(Bloomberg) — Donald Trump’s rising presidential prospects rippled through global markets on Wednesday, with US stock futures rallying, Treasury yields jumping and the dollar surging the most since March 2020.

Most Read from Bloomberg

S&P 500 futures climbed 1.8%, 10-year yields rose 14 basis points to a four-month high of 4.41% and Bitcoin spiked to a record – moves that reflect the Republic nominee being on the cusp of recapturing the White House. Trump claimed victory in an address to supporters as the latest results showed he won both Pennsylvania and Georgia, and Republicans gained control of the US Senate.

The Bloomberg Dollar Spot Index was up 1.4%. The Mexican peso slumped 2.6%, while the Japanese yen and the euro slid at least 1.6%. Contracts on the Russell 2000 Index added 4.6%. Smaller companies with typically domestic operations are seen as potential gainers in a Republican win, given the party’s protectionist stance. Trump Media & Technology Group Corp. surged in trading on Robinhood Markets Inc.’s 24-hour platform.

Hong Kong shares and the yuan weakened as investors factored in an increase in trade tensions. Eastern European currencies posted some of the biggest losses on speculation that the region may have to increase defense spending.

A cohort of investors on Wall Street have wagered that Trump’s stance on industrial policy, corporate tax cuts and tariffs would boost stocks and could fuel inflation — spurring bond yields and the US dollar higher. Crypto is seen as benefiting from relaxed regulation and Trump’s public support for the digital currency.

“When I came in this morning, it was obvious many assets had decided Trump had already won,” said Luke Hickmore, investment director at Abrdn. “We might hit 5% on the US 10-year yield. Maybe even this year. People will realize inflation is going to rise as he pushes hard on the fiscal side.”

Wall Street saw the potential for outsized moves almost regardless of the election’s outcome.

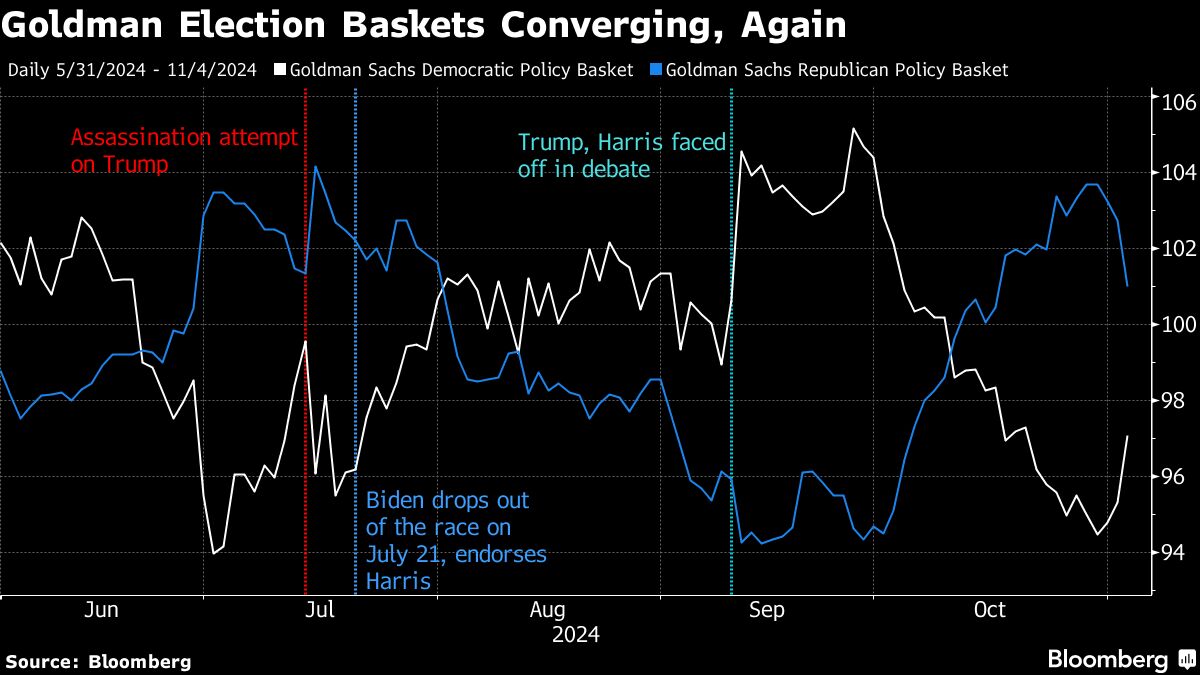

Goldman Sachs Group Inc.’s trading desk said a Republican sweep may push the S&P 500 up by 3%, while a decline of the same size is possible should the Democrats win both the presidency and Congress. Moves would be half as much in the event of a divided government. Andrew Tyler at JPMorgan Securities said anything other than a Democratic sweep is likely to cause stocks to rise.

A Morgan Stanley note says risk-taking appetite may dip in the event of a Republican sweep as fiscal concerns fuel yields, but if bond markets take it in their stride the likes of growth-sensitive cyclical stocks would rise. Meanwhile, it sees renewable-energy firms and tariff-exposed consumer stocks rallying under a scenario in which Harris emerges the victor with a divided Congress, while a corresponding fall in yields would benefit housing-sensitive sectors.

Here’s What Wall Street Says:

-

Mohit Kumar at Jefferies

If Trump gets confirmed as the next President, we see a continuation of the US equities rally. Our view has been that a number of investors are sitting on the sidelines and waiting for election uncertainty to be out of the way.

Assuming a clean election result, with Trump policies largely considered positive for the market, a growth picture that is doing fine and a Fed that is ready to cut rates, we see further upside in US equities. We also expect US equities to continue to outperform Europe and global indexes.

The notable and expected events if we have a Trump win is a weaker yen, falling Chinese equities, Japanese stocks outperforming emerging Asia.

If there is a Trump win and a Republican sweep indeed, the combination of stronger dollar and stronger US Treasury yields is negative for Asia assets, a stronger S&P is positive. Taiwan is well placed on the short term.

Our historical playbook analysis reminds us that the S&P 500 tends to rise regardless of the balance of power in Washington.

The strongest backdrops have tended to be a Democratic Presidency with a split or Republican Congress, and Republicans controlling the White House along with both chambers of Congress. In this context, we are more focused on longer-term opportunities that may open up from big gaps up or down around the event rather than short-term trades.

Investors should look past the election and focus on the fundamentals of what drives markets. The economy and earnings continue to be better than expected, most stocks are reasonably priced and the Fed is in an accommodative mode and is expected to cut interest rates again this week. There is an excellent backdrop for stocks right now.

First off, we would simply tell investors not to overreact.

We believe we are set for a strong end-of-year rally for many reasons, two of which are a possible case scenario by the bears who finally have to capitulate, and performance anxiety from large money managers who may have missed the big moves in certain names.

We do believe the market prefers Trump for lower taxes and less regulation, and with Kamala, we likely see higher taxes and more regulation, but again with the balance of power, we may not see many of their proposed policies go into effect.

Key events this week:

-

Eurozone HCOB Services PMI, PPI, Wednesday

-

China trade, forex reserves, Thursday

-

UK BOE rate decision, Thursday

-

US Fed rate decision, Thursday

-

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 1.2% as of 8:12 a.m. London time

-

S&P 500 futures rose 1.8%

-

Nasdaq 100 futures rose 1.7%

-

Futures on the Dow Jones Industrial Average rose 2%

-

The MSCI Asia Pacific Index fell 0.3%

-

The MSCI Emerging Markets Index fell 0.7%

-

E-Mini Russ 2000 Dec24 rose 4.6%

Currencies

-

The Bloomberg Dollar Spot Index rose 1.4%

-

The euro fell 1.7% to $1.0739

-

The Japanese yen fell 1.6% to 154.07 per dollar

-

The offshore yuan fell 1.1% to 7.1812 per dollar

-

The British pound fell 1.3% to $1.2870

Cryptocurrencies

-

Bitcoin rose 6% to $73,339.13

-

Ether rose 7.6% to $2,598.55

Bonds

-

The yield on 10-year Treasuries advanced 14 basis points to 4.41%

-

Germany’s 10-year yield declined four basis points to 2.39%

-

Britain’s 10-year yield was little changed at 4.54%

Commodities

-

Brent crude fell 1.4% to $74.51 a barrel

-

Spot gold fell 0.6% to $2,727.27 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Cecile Gutscher and Rita Nazareth.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel