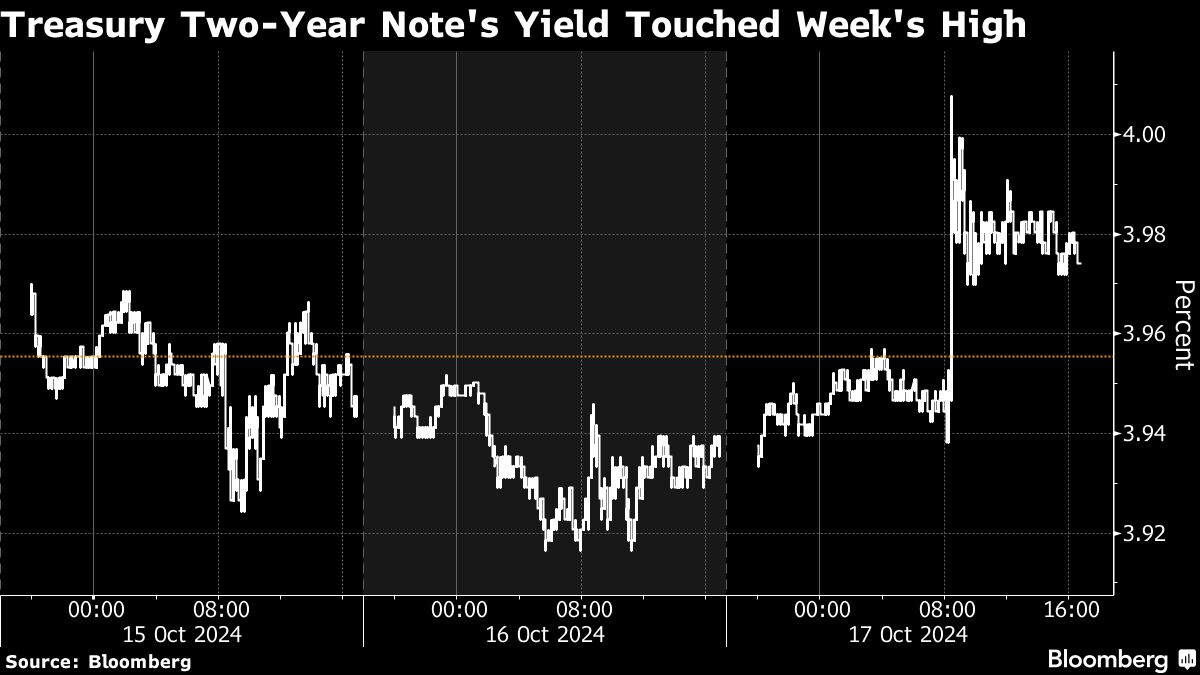

Treasuries steadied after heavy selling on Thursday, when new signs of vigor in the US economy led traders to trim expectations for rate cuts. Swaps traders further reduced bets on Federal Reserve rate cuts in the remaining two meetings of the year, and an index of dollar strength rose for a fourth session to a level not seen since early August. Australian and New Zealand yields climbed in early Friday trading, tracking the moves.

The shift in forecasts reflected robust US retail sales in September that exceeded expectations, illustrating resilient consumer spending that continues to power the economy. The data followed a blowout jobs report and a hotter-than-estimated consumer inflation print released earlier this month that only reinforced the view the US is nowhere near a recession.

“There’s a narrow path toward a Fed pause in November, but it would likely require every notable economic report between now and then indicating a stronger-than-assumed US economy,” said Matthew Weller at Forex.com and City Index. “Regardless of what the Fed does in November though, the projected path for interest rates looking out into 2025 and beyond is higher than it’s been in weeks.”

Elsewhere in the region, headline inflation in Japan rose 2.5% as expected. The yen was moderately stronger after passing the psychological level of 150 per dollar Thursday, bringing the risk of official intervention back into focus.

In a statement Friday, China’s central bank said it has set up a relending mechanism for 21 national banks to issue loans for the purpose of share buybacks. The initial quota for the relending is 300 billion yuan with a rate of 1.75% for one year maturity, according to the statement.

US Economy

A string of stronger-than-estimated data points sent the US version of Citigroup’s Economic Surprise Index to the highest since April. The gauge measures the difference between actual releases and analyst expectations.

The retail sales data released Thursday “highlight undeniable strength across the economy,” said Ellen Zentner at Morgan Stanley Wealth Management. “Strong data will encourage some pushback from Fed participants to cutting again in November, but Chair Jerome Powell is unlikely to be swayed from forging ahead with steady, quarter-point moves.”

In commodities, gold climbed to a fresh record amid ongoing tensions in the Middle East, while West Texas Intermediate, the US crude price, edged higher to trade around at almost $71 per dollar.

Key events this week:

-

China GDP, Friday

-

US housing starts, Friday

-

Fed’s Christopher Waller, Neel Kashkari speak, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 11:08 a.m. Tokyo time

-

Japan’s Topix rose 0.2%

-

Australia’s S&P/ASX 200 fell 0.8%

-

Hong Kong’s Hang Seng rose 0.4%

-

The Shanghai Composite fell 0.3%

-

Euro Stoxx 50 futures fell 0.1%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0836

-

The Japanese yen was little changed at 150.06 per dollar

-

The offshore yuan was little changed at 7.1338 per dollar

Cryptocurrencies

-

Bitcoin rose 1.4% to $67,850.85

-

Ether rose 1.4% to $2,634.13

Bonds

-

The yield on 10-year Treasuries was little changed at 4.09%

-

Japan’s 10-year yield advanced 1.5 basis points to 0.975%

-

Australia’s 10-year yield advanced six basis points to 4.31%

Commodities

-

West Texas Intermediate crude rose 0.4% to $70.95 a barrel

-

Spot gold rose 0.5% to $2,706.14 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel