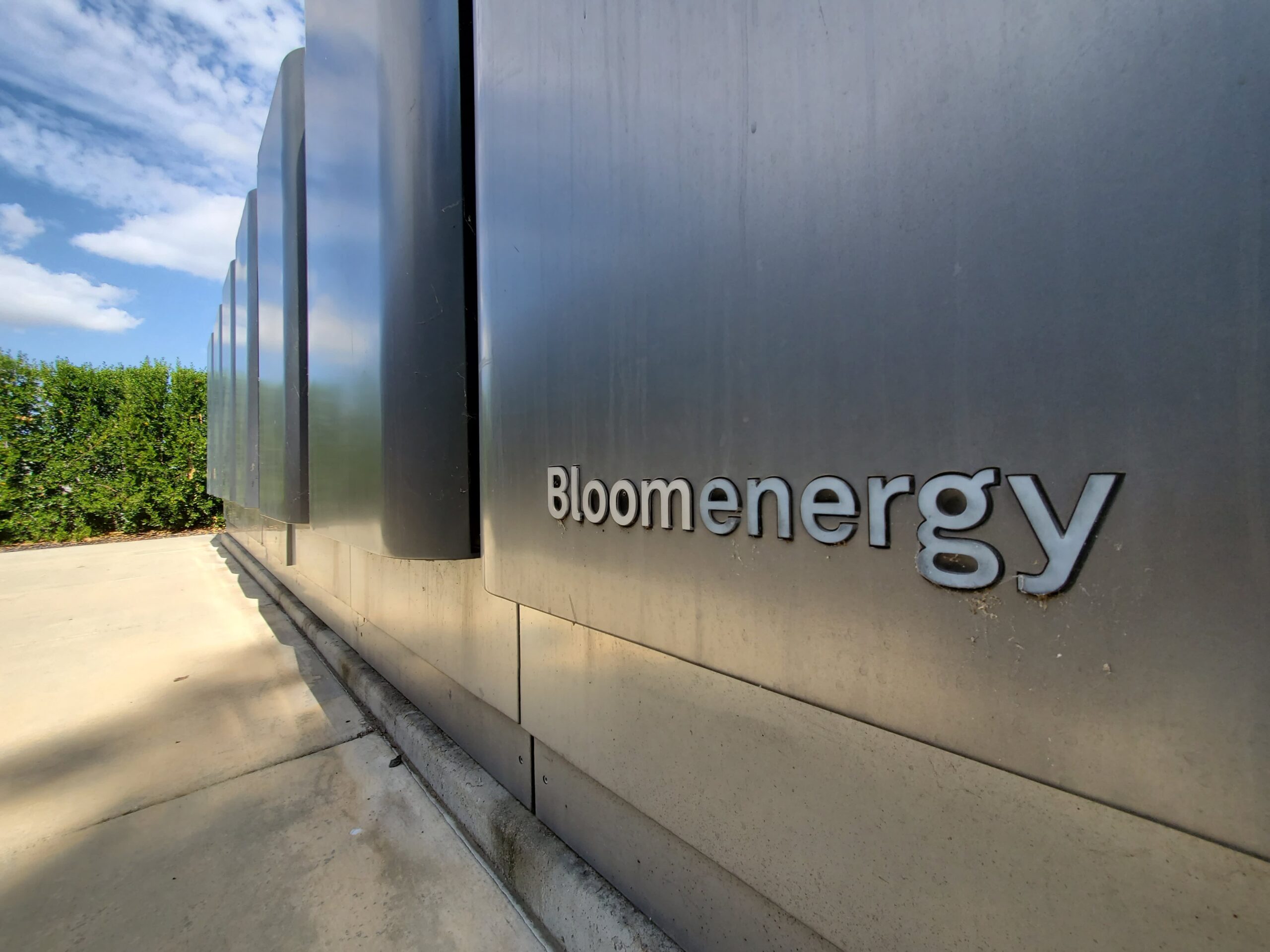

Bloom Energy may be due for massive gains on the heels of its recent supply agreement with American Electric Power , according to Piper Sandler. Analyst Kashy Harrison upgraded the stock to overweight from neutral and raised his price target by $10 to $20. That reflects 50.6% upside from Thursday’s close. While the stock has seen sizable gains recently, rising about 27% in the past one month, it’s still fallen more than 10% this year. BE YTD mountain BE, year-to-date On Thursday, Bloom Energy announced that it reached an agreement with AEP to power artificial intelligence data centers and supply up to 1 gigawatt of its products. The company also said that AEP has ordered 100 megawatts of fuel cells, with more orders expected next year. Harrison believes the scale of the agreement – he estimates that the equipment alone could be worth $3 billion – could mean more growth opportunities for the company in the future, despite softened sentiment around the name among investors. “Despite BE’s insistence that it was working on 100 MW deals and extremely bullish commentary from the [Chief Commercial Officer Aman Joshi] in a Taiwanese interview, the market has been generally skeptical on BE’s ability to deliver power to large data centers given prior grand unfulfilled promises,” he wrote in a Thursday note. “The 100 MW order from AEP is inline with prior commentary; however, upside potential to 1-GW is literally 10x what we were expecting,” the analyst continued. “Given the endorsement of BE’s technology from a large utility, agreements with other large players could materialize.” With the AEP order and potential momentum from other domestic customers as catalysts for growth, Harrison expects revenue to reach $1.8 billion in 2025. The majority of the Street is bullish on the name, with 14 of the 26 analysts covering it having a strong buy or buy rating. Even though 11 of the 26 have taken a neutral stance, the average target price for the stock still implies big gains from here, reflecting more than 23% upside, as of Thursday’s close.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel